61% of ACO Contracts Only Include Upside Financial Risk

Most ACO contracts only contain shared savings provisions, showing that most ACOs are not willing to take on more financial risk, a new study indicates.

- A recent Leavitt Partners study showed that 61 percent of accountable care organization (ACO) contracts are upside risk-only, indicating that ACOs may be risk-adverse or are still in the experimental stage with financial risk.

Even though ACOs are taking on more accountable care contracts, the study of 104 surveyed ACOs and 847 ACOs in the Leavitt Partners database revealed that most ACOs preferred upside risk contracts with 50 percent stating they would consider entering a shared saving arrangement in the future versus higher risk arrangements.

“However, despite a large number of ACOs assuming more than one accountable care contract, there is still a strong preference by ACOs to pursue upside risk-only shared savings agreements in future contracts,” wrote Leavitt Partners.

Downside risk is key to expanding many value-based reimbursement models. Under a downside risk arrangement, clinicians are financially responsible for the quality and cost of care they provide.

Clinicians can share in a portion of savings if spending and quality performance exceed benchmarks, but they could also face repayment if spending and quality are below expectations. Those in upside risk-only models only share in the savings and do not have to repay payers losses.

As April Wortham-Collins told RevCycleIntelligence.com in January, the ‘A’ in ACO stand for accountable and organizations cannot be fully accountable for patient populations until they accept more financial risk.

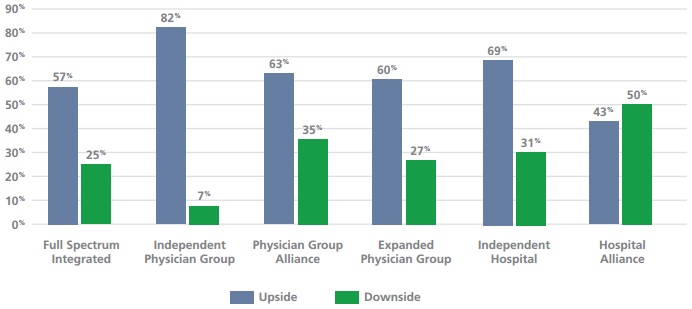

However, the Leavitt Partner study found that the level of financial risk in ACO contracts depended on organizational type. ACOs were divided into six organizational types: full spectrum integrated, independent physician group, physician group alliance, expanded physician group, independent hospital, and hospital alliance.

Of the six types, only hospital alliance ACOs, which have a single owner and were primarily focused on inpatient, hospital-based advanced care, had more downside risk contracts (50 percent of all contracts) than upside risk-only contracts (43 percent).

In contrast, independent physician group ACOs, which have a single owner and focus on outpatient and ambulatory care, were overwhelmingly involved in upside risk-only contracts. About 82 percent of their contracts involved shared savings and only 7 percent were downside risk arrangements.

The study also reported that more complex ACOs, such as those with multiple owners and more integrated care, did not accept more financial risk even though they tended to have more accountable care contracts.

For example, 92 percent of full spectrum ACOs, which have single or multiple owners and the full range of advanced care services, had two or more accountable care contracts, but only 23 percent of these contracts included downside risk.

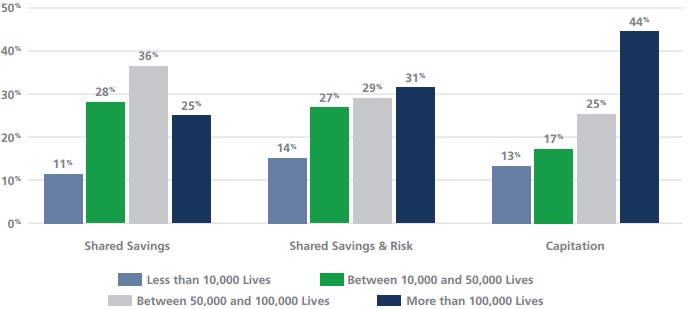

In addition to organization type, the level of financial risk accepted by ACOs was also related to the number of lives the contract covered, the study determined. Contracts that included more financial risk usually had more lives attributed to them.

About 44 percent of capitated payment contracts, which require full financial risk on the provider side, covered more than 100,000 patients.

Similarly, 31 percent of shared savings and losses contracts included over 100,000 patients.

On the other hand, more ACO contracts that covered less than 100,000 patients were upside risk-only shared savings arrangements (75 percent) versus shared savings and losses (70 percent) and capitation (55 percent).

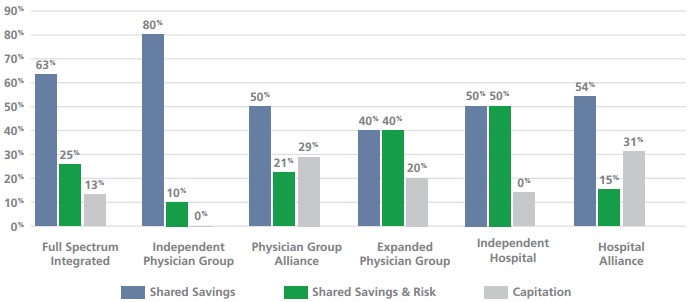

Look forward, Leavitt Partners found that very few ACOs would consider increasing their level of financial risk in accountable care contracts. While half of the ACOs said they would consider a shared savings contract in the future, another 40 percent said they would think of entering a shared savings and losses contract.

Only hospital alliance ACOs (31 percent) and physician group alliance ACOs (29 percent) said they would consider capitation in their next accountable care contract.

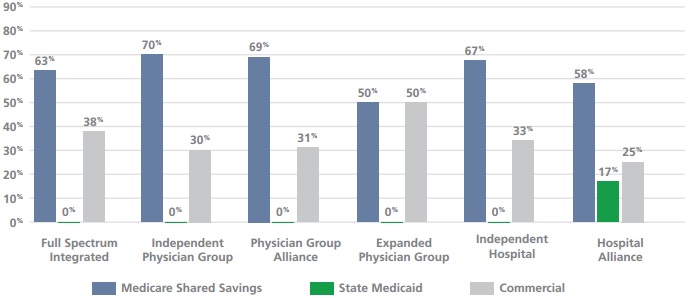

ACOs also tended to favor the Medicare Shared Savings Program as their next ACO program. Five out of the six organizational types would consider the Medicare program first before a commercial or Medicaid arrangement.

Leavitt Partners noted that the push for more Medicare ACO programs in the future may be because the Shared Savings Program offers an upside risk-only track and does not require organizations to jump into downside risk.

Healthcare organizations may feel more comfortable with upside risk-only options in ACO contracts because they are still experimenting with financial risk. Eric Chetwynd, former Director of Product Strategy at Curaspan, a health IT and service company, told RevCycleIntelligence.com in June 2015, “Provider organizations have not traditionally had to really manage risk. There definitely is the tendency to go towards the safer versions of those programs.”

Based on study results, Leavitt Partners suggested that healthcare organizations seeking an ACO contract should consider their organizational type to determine what level of financial risk best fits their facility.

“As more financial and quality results from current ACOs is released, and more public information regarding commercial entities is available, organizations adopting accountable care will be able to utilize frameworks from similar organizations and determine their own successful strategies for value-based care,” concluded the study.

Image Credit: Leavitt Partners

Dig Deeper:

• The Future of Accountable Care Organizations Involves Risk

• Time, Commitment Required for ACO, Value-Based Care Success