9.4 Million Fewer Americans Struggle to Pay Medical Bills

9.4 million fewer adults had issues with covering the costs of their medical bills in March 2015 when compared to September 2013.

- Several years after the implementation of the Patient Protection and Affordable Care Act, the results seem to be showing that fewer Americans are struggling with paying medical bills and more than ever before have gained health insurance coverage. Last year, the Urban Institute released a study showing that far fewer people are struggling with the costs of their medical bills.

The results illustrate that 9.4 million fewer adults had issues with covering the costs of their medical bills in March 2015 when compared to September 2013. This shows a correlation that the Affordable Care Act has benefited consumers with regard to healthcare spending.

Within the states that have expanded Medicaid coverage, individuals who have enrolled in Medicaid will have greater access to care and lower medical costs when compared to the uninsured. Additionally, far fewer nonelderly adults were reporting difficulty with paying family medical bills between 2012 and 2014, the Urban Institute study found.

The researchers had asked the participants whether they or anyone in their family had difficulty paying medical bills before September 2013, which is right ahead of the first open enrollment in the health insurance exchanges. The researchers also sought to find out whether families had trouble with their healthcare costs after March 2015 when the second open enrollment completed.

The researchers tried to determine how the Affordable Care Act impacted the burdens associated with healthcare spending. Obamacare seemed to have reduced consumer struggles with healthcare costs. Nonetheless, the study also exhibits that certain gaps exist when it comes to health insurance coverage and out-of-pocket medical bills.

“Though adults who maintain continuous health insurance coverage are much less likely to have problems paying family medical bills than those with spells of un-insurance, our results show that insurance coverage leaves gaps in financial protection from medical bills for many adults,” the study from the Urban Institute stated.

“Among adults who maintain continuous coverage for a full year, problems with medical bills are more prevalent for those with higher annual per-person health plan deductible amounts. A recent study shows that 76 percent of nonelderly, non-poor households with private insurance have sufficient liquid financial assets to cover a midrange single deductible of $1,200 or family deductible of $2,400.”

“Since 2006, health plan deductibles have risen steadily for adults with employer-sponsored insurance, with 18 percent of covered workers enrolled in health plans with deductibles of $2,000 or more as of 2014. High deductibles are also common among the most popular plans in the health insurance Marketplaces. For example, the average single coverage, silver plan deductible for a 40-year-old nonsmoker is nearly $3,000. ACA provisions that reduce deductibles and other out-of-pocket cost burdens, such as cost-sharing reductions for silver plans purchased by those with incomes up to 250 percent of FPL, are likely to mitigate the burden of family medical bills.”

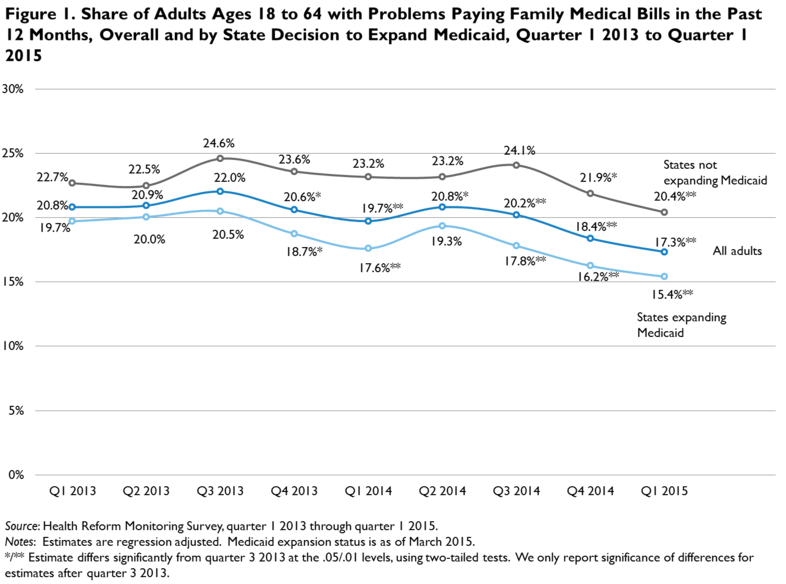

The results show that, in September 2013, 22 percent of respondents had difficulty paying family medical costs while in March 2015, only 17.3 percent of those polled struggled with their healthcare bills. When the researchers applied these numbers to the national population of nonelderly adults, they found a drop of 9.4 million people.

The study also found that 5.1 percent fewer families residing in Medicaid expansion states had trouble with their healthcare costs. States that didn’t expand their Medicaid coverage also saw a drop of 4.2 percent.

Earlier this year, the Rice University’s Baker Institute for Public Policy and the Episcopal Health Foundation (EHF) released a study that showed Texans have found it easier to cover their medical costs in 2015 when compared to 2013.

In 2013, 25.8 percent of nonelderly adults in Texas had difficulty paying their medical bills while in September 2015, that number fell to 22 percent. These results are likely due to the fact that many more Texans now have health insurance due to the Patient Protection and Affordable Care Act along with the individual mandate.

However, as many as 30 percent of uninsured Texans had problems with covering their medical costs in 2015, which was still a drop from the 35 percent of polled Texans found in 2013. The study also illustrated that primary care services were more commonly sought in 2015.

Even though the Affordable Care Act has brought more coverage for American citizens and lessened the burden of medical bills on the consumer, there are still findings that as many as one out of five insured individuals are struggling to cover the costs of care.

“The fact that Texans had fewer problems paying their medical bills in 2015 is good news,” Vivian Ho, the Chair in Health Economics at Rice’s Baker Institute, a professor of economics at Rice and a professor of medicine at Baylor College of Medicine, stated in a press release.

“One reason fewer Texans are having problems paying medical bills is because more Texans now have health insurance. However, one in five Texans still has problems affording health care. And it’s no surprise our data show the uninsured and those with lower incomes continue to struggle paying those bills more than anyone else.”

The Henry J. Kaiser Family Foundation and The New York Times released a survey in January showing that 20 percent of people who have health insurance still find it difficult to manage their healthcare costs. Additionally, more than half of people without health insurance had trouble paying their bills.

There are also many other areas in which the consumers cut down on their spending including planning vacations, purchasing large household items, and even spending less on groceries.

While the Affordable Care Act has enabled healthcare access among many Americans, the costs associated with medical care still seem to be putting a burden on the typical American family. Healthcare reform may need to go further to ensure fewer are struggling to pay their bills.

Image Credits: Urban Institute