Hospital Profitability Rises by 35% in Oregon After ACA Passage

ACA implementation had a positive effect on hospital profitability in Oregon because of growing patient revenues and declining, according to a state-funded report.

- Hospital profitability has increased for healthcare organizations across Oregon since the passage of the Affordable Care Act (ACA) in 2010, which enabled more individuals to become insured, the Oregon Health Authority has found. The report revealed that operating margins across all hospital types, including rural healthcare organizations, grew by nearly 35 percent in 2015.

“This data shows us that the new healthcare environment is providing more people access to affordable care while improving the financial stability of hospitals in Oregon,” said Lynne Saxton, Director of the Oregon Health Authority.

“Hospitals are a critical part of our healthcare delivery system, and their financial viability ensures that essential community services are delivered effectively and efficiently. This report provides patients and policymakers an accessible and transparent vantage point for exploring future opportunities.”

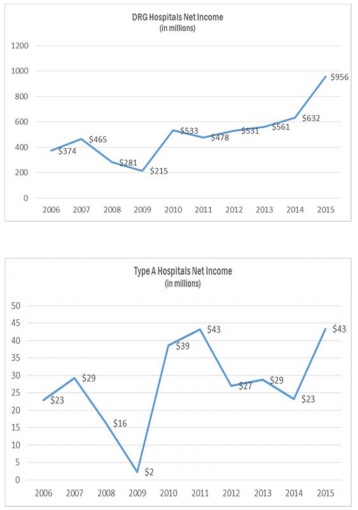

In addition to more profitable operating margins, Oregon’s hospitals also experienced an increase in net hospital income. In 2015, net hospital income in the state increased by 53.8 percent, or $367 million, compared to the previous year.

The 2015 boost was the largest increase in net income since the Affordable Care Act was passed, stated the report.

The Oregon Housing Authority explained that hospital profitability increased because healthcare organizations experienced a boost in patient service revenue and uncompensated care decreased.

While patient revenue had steadily increased since 2006, Oregon hospitals faced more significant increases after the state implemented a Medicaid expansion project in 2014. Statewide net patient revenue rose by 7.6 percent, or $688 million, in 2014 and by 8.1 percent, or $790 million, in 2015.

The year 2014 also marked substantial decreases in charity care and bad debt for Oregon hospitals. Uncompensated care decreased by $406 million, a 31.8 percent decrease, in 2014, followed by a $342 million drop, or 39.4 percent decrease, in 2015.

Specifically, charity care was reduced by 33 percent in 2014 and almost 40 percent in 2015, while bad debt declined by 38.4 percent and nearly 30 percent.

Implementation of the Affordable Care Act caused uncompensated care to decline, reported the Oregon Housing Authority. The legislation allowed more individuals to gain healthcare coverage through expanding Medicaid eligibility and opening health insurance exchanges.

The proportion of uninsured individuals in Oregon fell to just 5.3 percent in 2015, representing a nine percent difference in two years.

“This significantly reduced the need for financial assistance and charity care as more people became insured and the cost of services provided to them were recouped by hospitals,” explained the state health department.

Even though there was a statewide trend of increasing hospital profitability, rural hospitals experienced more fluctuation in revenue and operated with tighter margins than Diagnostic Related Group hospitals, which are urban hospitals that use a different reimbursement system.

For example, Type A rural hospitals, which contained 50 or fewer beds and were located 30 or miles from another hospital, experienced alternating losses and gains in terms of net hospital income from 2010 to 2015, whereas Diagnostic Related Group hospitals saw a relatively steady increase in income.

The Oregon Housing Authority also found that rural hospitals generally had lower operation margins than Diagnostic Related Hospitals. Type B hospitals, which contained 50 or fewer bed and were 50 miles or more from another hospital, finished 2015 with a 3.1 percent operating margin, while Diagnostic Related Hospitals reported a 7.5 percent margin.

Despite their challenges, both Type A and B hospitals experienced significant increases in net income and operation margins by 2015.

With overall hospital profitability on the rise in Oregon, the health department stated that hospitals could reinvest their profits back into healthcare initiatives.

“The fact that uncompensated care in general and charity care in particular are declining while total profit margin is growing in the new ACA environment provides hospitals with opportunities to explore new services and expand existing ones to continue to serve their communities as tax-exempt entities,” the Oregon Health Authority added.

Image Credit: Oregon Health Authority

Dig Deeper:

• 5 Ways to Increase Hospital Profitability, Aid Revenue Cycle

• Nonprofit Organizations Lead Way in Hospital Revenue Cycle