How to Reduce Wasteful Spending in the Medicare Program

By changing the reimbursement structure of the Medicare program and reforming payments to value-based care, the Affordable Care Act was meant to stimulate greater efficiency.

- When the Affordable Care Act was passed several years ago, it had major implications for the future of the Medicare program. According to a study from the Private Enterprise Research Center at Texas A&M University, the Affordable Care Act has brought forward a greater focus on reducing federal spending within the Medicare program while at the same time strengthening health outcomes across the medical industry.

By changing the reimbursement structure of the Medicare program and reforming hospital payments from fee-for-service to value-based care, the Affordable Care Act was meant to stimulate greater efficiency in the healthcare field. However, the question remains – how will this efficiency occur due to the ACA?

The study from Texas A&M University attempts to answer this question. It’s possible that income targeting for medical supplies among providers could play a role. It is believed that cutting the price of services could boost the supply and efficiency, the study explained.

The issue at hand is that the population of Medicare beneficiaries is expected to rise significantly over the next several years due to the aging baby boomers. There are other key reasons for the continuing rise in Medicare spending. For instance, the amount of out-of-pocket expenses paid by consumers has dropped from 25 percent to slightly more than 10 percent in the last three decades.

Secondly, more affluent American citizens have received better care in higher volume. Finally, technological advances have made it possible to live longer and healthier lives through the implantation of medical devices and joint replacement surgeries.

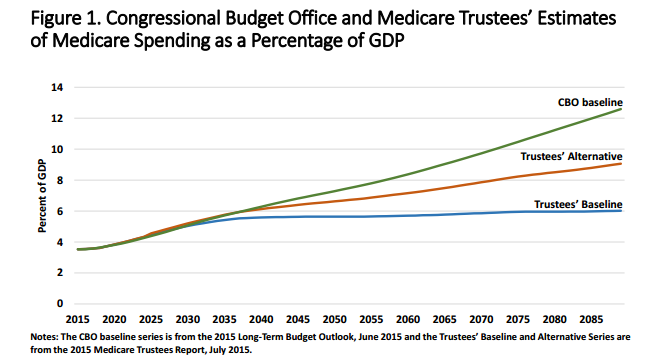

When it comes to Medicare spending, there are three possible pathways outlined in the report: the Trustees’ baseline, the Trustees’ alternative and the Congressional Budget Office (CBO) baseline. Over the next 10 years, all of the three paths show an identical rise in federal Medicare spending.

The study also outlines how Medicare benefits, premiums, and taxes are divided across several generations. The results show that the net financial cost for median earning employees will be positive in the Medicare program even for young people who are just entering the workforce.

However, the report also explained that the retirement benefits associated with the Medicare program are dependent upon taxing future generations at higher rates. It could be possible to minimize the burden of high taxation across multiple generations by minimizing “the tax financed portion of Medicare,” which would ensure that “per capita spending grows at the same rate as per capita GDP.”

“Even if we are able to constrain the taxpayer burden, the baseline forecasts future retirees would continue to receive an annual transfer in retirement that maintains its share of pre-retirement earnings,” the report stated.

“Retirees would then be responsible for any health care spending in excess of this amount. Due to the rising number of retirees and excess cost growth it is important and indeed almost imperative that we change the extent that a growing Medicare cost burden is taxpayer financed.”

“Indeed most reforms either passed or suggested have exactly that goal. These proposals all are geared toward bringing the per-capita federal cost growth of Medicare, the taxpayer burden, in line with the per-capita growth of GDP. In addition, all seem to agree that this goal will not be accomplished by reducing the payments to providers. Thus, any real solution must entail an increase in the share of senior health care that is paid for by the senior population.”

The Centers for Medicare & Medicaid Services (CMS) could also keep federal spending lower within the Medicare program by keeping track of hospital claims and fraudulent charges. For example, new research from CMS showed that 21 states have overbilled the Medicare fee-for-service payment structure. As such, keeping a closer eye on claims data could help reduce wasteful spending across the board.

Adopting some of these strategies could play a key role in keeping expenditure rising at a rate similar to the per capita GDP within the Medicare program and, essentially, reducing wasteful spending across the healthcare delivery system.

Image Credits: Private Enterprise Research Center at Texas A&M University