Inpatient Volume, Revenue Drops as Outpatient Care Makes Gains

Hospitals must find ways to leverage outpatient service opportunities as a reduction in inpatient volume leaves a trail of empty beds.

- Inpatient volumes, and the revenues from hospital admissions, are dropping rapidly as the healthcare industry focuses on reducing long stays and bolstering outpatient services, according to new data from the Medicare Payment Advisory Commission (MedPAC). A number of hospitals, half of which were rural facilities, have closed due to declining inpatient volumes, but hospitals that successfully shift their costs to maximize the benefits of outpatient services continue to provide high quality care and sufficient access to patients in need.

At the MedPAC November meeting, Jeff Stensland and Zach Gaumer presented data on the relationship between hospital volumes and costs. The study found evidence for a significant trend towards utilizing outpatient care as a first resort, resulting in falling occupancies and the need for hospitals to reallocate their spending to make the most of the evolving landscape.

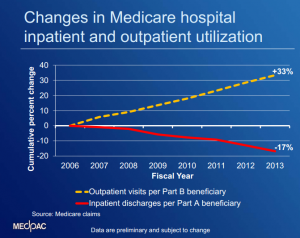

According to preliminary Medicare claims data, inpatient discharges per Part A beneficiary have dropped 17% since 2006, while outpatient visits for Part B beneficiaries have risen 33% over the same time period. Hospital occupancy rates have decreased from an average of 63.9% in 2006 to 60.3% in 2013, suggesting that healthcare organizations have an excess inpatient bed capacity. Among rural hospitals, which have had lower than average occupancy rates in general, inpatient volume dropped from 47% to 41% during the same time.

This has led to a number of hospitals closing their doors to inpatient care. Twenty-seven hospitals closed in 2013, many of which were struggling along with occupancy rates as low as 32 percent. As is the case with Quincy Medical Center, which announced its closure last week, competing hospitals simply outperformed the facility in regards to patient attraction, retention, and reputation. MedPAC found that nearby hospitals experienced occupancy rates that were almost 20% higher than the facilities that closed. All-payer margins for shuttered hospitals were low, at -5.7 percent, compared to the average of +6.5 percent.

Rural hospitals have been particularly hard-hit during the shift away from inpatient care. Thirteen of the twenty-seven hospitals that closed in 2013 were rural facilities. Some hospitals have transformed themselves into outpatient facilities instead, resulting in a net loss of 1,100 beds. However, 18 hospitals have opened in the past year, which leaves a net loss of only 9 facilities. Hospitals that have opened in 2013 are generally very small, with an average of 38 beds, and only offer a limited set of services, the data shows.

Despite the closure of some facilities, most non-profit hospitals continue to have access to operating capital at reasonable interest rate, while for-profit organizations have seen a rapid increase in share prices that reflect their attractiveness as investment targets. Hospitals that are having trouble adjusting their financial situation to the new realities of the healthcare delivery system may be the target of mergers and acquisitions (M&A), which have increased 16% between 2012 and 2013. Two hundred and eighty-three hospitals took part in M&A deals in the past two years.

The data indicates that the movement towards outpatient services is more than anecdotal. Hospitals and health systems are actively building up their outpatient offerings, including urgent care centers and independent emergency departments, in order to combat a declining ability to rely on inpatient revenues to stay afloat. While rural hospitals have taken the hardest knocks during the transition to outpatient services, MedPAC believes that closures and reductions are in line with the pace of changes in volume.