Medical Billing Needs Revenue Cycle Management Transparency

Transforming revenue cycle operations will help shrink bad debt, increase collections from healthcare consumers, and allow for greater flexibility with medical billing.

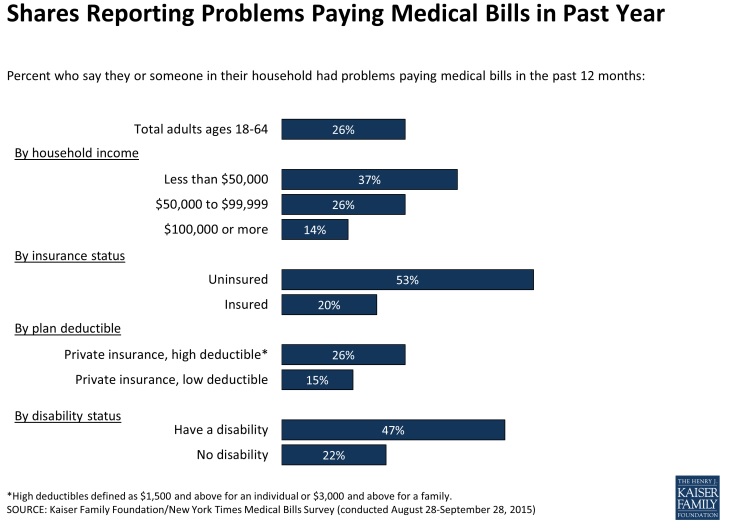

- Medical billing problems, such as unpaid medical bills, the acquisition of medical debt, and a detrimental impact on care access, are negatively affecting the healthcare industry. Twenty percent of over 1,200 surveyed adults had trouble paying their medical bills within the last year, according to a survey conducted last Fall by both the Kaiser Family Foundation and The New York Times.

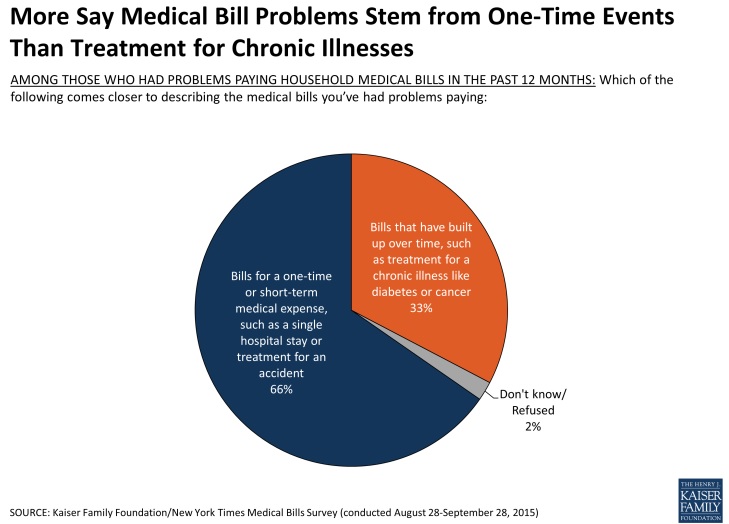

Surveyed healthcare consumers said they were unaware their care was not covered in-network. Most medical billing costs they struggled to manage were reportedly tied to one-time medical events, such as a hospital room visit or an accident. Health plans apparently need to work on promoting greater transparency to rectify widespread medical billing issues. Greater simplicity in healthcare pricing needs to be a top focus if the healthcare industry is to financially survive.

“The cost of health care has long been a concern in the U.S., on both a national and a personal level. For individuals, this concern plays out most prominently among those who face difficulty paying medical bills or who are unable to pay such bills at all,” said researchers.

“For people who are uninsured, lack of coverage not only hinders access to care but also leaves them vulnerable to medical bills that cannot be paid.”

“While insurance provides financial protection, that protection can be incomplete for a number of reasons, including rising deductibles and other forms of cost-sharing, out-of-network charges, the growing complexity of insurance that can leave consumers with unexpected bills, and the fact that many people have only modest financial assets to cover medical expenses.”

Medical billing problems are more likely among those with low to moderate income levels, poorer health status, greater health needs, and those with disabilities that hinder their overall quality of life. Other noted discrepancies exist in regard to education level, gender, region, insurance status, and race.

Among those surveyed who reported having problems paying medical bills, over two-thirds said they were dealing with either a one-time or short-term medical expense. One-third of respondents said any medical bills tied to their treatment of chronic conditions were only accruing over time.

Physician visits, tests, and lab fees were reportedly dominating the medical billing realm. Emergency room visits made up the largest share – 21 percent of medical bills. Hospitalization followed at 20 percent. Coming in third was dental care at 12 percent. Fourth was diagnostic tests such as X-rays or MRIs at 11 percent.

But smaller payment amounts are also posing problematic. “[Even] a bill of $500 or less can present a major problem for someone who is living paycheck to paycheck,” researchers said.

“[It’s] not surprising that those with health insurance are less likely than those without insurance to say they struggle to meet basic expenses.”

“However, even among the insured, those who have faced medical bill problems are significantly more likely than their counterparts who haven’t had such problems to say they are either just getting by or don’t have enough to make ends meet (55 percent versus 22 percent).”

Most receiving care out-of-network did not know their healthcare provider was actually out-of-network, according to researchers.

“Health plans should seek to be proactive about achieving and ensuring provider directory accuracy, despite the operational challenges involved in doing so,” said Brian Hoyt, Managing Director at Berkeley Research Group (BRG), to RevCycleIntelligence.com.

“If a member needs to see a doctor and they go to their health plan’s provider directory and see a provider listed in the provider directory, there's a presumption that that particular provider is actually participating with that health insurance product. If that turns out not to be the case, then that member could be hit with a bill for out of network charges.”

“Health plans are going to consolidate their offerings, in essence making their offerings simpler to understand. Or they're going to have to improve their provider education processes to make sure network providers understand exactly which products they're participating in.”

Transparency may be the medical billing solution

Researchers said people who have health insurance and also have medical billing problems reported skipping care entirely due to cost. Sixty-two percent reportedly postponed a dental visit. Forty-three percent skipped a test or treatment recommended to them by a physician. And forty-one percent said they did not fill a prescription.

Those who can’t pay are apparently saving money by staying clear of the physician’s office. “Already, one out of every three Americans is skipping essential care because they can’t afford it,” stated Craig Hodges, CEO of CarePayment.

But healthcare transparency solutions are available to help rectify the problem of patients being unable to pay for their care.

“If providers want to engage patients clinically to improve health outcomes and lower costs, they first must engage them financially.”

“Instead of ignoring a $5,000 bill, or a $500 monthly payment, patients will make payments of $100 a month or less over a longer period of time. ... It is amazing to me how long the opportunity has been around and nobody has done it.”

“Transforming revenue cycle operations will help shrink bad debt and increase collections from consumers, as will investing in price transparency tools and providing numerous options to plan, manage and pay medical bills,” confirmed a report from PwC’s Health Research Institute (HRI).

Things like discount loyalty programs – popular at retailers such at Starbucks, Wal-Mart, and Amazon.com – are requested by patients, said Todd Craghead, Intermountain Healthcare’s Vice President of Revenue Cycle.

“People want to know, how much is a visit? $40. What if we do this or that at the visit? $40. Is there any way for it not to be $40? Yes, labs could add $3 to $17,” added Marcus Osborne, Wal-Mart's President of Health and Wellness Payer Relations, to HRI.

“[It] is fundamentally about the challenge of providing dead simplicity on pricing and being really transparent about it.”

Image Credits: [Kaiser Family Foundation/New York Times] (Charts 1-3)