Medicare Spending on Drug Coverage Tripled from 2010 to 2015

CMS saw a 208 percent increase in Medicare spending on catastrophic coverage, largely because of rising prescription drug rates, OIG reported.

Source: Thinkstock

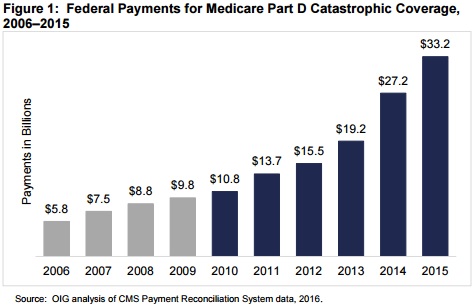

- Medicare spending on prescription drugs under the Part D catastrophic coverage program more than tripled from 2010 to 2015, increasing from $10.8 billion to $33.2 billion, the Office of the Inspector General (OIG) recently reported.

The significant growth in Medicare spending on prescription drugs largely stemmed from increases in high-priced medication utilization as well as prescription drug rate hikes since 2010.

Through catastrophic coverage, Medicare helps beneficiaries in the Part D program pay for prescription drugs. Beneficiaries qualify for catastrophic coverage when their out-of-pocket expenses for the year go over a certain threshold, which was $4,700 in 2015.

The catastrophic coverage program, however, does not include annual or lifetime caps on out-of-pocket spending.

When beneficiaries enter catastrophic coverage, they generally pay a 5 percent coinsurance on prescription drugs, while CMS-contracted sponsors take on 15 percent of the price. The federal government pays for the remainder after rebates and other price concessions.

READ MORE: Would Proposed Value-Based Reimbursements Reduce Drug Costs?

In the most recent report, the federal watchdog found that the 208 percent, or $22.4 billion, growth in Medicare spending on catastrophic coverage could threaten the future of the Part D program, especially as prescription drug rates increase.

A CMS report from August already showed that Medicare Part D program spending increased by $17 billion from 2013 to 2014. But the OIG investigation found that catastrophic coverage in the Part D program dramatically grew around the same time.

Source: OIG

Between 2006 and 2010, Medicare spending for catastrophic coverage went up by 85 percent, or $5 billion.

But the largest annual Medicare spending increase happened in 2014 and 2015. Medicare spending went up by $8 billion at first, but then jumped by another $6.1 billion.

As a result, catastrophic coverage became the most expensive Part D program component in 2014 and Medicare spending on the prescription drugs represented 42 percent of all Part D federal payments.

READ MORE: Will Medicare Part D Prescription Drug Plans Stabilize?

OIG attributed the dramatic increase to higher-priced drugs, which have an average price of more than $1,000 per month. By 2015, high-price prescription drug costs accounted for about two-thirds of total Medicare spending in the catastrophic coverage program, up from just one-third in 2010.

While high-price prescription drug spending jumped from $5 billion to $33.4 billion by 2015, the number of beneficiaries getting high-price medications also significantly increased. Only 14 percent of beneficiaries received high-price prescription drugs in 2010, but that figure rose to 28 percent in 2015.

In addition, the proportion of beneficiaries qualifying for catastrophic coverage grew from 2010 to 2015. About 53 percent more beneficiaries reached catastrophic coverage in the investigation’s period, increasing from 2.4 million to 3.6 million beneficiaries.

The steepest increase, however, occurred in 2014, when about half a million more beneficiaries qualified for catastrophic coverage.

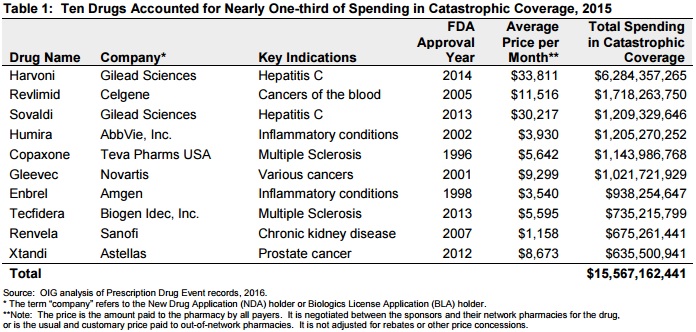

OIG uncovered that the most recent increases in Medicare spending and catastrophic coverage utilization stemmed from ten high-price drugs, including those commonly used to treat hepatitis C, cancer, and multiple sclerosis. Prescription drug costs on the ten medications accounted for 30 percent of total Medicare spending on catastrophic coverage in 2015.

READ MORE: What Is Healthcare Revenue Cycle Management?

Total prescription drug spending on the ten high-price medications ranged from $635.5 million to $6.3 billion in 2015, the federal watchdog added.

Source: OIG

Topping the highest Medicare spending list was two hepatitis C treatments, Harvoni and Sovaldi, which were new to the market. Both medications represented about $7.5 billion in Medicare spending on catastrophic coverage in 2015.

OIG also noted that the average price per month for each hepatitis C drug was over $30,000, meaning any beneficiary getting the treatment would almost immediately qualify for catastrophic coverage.

Cancer care drugs accounted for the second most expensive category of drugs in the catastrophic coverage program, representing about $3.4 billion in Medicare spending in 2015. The average price for Revlimid, Gleevec, and Xtandi was about $8,600 per month.

In addition to Medicare spending growth, cancer care centers also recently identified high prescription drug costs as their top challenge to providing high-quality, patient-centered care. High costs even prevented some centers from implementing targeted therapies.

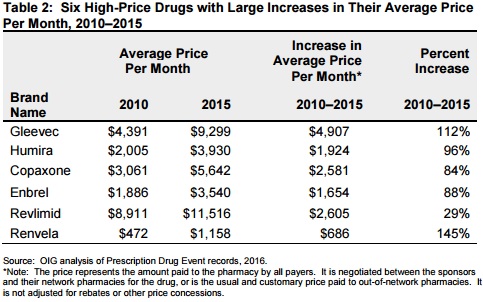

While some of the most expensive drugs were new to the market, OIG found that the majority (60 percent) had been on the market, but experienced significant price hikes since 2010. The average price per month for each of the older drugs on the list increased by more than $600 between 2010 and 2015.

Source: OIG

The federal watchdog also noted that Gleevac, a cancer care medication approved in 2001, had the steepest price increase, going up about 112 percent, or $4,900.

With rising prescription drug rates, beneficiary out-of-pocket spending went up in addition to Medicare spending. Between 2010 and 2015, beneficiary out-of-pocket costs increased 47 percent, going from $175 a month in 2010 to $257 a month in 2015.

To decrease Medicare spending and protect beneficiaries from heavy financial burden, OIG recommended that CMS develop resources and tools to address the issues, including:

• Redesigning the Part D benefit to incentivize sponsors to lower prescription drug costs

• Boosting prescription drug pricing transparency

• Developing value-based purchasing options

• Modifying the law to allow the federal government to negotiate prices for some medications

“CMS should carefully assess these and other options, taking into account beneficiary costs and access to needed drugs, and should, working with Congress, make any needed changes to the Part D program,” OIG concluded.