Provider Profitability Tops Healthcare Revenue Cycle Concerns

About 40 percent of providers viewed provider profitability as their biggest healthcare revenue cycle worry and market consolidation ranked low, a survey showed.

Source: Thinkstock

- One of the top healthcare revenue cycle concerns with 40 percent of providers is maintaining profitability while remaining independent, a recent RemitDATA survey revealed.

The survey of healthcare providers, billing companies, and vendors showed that healthcare mergers and acquisitions may not have been a top concern for most stakeholders. But ensuring that their facilities keep their doors open while maintaining their independence was.

Approximately 15 percent of both provider and healthcare billing company participants said that market consolidation was not a major concern for them. Vendors expressed even less worries about healthcare consolidation trends.

Even though some stakeholders were not fazed by healthcare mergers and acquisitions, market consolidation is moving at a significant pace. A September Health Affairs study uncovered that the number of providers in group practices of nine or fewer physicians dropped from 40.1 percent in 2013 to just 35.3 percent in 2015.

Larger group practices, on the other hand, gained more providers. The number of providers in group practices of 100 or more physicians grew from 29.6 percent to 35.1 percent in the same period.

As healthcare market consolidation trends upwards, providers in the RemitDATA survey were split on how healthcare acquisitions would impact them. One-half of the provider participants said they were worried about being acquired.

Although, some providers actually voiced interest in acquiring more providers and facilities rather than merging. One-third of surveyed providers said that they are looking to acquire other physicians.

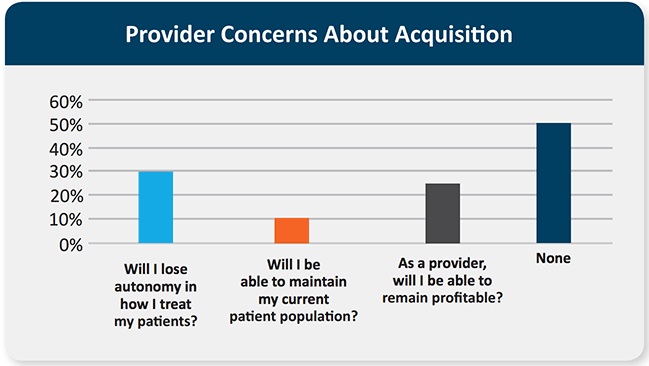

While some providers have their sights on healthcare acquisitions, many providers stated that they were concerned about independence and profitability issues stemming from a potential acquisition. When asked what the top issues would be if a provider’s practice was acquired, respondents shared that losing autonomy in how they treat their patients was the top concern with about 33 percent of participants.

Another one-fourth of providers said that a potential acquisition would lead to profitability concerns.

Source: RemitDATA

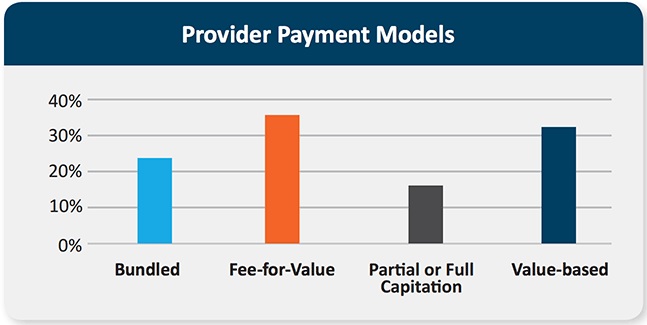

Additionally, the survey explored how providers and other stakeholders are managing the value-based reimbursement transition. Researchers found that stakeholders are participating in a wide range of value-based reimbursement arrangements with no clear forerunner.

Among provider respondents, about 35 percent said they participated in “fee-for-value,” 32 percent in “value-based reimbursement,” 24 percent in bundled payment models, and 18 percent in either partial or full capitation structures.

Source: RemitDATA

Healthcare billing companies also supported a wide range of value-based reimbursement structures. Thirty-six percent stated that they participated in fee-for-value structures, 34 percent in bundled payment models, 32 percent in value-based reimbursement, and 15 percent in partial or full capitation models.

However, vendors reported less value-based reimbursement participation than other stakeholders. Vendor participation in bundled payment, fee-for-value, and value-based reimbursement models was around 15 percent, whereas partial or full capitation model participation barely reached 5 percent.

Despite significant value-based reimbursement adoption, the survey showed that revenue cycle analytics capabilities were still lacking among all stakeholders. Only two-thirds of providers said that they have some type of revenue cycle analytics tool.

But just one-third of vendors have a revenue cycle analytics solution and only about 25 percent of billing companies have one.

Many respondents also reported that they do not have the data analytics capabilities necessary to properly negotiate payer contracts. Forty percent of providers stated that it was difficult to acquire the data necessary for contract negotiations.

About 48 percent of vendors and 30 percent of billing companies faced the same challenge.

Researchers concluded that there is a market opportunity to better assist providers with improving their healthcare revenue cycles.

“Providers need partners and vendors who can provide solutions to help improve their bottom lines – through help with managing claim denials to resolution, acquiring new patients, and navigating the continued impact in transitioning to alternative payment models,” the survey stated.

Health IT will be the key to not only helping providers improve their financial health, but assist other stakeholders with supporting healthcare organizations in a time of market consolidation and value-based reimbursement.

“Technology continues to play a key role in making it easier for stakeholders to navigate the complexities of today’s healthcare environment,” concluded the survey. ”In reviewing internal business processes, ensure you are adopting a solution that addresses your needs and seeking partners or vendors who can help keep your business competitive.”