Tracking Key Hospital Revenue Cycle Metrics to Up Profitability

Providers and executives should track hospital revenue cycle metrics, including financial, claims management, and patient access measures, to improve hospital profitability.

Source: Thinkstock

- As the value-based reimbursement transition rolls on, many hospitals have adopted “If you can measure it, you can manage it” as their new motto. But how can providers and executives measure hospital revenue cycle management?

Hospital revenue cycle management processes track the organization’s financial health and efficiency from medical billing to clinical workflows. Since revenue cycle management touches every part of the hospital, providers and executives could monitor an endless number of measures to understand financial health.

However, the key to effectively measuring hospital revenue cycle management lies with developing key performance indicators (KPIs). A KPI consists of quantifiable measures that an organization can use to evaluate and compare performance on business objectives.

The comparison aspect is crucial to KPIs. Rather than just gathering and reporting data for measures, KPIs start with a historical performance benchmark and hospitals continue to gather and report data to compare their performance against the benchmark.

Developing hospital revenue cycle KPIs can help providers and executives set and realize revenue and efficiency goals. About 30 percent of medical practices fell short of their net healthcare revenue expectations in 2016, the Medical Group Management Association (MGMA) reported in January 2017.

READ MORE: What Is Healthcare Revenue Cycle Management?

To better achieve revenue goals, hospitals should implement workflows that regularly monitor top KPIs for financial management, claims management, and patient access and accounting.

Understanding general financial metrics to boost hospital revenue

Most hospitals already have systems in place to capture some financial management metrics to measure hospital profitability. Nevertheless, hospitals should develop three KPIs for financial management to better track and improve profitability.

The first key financial management KPI is accounts receivable (A/R) days. From retail to business to healthcare, companies across industries usually quantify the average time money stays in an account before it is collected.

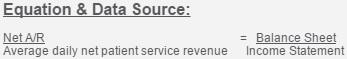

For hospitals, the A/R days KPI is the net of credit balances, uncollectible accounts allowances, charity care discounts, and third-party payer contractual allowances, according to the Healthcare Financial Management Association’s (HFMA) MAP Keys initiative. Some of the key measures included in the net A/R day KPI are:

• A/R receivables outsourced to third-party companies, but not bad debt

READ MORE: 5 Most Common Hospital Revenue Cycle Management Challenges

• Medicare Disproportionate Share Hospital payments

• Medicare Indirect Medical Education paid on an account-by-account basis

• A/R associated with patient-specific third-party settlements

• Critical access hospital payments and settlements

The organization also developed a net A/R days formula that takes the net A/R and divides it by the average daily net patient service revenue. Hospitals can collect the information from balance sheets and income statements.

Source: HFMA

READ MORE: Key Ways to Improve Claims Management and Reimbursement in the Healthcare Revenue Cycle

An editorial in Physicians Practice from CareCloud stated that healthcare organizations should aim to keep net A/R days below 50 days, but any value between the 30- to 40-day range also indicates efficiency.

Hospitals should also develop a KPI for bad debt to monitor hospital profitability. According to an MGMA resource from DataPlus CEO Frank Trew, bad debt is the revenue hospitals should have collected but did not.

Some of the revenue may not have been received because of controllable factors, such as credentialing errors or lack of claims follow-up, as well as uncontrollable factors, such as patient failure to pay and payers retroactively denying claims.

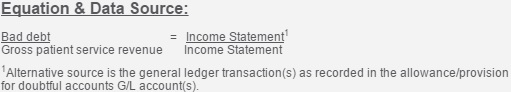

HFMA defined a healthcare organization’s bad debt metric as the total bad debt divided by the gross patient service revenue. Hospitals can find this information on income statements or general ledger transactions.

Source: HFMA

The group also recommended tracking uncompensated care, including charity care, as part of the bad debt KPI.

Uncompensated care costs dropped by $6 billion for hospitals in 2014 after some states implemented Medicaid expansion projects, a June 2016 Henry J. Kaiser Family Foundation study found. However, some hospitals may soon face trouble trying to cover uncompensated care costs even though unpaid hospital costs have decreased. Under the Affordable Care Act, the federal government must reduce uncompensated care reimbursements by $2 billion by 2018 and by another $8 billion by 2025.

Understanding how much bad debt a hospital typically incurs in a given period should better position providers to manage potentially lower reimbursements for treating low-income and uninsured individuals.

As part of their financial management strategy, hospitals should also create KPIs for payer performance. Trew advised healthcare organizations to understand payer mix and claims reimbursement rates from payers.

“Being able to accurately produce and graph data on major payers without hours and hours of work is of high strategic value to a well‐planned business decision,” he wrote. “It can answer questions about the impact on a practice if a particular payer is dropped, or how those patient slots would be filled.”

By measuring the revenue percentage that stems from each payer, hospitals can better understand how valuable each entity is to the hospital’s profitability model. Having data available on how much each payer reimburses for the same services is also key for improving contract negations.

Tracking claims management metrics for faster reimbursement

Developing an effective claims management system will ensure hospitals are reimbursed accurately and quickly for services. To improve claims management processes, hospitals should create claims management KPIs for clean claim submissions and claims denials.

A clean claim submission rate is the percentage of claims that clear internal claim scrubbing processes and claims clearinghouse edits (if a hospital uses a clearinghouse) to go straight to the payer, Hayes Management Consulting stated.

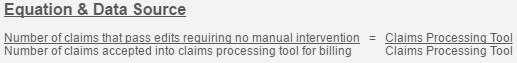

According to the HFMA, the clean claims rate equation is the aggregate number of claims that do not require edits before submission divided by the total number of claims accepted into a hospital’s claim processing tool for submission.

Source: HFMA

The organization clarified that claims submissions are clean if the claim did not need any manual intervention for the reporting month. That means any claims that were red-flagged, submitted directly to a third-party payer without internal claim edits, or internally tapped for print and hardcopy submission do not qualify as clean claims.

The HFMA’s Central Ohio group reported that healthcare organizations should aim to have a clean claims submission rate around 97 percent. Higher clean claim submission rates indicate that hospitals are getting paid faster due to fewer claim errors.

To boost clean claim rates, hospitals should improve patient registration processes to ensure the correct information is captured before claims are submitted with avoidable errors.

“From a revenue cycle perspective, getting the most accurate information upfront starts with patient scheduling and patient registration,” Gary Marlow, Vice President of Finance at Beverly Hospital and Addison gilbert Hospital, told RevCycleIntelligence.com in March 2015. “That provides the groundwork by which claims can be billed and collected in the most efficient and effective manner possible.”

Another key claims management KPI is a hospital’s claims denial rate. Claims denials and rejections may be a staple of the healthcare industry, but hospitals with higher profitability tend to closely monitor and improve claims denials rates to ensure money is not left on the table.

Quantifying how many claims denials the hospital receives in a set period is key to creating the claims management KPI. Hospitals should also know the reasons behind all denials.

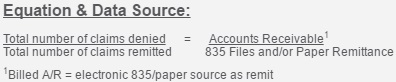

HFMA defined the claims denial formula as the total number of claims denied divided by the aggregate number of claims remitted.

Source: HFMA

The organization added that the rate should not include denials for non-covered services, patient financial responsibility, duplicate claims, Recovery Audit Contractor recoupments, or shadow encounter claims.

Based on the rate, hospitals should be able to assess their ability to follow payer requirements for claim reimbursement as well as each payer’s ability to accurately pay claims.

The industry standard for initial claims denial rates is 4 percent or under, Joncé Smith, Stoltenberg Consulting’s Vice President of Revenue Management for Stoltenberg Consulting, reported in December 2016.

However, he advised healthcare organizations to look at two claims denials categories to truly understand their financial position. First, hospitals should monitor hard, unpreventable denials, such as when an annual covered service is repeated in the same year.

Second, hospitals should track soft, unavoidable claims denials, like when a claim contains the incorrect number for a beneficiary’s policy.

“Using a business intelligence tool to analyze different denial reason codes and the volume of rejections for each code and department can pinpoint areas for process improvements,” he stated.

Tracking patient access and accounting metrics to improve collections and denial rates

With almost one-quarter of healthcare providers seeing a rise in patient financial responsibility in 2015, it is no wonder that hospitals are monitoring more consumer-focused measures, such as patient onboarding rates and point-of-service cash collections.

As with improving claims denial rates, hospitals should go back to the point-of-service to better capture patient and insurance information for cleaner claim submissions. To develop patient access KPIs, hospitals may want to consider measuring rates for pre-registration and insurance verification.

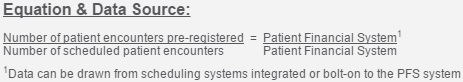

The hospital pre-registration rate quantifies the total number of monthly patient encounters that are fully pre-registered before the service date, HFMA explained. Whether done in-person, on the phone or electronically, the pre-registration rate includes outpatient and inpatient encounters as well as canceled pre-registered appointments.

The equation for determining the rate is the total number of pre-registered patient encounters divided by the number of scheduled patient encounters. The data can be found in a hospital’s patient financial system.

Source: HFMA

Hospitals should try to maintain a pre-registration rates around 98 percent of more of all scheduled appointments, Smith added.

In addition, Smith advised hospitals to evaluate insurance verification rates to understand revenue cycle and front-end staff efficiency.

“Ideally, insurance verification should be mandatory in every facility, and should be performed 10 to 14 days prior to patient arrival,” he said. “Advance verification allows patients to make self-pay arrangements if insurance coverage cannot be validated, or if a patient has a high-deductible plan. If performed too far in advance, however, insurance verification will need to be repeated in case of lapses or changes in coverage.”

Hospitals should aim to verify insurance for 98 percent of more of all registered patients.

“Ten more minutes from front-end registration staff can save three to four hours in the business office obtaining authorization numbers and resubmitting claims,” Smith added.

Additionally, hospitals should develop patient accounting KPIs, such as point-of-service collections rate.

As patients take on more financial accountability for their healthcare, hospitals may want to assess if their staff is effectively collecting patient payments before overdue bills turn into hospital bad debt.

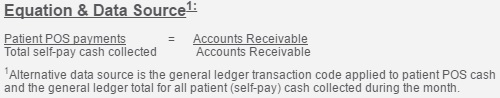

HFMA defined patient point-of-service payments as “patient cash (self-pay cash) collected prior to or at time of service and up to seven days after discharge and/or patient cash collected on prior service(s) at the time of a new service.”

The formula to calculate the measure is the total value of patient point-of-service payments divided by the total self-pay cash collected.

Source: HFMA

Applicable payments include all posted point-of-service payments, cash collected during previous encounters at a pre-service or time-of-service visit, posted pre-admit money captured in the monthly payments, and both hospital and provider payments.

However, hospitals should not include refunds or payment plan money unless received at the time of the encounter, HFMA stated.

Hospitals should aim to collect about $75 per eligible encounters on average, the Central Ohio HFMA explained.

Many healthcare organizations struggle with increasing patient point-of-service collections because of a lack of staff education on collection strategies and financial terms. As a result, some front-end staff are not notifying patients about their financial responsibilities and medical billing staff are slowed down by the breakdown in communication and data collection.

“Staff will definitely be more confident if they understand and have the information in front of them and understand what they’re actually asking for,” Rebecca Wright, Vice President of Strategic Planning at Iroquois Memorial Hospital, told RevCycleIntelligence.com in November 2016. “It comes across in their confidence levels and patients pick up on that. They’re more trusting of our healthcare organization if confidence is portrayed from the beginning.”

Through more staff education about patient financial responsibility, her 25-bed community hospital increased patient point-of-service collections by 300 percent and realized a $7,000 per month collection goal.

While developing hospital revenue cycle KPIs should help providers and executives improve profitability, Smith also recommended that healthcare organizations develop a cross-disciplinary team to carry out improvement plans.

The team should include a project manager as the lead as well as staff from across clinical departments, the business office, and IT. The chief financial officer should also be involved for higher-level participation.

The team’s responsibilities will be to monitor KPIs and create transformation plans to improve performance. The end result should be more efficient healthcare revenue cycle management processes that not only increase revenue but maintain profitability.