Best Practices for Value-Based Purchasing Implementation

To implement value-based purchasing, healthcare organizations should ensure their staff have the right tools to manage alternative payment models.

Source: Thinkstock

- The value-based purchasing boat is leaving the dock and providers can either choose to board and shift their care delivery and reimbursement methods to align with the push for value or be left behind.

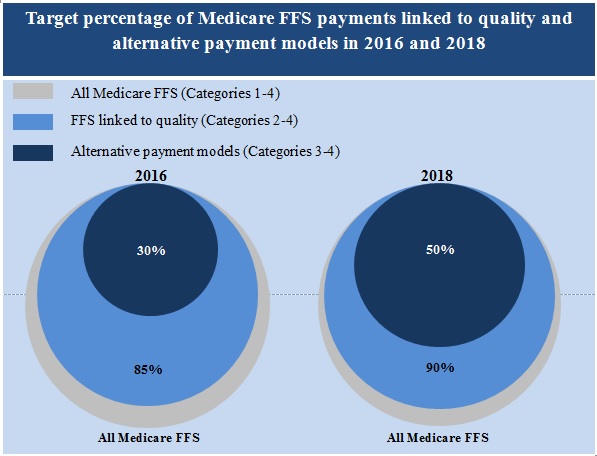

Value-based purchasing made a splash as part of the Affordable Care Act, but the federal government recently set more aggressive goals for shifting healthcare payments away from fee-for-service payment structures.

HHS already met its goal of linking 30 percent of traditional Medicare payments to value-based purchasing models, such as accountable care organizations, bundled payments, or hospital quality programs, by the end of 2016.

To continue its progress, the federal agency plans to tie 90 percent of Medicare payments to value-based purchasing models by the end of 2018.

Source: CMS

Private payers may be lagging behind HHS with connecting more healthcare payments to value-based purchasing models, but the private sector is following the federal government’s lead. About one-quarter of healthcare payments made through commercial, Medicare Advantage, and Medicaid health plans, were paid via an alternative payment model with population-based accountability in 2016, the Healthcare Payment Learning & Action Network reported in October 2016.

“With CMS detailing specific targets for transitioning to value-based payment and private payers clearly expressing their intent to accelerate the transition, now is the time for providers to focus on their capabilities to manage the transition, if they haven’t done so already,” stated Jim Landman, a Healthcare Financial Management Association (HFMA) Director.

As public and private payers introduce more value-based purchasing models, providers should be preparing their organization for the shift away from fee-for-service. Alternative payment models require a unique set of capabilities for successful participation, such as quality reporting systems and more effective healthcare cost management strategies.

To implement value-based purchasing models, providers should upgrade EHR systems, develop strategies for quantifying performance, establish population health management programs, and partner with providers across the care continuum.

Understanding the Value-Based Reimbursement Model Landscape

Preparing the Healthcare Revenue Cycle for Value-Based Care

Updating EHR systems to advance value-based purchasing performance

Value-based purchasing models determine reimbursement based on provider performance on health outcomes, cost management, or a combination of both. But to assess providers, healthcare organizations need to implement health IT systems that can gather, analyze, and report data from across the organization.

Many healthcare organizations look to their EHR system for the necessary data. As of 2015, about 74 percent of office-based physicians and 96 percent of hospitals have adopted certified EHR technology, according to the ONC.

"What providers absolutely must have are really powerful analytics that are able to take clinical and outcomes data and combine it with financial data."

With widespread EHR adoption, healthcare organizations should start to move from reporting meaningful use of their technology to developing actionable insights from their data. To achieve more meaningful EHR use, Marjie Harbrecht, a Medical Group Management Association (MGMA) consultant, advised organizations to upgrade their system to include interoperability.

“Your infrastructure needs to look at data to not only see if are we doing a good job but to see if we are getting the necessary information at the point-of-care,” she stated. “We see a lot of waste, such as repeating tests because a patient just had an MRI at their primary care provider but the specialist didn’t get the results, so they are just going to order it again.”

Under alternative payment models, providers take on financial responsibility for care episodes or patient populations. To successfully do so, providers across the care continuum should be able to communicate in real-time about shared patients via the EHR system to develop a single, personalized care plan (i.e., a longitudinal record).

EHR systems should also bridge the communication gap between different health IT systems within an organization. The clinical systems should be connected to financial solutions.

“What providers absolutely must have are really powerful analytics that are able to take clinical and outcomes data, a lot of which resides in clinical systems, and combine it with financial data to accurately measure where we improve quality based on outcomes results,” Deanne Kasim, Research Director of Payer Health IT at IDC Health Insights, told RevCycleIntelligence.com.

To determine if an organization’s EHR system supports value-based purchasing models, Modernizing Medicine, a health technology company, advised healthcare leaders to ask their EHR vendors the following questions:

- Does the EHR system use unstructured templates or macros?

- Is the system able to collect unstructured data needed for value-based purchasing models?

- Does the EHR system record quality data through a list of yes or no questions or does it automate denominator and numerator calculations based on clinical notes?

The company also suggested these leaders request EHR system demonstrations that show providers how value-based purchasing measures and reporting requirements integrate with the system.

How EHR Data Analytics Influences Value-Based Reimbursement

What Is EHR Optimization, How Does It Start?

Quantifying provider progress with value-based purchasing

Once a healthcare organization installs the necessary interoperable health IT systems for value-based purchasing implementation, executives and providers should partner to develop key performance indicators (KPIs) to maximize reimbursement.

The unofficial motto of value-based purchasing is, “If you can measure it, you can manage it.” However, healthcare organizations should go beyond simply gathering and reporting data to receive value-based reimbursement.

By developing KPIs for value-based metrics, healthcare organizations can quantify their performance across a variety of care quality and cost management metrics and compare their progress. KPIs also allow healthcare organizations to show staff across the organization their progress with value-based purchasing and motivate change before the organization is hit with reduced value-based reimbursement rates.

“Continuously monitoring your progress will help you determine the impact you have on your target patient population,” the American Medical Association (AMA) suggested. “In order to achieve positive outcomes, reassess how well your practice is accomplishing the predetermined goals monthly or quarterly and adjust your efforts to continuously improve.”

Based on an organization’s KPI success or failure, executives can also use the data to negotiate value-based purchasing terms with payers.

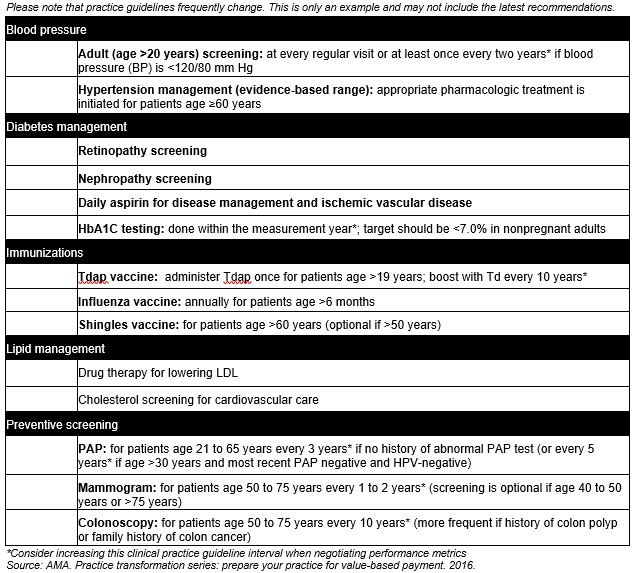

Determining which value-based metrics to track will be based on which patient populations the organization targets for population health management. However, all KPIs should incorporate evidence-based guidelines and healthcare organizations should be prepared to frequently update and add new metrics depending on different models and changing guidelines.

Source: American Medical Assocation

“It is important to consider realistic measurement windows and outcomes targets that your practice can meet when negotiating these terms,” AMA added. “Performance metric intervals should be extended beyond the clinical practice guideline interval to accommodate the lives and schedules of patients. This also reduces pressure on providers to over test patients to ensure that tests fall within the measurement window.”

For example, if a clinical practice guideline recommends that a service be performed annually, the value-based metric should be set at about 15 months to accommodate potential scheduling challenges.

The AMA also suggested that performance measurement intervals be set at 130 percent of the clinical practice guideline interval.

Additionally, healthcare organizations should create a cross-disciplinary team to manage KPIs, advised Joncé Smith, Stoltenberg Consulting’s Vice President of Revenue Management.

“The team will be responsible for defining new performance standards for selected KPIs and will be tasked with developing the plan to improve associated processes,” he said. “The end goal is that the results must be fully sustainable by the daily operational staff.”

Led by a project manager, the team of clinical, business office, and IT staff should measure KPI progress weekly and develop visual plans to improve progress.

“Visualizations provide clear roadmaps that highlight points where process modifications are needed. To maximize actionable insight, the visualizations should also depict the impact of those potential changes,” he added.

Tracking Key Hospital Revenue Cycle Metrics to Up Profitability

Quantify Denial Rates for Smooth Revenue Cycle Management

Developing population health management strategies to reduce cost and utilization

Unlike fee-for-service payment structures, value-based purchasing models aim to keep patients out of the hospital or physician office. Therefore, healthcare organizations should develop a strategy to identify patient populations that are at risk for higher healthcare costs or greater utilization.

“You need a methodology to identify high-risk patients and then a care management program to manage the care of those high-risk patients,” said Jonathan Niloff, MD, McKesson’s Chief Medical Officer. “It's a well-known phenomenon that a small proportion of patients always account for a disproportionate share of costs, so one can get a lot of return from focusing on those high-cost patients.”

Healthcare organizations can pinpoint target populations through data analytics tools. The analytics solution may be as simple as a spreadsheet or healthcare organizations can work with vendors to implement advanced population health solutions or EHR functionalities.

Once the organization decides on a patient cohort, providers should develop a population health management program that aligns with value-based purchasing. To create an appropriate population health management program, the AMA suggested the following steps:

- Identify which payers will reimburse providers for the services furnished under the model

- Estimate how service type and volume will change

- Calculate the potential benefits for patients and payers

- Develop necessary workflows to achieve population health management goals

- Establish metrics to measure success that can be captured in the EHR or population health registry

- Determine population health management program costs

Healthcare organizations should also develop a staffing model to complement population health management programs, AMA recommended. Current staff should undergo additional training to align their workflows with the value-based purchasing model and its population health management component.

“Utilizing current staff can be cost effective during the initial transition period, but additional staff may be needed as the model continues to be adopted by the practice, particularly since these new value-based models rely on effective care coordination and require a greater amount of data capture and analytics,” the industry group added.

Organizations may want to consider adding healthcare extenders to their team, such as patient outreach coordinators, care coordinators, nurse navigators, and care transition nurses. A recent Health Affairs study found that adding care navigators to a healthcare team was one of the most cost-effective care transformation efforts. The additional staff saved over $150 per beneficiary per quarter.

Navigating Value-Based Payment and Population Health Management

Value-Based Care Drives Progress in Population Health Management

Partnering with providers across the care continuum for value-based purchasing success

Many providers have voiced concerns that value-based purchasing will drive more healthcare mergers and acquisitions. While consolidation is an option, healthcare organizations should consider partnering with providers across the care continuum to ensure value-based purchasing success.

Under some value-based purchasing arrangements (e.g., bundled payment models), providers are accountable for the quality and cost of care for a period of time (e.g., 90-days post-discharge). If patients attributed to the value-based purchasing model see other providers outside of the original treating facility, the initiating provider may still be held responsible for the costs and care quality.

Therefore, healthcare organizations should develop partnerships with providers across the care continuum to ensure that initiating providers can control the costs and care quality associated with post-discharge care.

"In the value-based reimbursement environment, what organizations need to think about is identifying those top performers who are going to help."

The health alliance Premier Inc. suggested that organizations start by developing a post-acute care network of preferred providers.

“Given this new reality, providers must better understand trends after patients are discharged from the health system and better manage how and where they engage PAC [post-acute care] providers,” it stated. “As our healthcare system pushes providers toward more population health, hospital leaders must optimize their use of PAC and establish partnerships to deliverthe highest quality, most cost-effective patient care.”

Healthcare organizations should aim to establish a high-value post-acute care network, and their leaders should evaluate post-acute care performance by facility to identify which organizations provide high-quality and low-cost care.

“Organizations need to consider the data they’ve learned, but they also need to evaluate in-person and via data requested from the post-acute providers about their capacity and their ability,” said Andy Edeburn, Principle of Population Health Advisory Services at Premier. “A lot of organizations do that via surveys or requests for information from the post-acute providers. A lot of it is done via on-site visits.”

“In the value-based reimbursement environment, what organizations need to think about is identifying those top performers who are going to help address that need that was identified early on,” he added.

Healthcare organizations should also consider physician integration models (e.g., independent practice associations), open and closed physician-hospital organizations, and fully integrated organizations.

A 2017 report published by Rice University’s Baker Institute for Public Policy revealed that 599 cases out of 1,445 hospitals reporting a change in integration represented a shift to more physician-hospital integration.

Researchers noted that value-based purchasing models, such as accountable care organizations, may have pushed for greater integration. Hospitals and physicians may benefit from more formal connections to achieve greater cost savings under the value-based purchasing contracts.

“Through integration hospitals could better control physician practices to increase efficiency and decrease costs,” stated the report. “Increased integration could reduce duplication of services, provide clinical benefits, and improve communication and coordination of care between hospitals and physicians.”

Did Risk-Based APMs Propel Greater Provider Consolidation?

Public and private payers may be pushing for increased value-based purchasing implementation, but providers have been slower to take on alternative payment models.

A December 2016 American Medical Group Association (AMGA) survey found that 77.3 percent of 2016 commercial revenue came from a fee-for-service payment structure.

Providers generally believed their practices would be further along with value-based purchasing revenue by 2016. In the 2015 AMGA survey, providers predicted just 68 percent of 2016 commercial revenue to stem from a fee-for-service arrangement.

But with many public and private payers moving forward with value-based purchasing, providers may need to jump on board and ensure their organization has the core competencies to implement alternative payment models.

“The big negative that I see right now is that it’s going very slow,” Harbrecht said. “We’ve got people with one foot on the boat and one foot on the dock, but the boat is taking off. Until we get people on the same page, a healthcare organization almost has to just dive in head first and commit to a redesign, including paying providers differently.”