1 in 7 In-Network Admissions End with Surprise Medical Bill

The analysis also showed that anesthesiologists performed and independent labs billed the most out-of-network services resulting in surprise medical bills.

Source: Thinkstock

- Approximately 14.5 percent of in-network hospital admissions resulted in a surprise medical bill for patients, researchers from the Health Care Cost Institute (HCCI) recently reported.

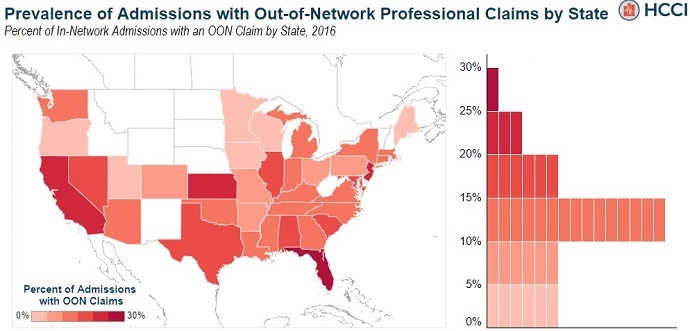

However, the occurrence of surprise medical bills significantly varied by state and medical specialty, HCCI researchers Kevin Kennedy, Bill Johnson, and Jean Fuglesten Biniek revealed in a blog post on the independent, non-profit research institute’s website.

Through their examination of almost 620,000 in-network inpatient admissions and their associated professional claims from 2016, they found the share of in-network inpatient admissions with at least one associated out-of-network professional claim ranged from 1.7 percent in Minnesota to 26.3 percent in Florida.

Source: Health Care Cost Institute

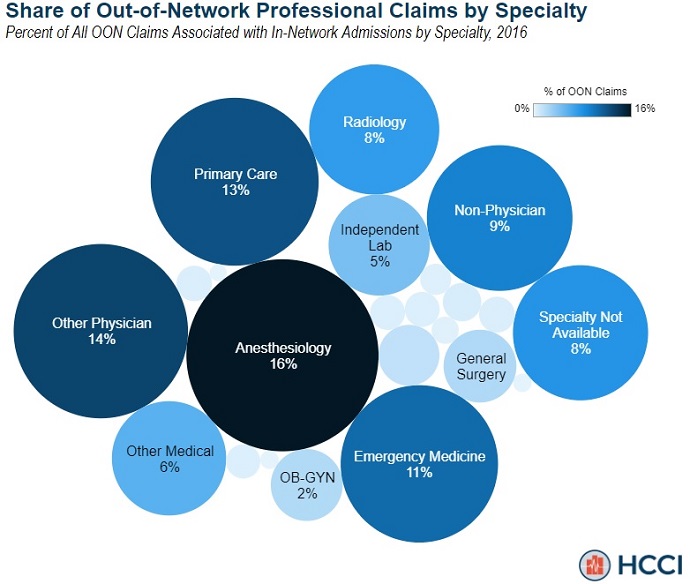

Additionally, the examination uncovered that the majority of out-of-network professional claims stemmed from anesthesiology.

Anesthesiology had the largest share of in-network hospital admissions resulting in a surprise medical bill, with 16.5 percent of the sampled out-of-network professional claims being performed by an anesthesiologist.

Physicians, primary care providers, and emergency medicine doctors also accounted for a considerable share of out-of-network claims. The providers performed 13.5 percent, 12.6 percent, and 11 percent of the sample’s out-of-network professional claims, respectively.

Source: Health Care Cost Institute

Medical specialties performing the least amount of out-of-network services included OB-GYN (2 percent), independent labs (5 percent), non-physicians (9 percent), and radiology (8 percent).

However, independent lab procedures did have the greatest likelihood of being out-of-network, HCCI researchers pointed out.

The HCCI researchers explored how often a professional claim for each specialty was out-of-network when it was related to an in-network hospital admission. They found the specialties that most frequently billed out-of-network at an in-network hospital were:

- Independent labs – 22.1 percent

- Emergency medicine – 12.0 percent

- Specialty not available – 11.5 percent

- Other physician – 9.4 percent

- Anesthesiology – 7.9 percent

In contrast, providers in oncology and hematology were the least likely to be out-of-network at an in-network hospital, with less than 1 percent of admissions with an oncology or hematology service resulting in a surprise medical bill.

Other specialties least likely to bill out-of-network included OB-GYN (1.1 percent), urology (1.2 percent), gastroenterology (1.5 percent), and orthopedic surgery (1.9 percent).

The findings from the HCCI researchers adds to the growing debate surrounding surprise medical bills.

Surprise medical bills occur when a patient receives care from an out-of-network provider despite seeking care at an in-network hospital or other healthcare facility. The bills are significantly more compared to what a patient would normally pay after their insurance covers the negotiated portion of the costs.

The out-of-network charges are putting significant financial stress on patients. Patients pay an estimated $6 billion a year for out-of-network emergency services alone, according to new research from the UnitedHealth Group.

Seventy-seven percent of patients have also worried about receiving a surprise medical bill, a 2018 Kaiser Family Foundation poll showed. And unexpected bills proved to be a larger concern than high premiums, high deductibles, and rising drug costs, as well as lifestyle needs such as rent or grocery bills, the survey revealed.

Policymakers are trying to address surprise medical bills. For example, a bipartisan group of senators proposed legislation in September 2018 that would put restrictions on surprise medical bills for services from out-of-network providers.

However, little has been done to implement protections against surprise medical bills, and that is largely due to the fact that providers and insurers trading blame over who is responsible for the charges.

Most recently, payer industry leaders sent a letter to Congress asking the federal government to prohibit providers from sending surprise medical bills for emergency care and require providers to disclose a provider’s network status to patients.

The group of payers also urged Congress to fix reimbursement rates for out-of-network hospital services. They suggested the rate be based on the amount providers are paid for similar services in the geographic region.

Hospital groups criticized the proposals from payer industry leaders, arguing fixed reimbursement rates would set a “dangerous precedent” and preserving the ability of hospitals to negotiate rates with payers is key to protecting patients.

The American Hospital Association (AHA) and Federation of American Hospitals (FAH) added that Congress should instead prohibit balancing billing.

“Our patients come first and the hospital community has proposed a plan to protect them from surprise bills,” the leaders of the hospital groups stated. “Consumers, health insurers, employers, and hospitals all agree and should seek a common solution. That solution is simple: patients should not be balance billed, and they should have certainty regarding their cost-sharing obligations based on an in-network amount.”