2.3% Medical Device Tax Won’t Heavily Impact Healthcare Buyers

The controversial medical device tax will not significantly upset the market for manufacturers or healthcare organizations, a new report says.

- The 2.3% medical device tax rolled up into the Affordable Care Act will have some impact on prices for healthcare providers purchasing products that fall under the excise, but won’t produce an undue burden for organizations that must pay more for the technologies, according to a Congressional Research Service evaluation of the issue. The tax, which took effect in January of 2013, is anticipated to raise about $29 billion in net revenues, and has been a contentious political issue since its inception.

All medical devices intended for human use, aside from eyeglasses, contact lenses, and hearing aids, are subject to the tax, which was intended to raise funds that would be applied to other provisions of the ACA, such as healthcare insurance subsidies for low-income consumers and small businesses. While relatively minor in scope, the tax was also seen as a way to offset any unanticipated profits that the medical device industry might accrue from the addition of so many millions of patients to their market as more Americans received affordable insurance coverage and accessed more services.

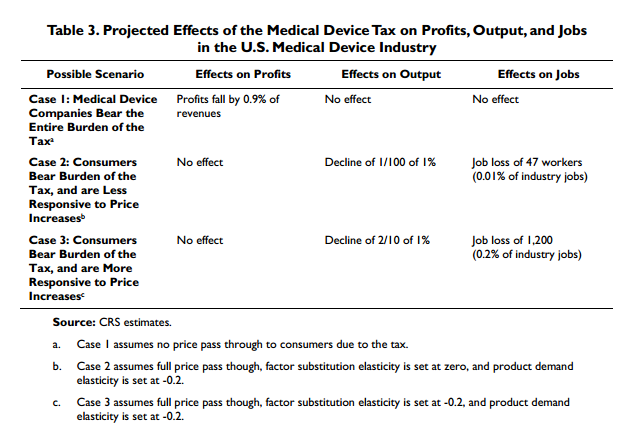

Despite objections from members of Congress over the structure and implementation of the ACA, and complaints from the medical device industry that the tax would result in job losses and hardships for developers and manufactures, the report argues that the impacts are relatively minimal.

“The estimates in this report suggest fairly minor effects, with output and employment in the industry falling by no more than two-tenths of one percent,” the brief states. “This limited effect is due to the small tax rate, the exemption of approximately half of output, and the relatively insensitive demand for health services.”

“The analysis suggests that most of the tax will fall on consumer prices, and not on profits of medical device companies. The effect on the price of health care, however, will most likely be negligible because of the small size of the tax and small share of health care spending attributable to medical devices.”

The report notes that healthcare providers have the opportunity to recoup the small increase in costs for medical device purchasing by slightly raising the cost of the overall procedure that makes use of the device, thereby cancelling out the effects on revenue. “Medical devices are generally not final consumer goods, but are rather inputs into delivering health care services to individuals,” it says. “An individual typically does not purchase a new hip joint directly from the manufacturer; he or she purchases a hip replacement procedure, which involves the joint, the services of doctors in diagnosing and operating, anesthesia, perhaps physical therapy, and other medical devices used in doctors’ offices and surgery (e.g., needles, scalpels, and sutures).”

“For a hip replacement, a joint is necessary, so the only response [to changing prices] might be to choose a different type of joint,” the report adds. “All joints, however, will be subject to the tax so their relative prices would not change. In addition, for many procedures there is likely little ability to economize on medical devices (for example, sutures), and also little incentive, where economizing is possible, when costs are charged to insurance and are less likely to affect doctors, who largely make these decisions.”

Because demand for medical devices is relatively constant, the report predicts little effect on jobs that are required to maintain the market’s level of output. In fact, due to the small size of the tax, medical device manufacturers still stand to make profits due to the more rapid expansion of the medical services industry. Small fluctuations in prices on the purchasing side may be inevitable, the report concludes, but stakeholders will be able to effectively spread the burden across the supply chain without seriously damaging the market or placing an undue hardship on healthcare providers, payers, or patients.