21 States Have Overbilled the FFS Medicare Program

Twenty-one states have improper fee-for-service reimbursement and are overbilling the Medicare program.

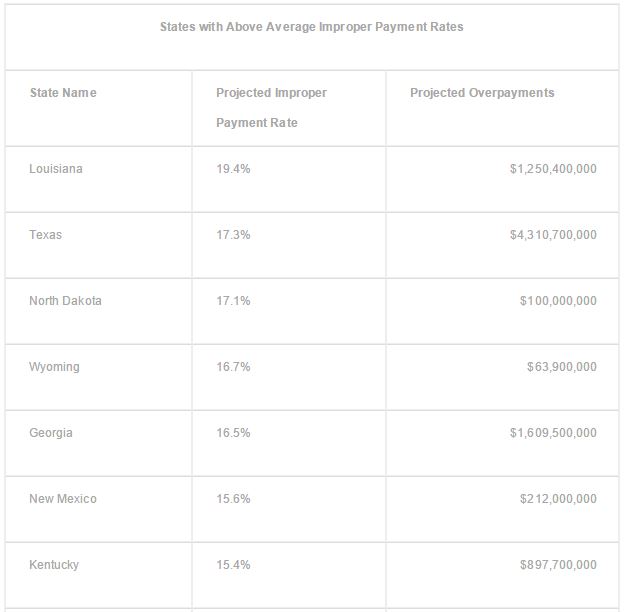

New research from the Centers for Medicare & Medicaid Services (CMS) shows that 21 states have above average rates of overbilling the Medicare program. The Supplementary Appendices for the Medicare Fee-for-Service (FFS) Improper Payment Report illustrates that the national average for inaccurate reimbursement in 2015 was 12.1 percent, which is one of the highest amounts seen so far.

The Council for Medicare Integrity reported on the 21 states that have improper fee-for-service reimbursement and are overbilling the Medicare program, which included the states of Louisiana, Texas, Virginia, and Georgia.

Louisiana was at the top of the list with its overbilling rate hitting 19.4 percent of claims, which amounts to $1.25 billion taken from the Medicare Trust Fund.

These findings encompass the data that will be part of the CMS' 2015 Comprehensive Error Rate Testing (CERT) report. The CERT initiative Looks at a random sampling of claims to determine whether reimbursement was completed appropriately including following all coding and billing rules as well as analyzing whether overbilling occurred.

“This shocking list shows that it is not just one or two states that are responsible for the high average of improper payments nationwide; but in fact, overbilling is rampant all across the country,” Kristin Walter, spokesperson for the Council for Medicare Integrity, stated in a press release from the organization.

Over the last five years, the Medicare fee-for-service rate for improper payments rose from 8.6 percent to 12.1 percent. This rise amounts to a total loss of $40 billion every year. The Congressional Budget Office (CBO) and the Medicare Trustees have stated in reports that the Medicare program will actually be bankrupt by the year 2030.

If the Medicare program goes bankrupt, a total of 55 million Americans will lose their healthcare coverage and will no longer be able to rely on this public insurance option for their medical care access.

“I believe that if we do not prevent Medicare from going bankrupt, it will go bankrupt. And that will be bad for everybody,” House Speaker Paul Ryan (R-WI) stated in an interview.

The healthcare industry will need to work with the federal government and CMS to ensure that proper medical billing occurs and the Medicare program can be saved. In 2009, the the Recovery Audit Contractor (RAC) Program was created to decrease wasteful spending throughout the Medicare program and CMS.

The Recovery Audit Contractor Program was meant to find and recover fee-for-service payments that were incorrectly reimbursed to healthcare providers, but research shows that it has only reviewed about 2 percent of all claims submitted. Since many medical associations warned of undue burden due to these recovery strategies, the rate of review of a medical provider’s reimbursement and claims fell to just 0.5 percent.

When it comes to hospital billing, as much as 99.5 percent of all medical claims after payment are not reviewed or verified for accuracy. However, when the Recovery Audit Contractor Program was operating at its top levels, Chairman and Ranking Member on the U.S. Senate Special Committee on Aging Senator Claire McCaskill (D-MO) clarified that the initiative brought back $10 billion for the Medicare program. McCaskill also stated that this helped Medicare by “extending its life by two years.”

Due to the rising costs of healthcare and the issues surrounding the potential for bankruptcy within the Medicare program, it is understandable why CMS is making a variety of reforms aimed at cutting healthcare spending and strengthening patient health outcomes.

For example, on April 1, CMS launched its Comprehensive Care for Joint Replacement Model (CJR), which utilizes bundled payments for hip or knee replacement surgeries and ensures providers are paid for an episode of care instead of for every service completed such as in fee-for-service reimbursement models.

“In 2014, more than 400,000 Medicare beneficiaries received a hip or knee replacement, costing more than $7 billion for the hospitalizations alone,” Patrick Conway, CMS Principal Deputy Administrator and Chief Medical Officer, wrote in a public statement. “Despite the high volume of these surgeries, quality and costs of care for these hip and knee replacement surgeries still vary greatly among providers. For instance, the rate of complications, like infections or implant failures, after surgery can be more than three times higher for procedures performed at some hospitals than at others.”

“In 2014, more than 400,000 Medicare beneficiaries received a hip or knee replacement, costing more than $7 billion for the hospitalizations alone,” Patrick Conway, CMS Principal Deputy Administrator and Chief Medical Officer, wrote in a public statement. “Despite the high volume of these surgeries, quality and costs of care for these hip and knee replacement surgeries still vary greatly among providers. For instance, the rate of complications, like infections or implant failures, after surgery can be more than three times higher for procedures performed at some hospitals than at others.”

“The model aligns with what matters to beneficiaries—better outcomes for a whole episode of care. The model includes patient-reported outcomes after surgery and incentivizes better care coordination.”