36% of ACOs Consider Quitting MSSP Under New Proposed Rules

Another 60 percent of respondents from ACOs opposed proposed changes to the Medicare Shared Savings Program (MSSP), a new survey shows.

Source: Thinkstock

- Over one-third of accountable care organizations (36 percent) said they are unlikely to continue with the Medicare Shared Savings Program (MSSP) if the proposed overhaul is finalized, a recent survey showed.

Only 48 percent of ACO leaders in the National Association of ACOs (NAACOS) survey reported that their organization would stay in the revised Medicare ACO program, which would be called the Pathways to Success initiative. There were 153 respondents from 127 unique ACOs.

The remaining 16 percent were neutral on whether their organization would continue in the revised program.

CMS proposed the Pathways to Success initiative in August 2018. The proposed ACO program would depart from the MSSP by reducing the number of payment tracks to just two – the Basic track, which gradually introduces downside risk after two years, and the Enhanced Track, which resembles the risk-based Track 3 of the MSSP.

If finalized as purposed, the Pathways to Success initiative would also:

- Increase the agreement period from three to five years

- Limit experienced ACOs to higher-risk participation options

- Accelerate the use of regional spending trends when calculating ACO benchmarks

- Implement additional waivers and benefits related to telehealth, beneficiary incentive programs, and the skilled nursing facility three-day stay rule

- Reduce the shared savings rates for upside-only ACOs

READ MORE: For Ongoing ACO Shared Savings, Look Outside Inpatient, Primary Care

CMS expects the proposed updates to the MSSP to increase accountability in the Medicare’s largest ACO program.

“After six years of experience, the time has come to put real ‘accountability’ in Accountable Care Organizations. Medicare cannot afford to support programs with weak incentives that do not deliver value,” CMS Administrator Seema Verma stated in the proposal’s announcement. “ACOs can be an important component of a system that increases the quality of care while decreasing costs; however, most Medicare ACOs do not currently face any financial consequences when costs go up, and this has to change.”

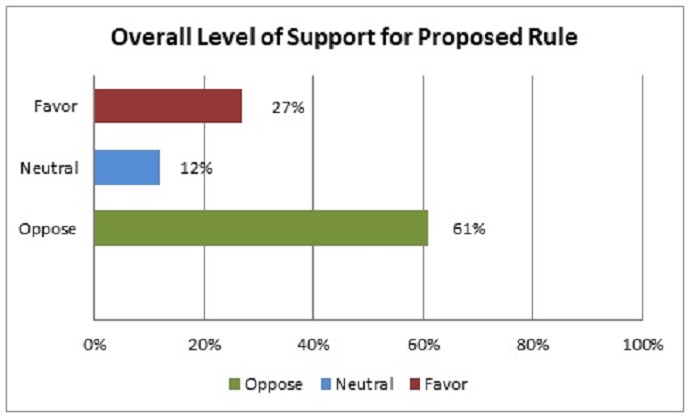

For the most part, however, MSSP ACOs are not on board with the Pathways to Success initiative. Only 27 percent of the ACO leaders in the NAACOS survey favored the proposed revisions, while the majority (61 percent) said they opposed the proposed rules.

Source: NAACOS

The remaining 12 percent of respondents were neutral about the potential MSSP changes.

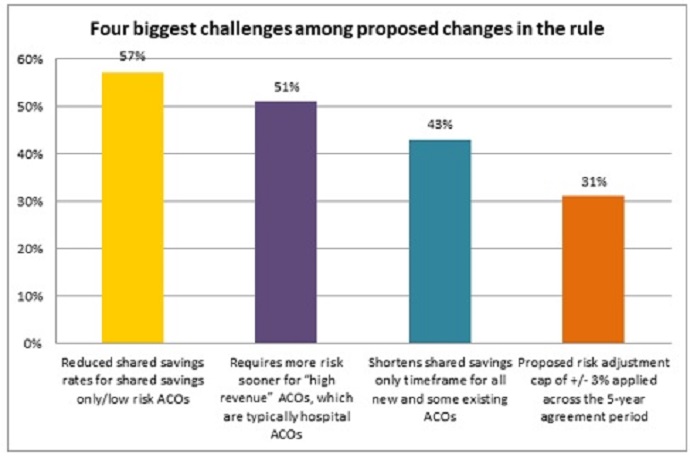

ACO leaders expressed the most concern with the proposal to reduce the shared savings rates for upside-only organizations in the Basic track of the Pathways to Success initiative. CMS proposed to reduce the rates by half, bringing the shared savings rates to as low as 25 percent.

READ MORE: How Next Generation ACOs Built a Foundation for Success

About 57 percent of survey respondents voiced concerns that the low shared savings rates for upside-only ACOs would negatively impact ACO operations.

“ACOs rely on shared savings payments to fund critical activities and infrastructure including hiring care coordinators, enhancing health information technology, investing in population health management, and analytics and running ACO operations,” the survey report stated.

“Finalizing this proposed reduction in shared savings rates would not allow ACOs to recoup these investments and would deter participation in the MSSP,” the report continued. “As one respondent noted, ‘The shared savings is what the ACOs use to help offset the additional costs, so cutting the savings in half doesn't make any sense.’”

The requirement for experienced, high-revenue ACOs to take on greater downside financial risk sooner was also a major challenge identified by respondents.

About one-half of ACO leaders (51 percent) raised concerns with the proposal to classify ACOs as either “high” or “low” revenue and require the high-revenue organizations to assume more risk sooner than the low-revenue organizations.

Source: NAACOS

READ MORE: Exploring Two-Sided Financial Risk in Alternative Payment Models

The proposal was particularly a challenge for ACOs in rural areas, the survey showed.

“Using the proposed CMS calculation of high and low revenue ACOs, hospital or health system based ACOs would typically fall into the high revenue category,” the report stated. “There were a number of comments from rural ACOs about being affected by this proposal, with one respondent commenting that there is, ‘no consideration of the challenges rural providers face as they move to value-based care/ACOs particularly related to limited resources, financial reserves and skills with actuary data analysis.’”

Some respondents also pointed out that the greater levels of risk for high-revenue ACOs would be an obstacle. The high-revenue ACOs would have to take on the same level of downside financial risk in Track 3 of the MSSP and some organizations would need to move to the higher risk track as early as 2021.

“We are currently in year one of Track 1+. The proposal would force us into the Enhanced Track with substantially more risk than we are likely prepared to take on at this time,” one respondent told NAACOS.

About 43 percent of respondents also cited the shortened time in the shared savings-only track as a major challenge with the proposed Pathways to Success initiative.

The shorter timeframe in the Basic track would be especially troubling for new ACOs joining the program. Under the proposed MSSP overhaul, new ACOs would only have one year’s worth of performance data before having to assume downside financial risk.

“NAACOS supports ACOs moving to risk but emphasizes the importance of an appropriate path to risk, including reasonable speed with which risk is required and attractive shifts in savings,” the report stated. “These key elements are critical when determining how ACOs assume risk. Many respondents expressed concerns with the ability of ACOs, especially those new to the program, to assume risk as quickly as in performance year three as proposed.”

One respondent pointed out, “There is no cookie cutter approach to ACOs and each market is different. I think that ACOs need more time to achieve savings.”

While ACO leaders identified major challenges, they also saw some opportunities in the proposed MSSP revisions.

Specifically, 55 percent of respondents said the ability to choose prospective or retrospective assignment each year was a top opportunity.

Another 42 percent of ACO respondents also identified the expanded telehealth and beneficiary incentive waivers for risk-bearing ACOs as a major opportunity. And 30 percent of respondents cited the five-year agreement period as a plus.

Despite the opportunities, most of the MSSP ACOs currently in operation (60 percent) stated that they would not have even joined the Medicare ACO program if the proposed rules were in effect when they decided to participation.

Just under one-quarter of respondents (24 percent) said they would have chosen to participate if the proposed rules were in effect and the remaining 16 percent were neutral.

“This result reflects that while there are some positive proposals in the rule as highlighted by those selected as key opportunities by respondents, on balance the challenges in the proposed rule outweigh those opportunities, especially as they would pertain to new ACOs considering entering the program,” the report stated.

In the same vein, one respondent told NAACOS:

“The majority of proposed changes in the NPRM [notice of proposed rulemaking] are logical when isolated by themselves, but what appears to have been lost is that this rule now creates a significant barrier to entry and/or continuation for many organizations, impacting both how the program’s growth and how provider organizations balance the value-based transition. If MSSP is to remain a growth engine for accountable care, the rule will need to be softened to allow organizations time to adjust infrastructure.”

In light of the survey results, NAACOS advised CMS to modify the proposals in the Pathways to Success initiative. Specifically, CMS should give ACOs at least four years in the shared savings-only track, not classify high and low revenue organizations, and apply a shared savings rate of at least the current 50 percent.

“The MSSP remains a voluntary program, and it’s essential to have the right balance of risk and reward to continue program growth and success,” NAACOS wrote. “Program changes that deter new entrants would shut off a pipeline of beginner ACOs that should be encouraged to embark on the journey to value, which is a long-standing bipartisan goal.”