65% of Organized Providers Paid Via Alternative Payment Models

A recent survey showed that only 35 percent of providers in an integrated employment model are not primarily reimbursed through an alternative payment model.

Source: Thinkstock

- Nearly two-thirds of healthcare providers in some type of integrated employment model, such as integrated health networks, physical hospital organizations, accountable care organizations, and large medical groups, are primarily reimbursed through an alternative payment model, a recent Capgemini Consulting and Omnicom Health Group survey showed.

Only 35 percent of the 886 providers surveyed said that their revenue mostly comes from fee-for-service reimbursement models.

Respondents stated that the majority of claims reimbursement revenue stemmed from a range of alternative payment models, including pay-for-coordination, pay-for-performance, bundled payments, and capitated payments.

Based on survey results, researchers projected the percentage of revenue stemming from these models to increase as MACRA matures.

While the survey indicated that organized providers, or those in an integrated employment model, are well on their way to increasing value-based reimbursement revenue, other recent research has suggested that providers in general are lagging.

The Healthcare Payment Learning & Action Network reported in October 2016 that only one-quarter of healthcare payments in 2016 were reimbursed through an alternative payment model that includes population-based accountability.

The healthcare industry also did not significantly progress with moving additional healthcare payments to more advanced alternative payment models. Only 23 percent of healthcare payments in 2016 were tied to a population-based accountability model and 15 percent were connected to a hybrid fee-for-service and value-based incentive model.

Another survey from the American Medical Group Association (AMGA) also found that medical groups ranging from one to over 1,000 physicians experienced a slowdown in the value-based reimbursement transition. About 77 percent of commercial revenue and 40.7 percent of federal revenue came from a fee-for-service arrangement in 2016.

However, respondents predicted in 2015 that only 68 percent of 2016 commercial revenue would come from a fee-for-service structure.

With more organized providers receiving value-based reimbursement revenue, according to the Capgemini Consulting and Omnicom Health Group survey, researchers found that they still faced similar challenges with the transition away from fee-for-service compared to private practice providers.

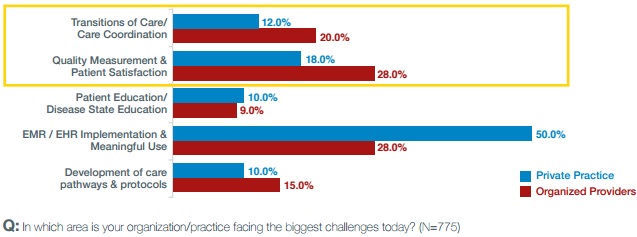

The top challenges that organized providers identified with the value-based reimbursement transition were quality measurement and patient satisfaction as well as EHR implementation and meaningful use. Twenty-eight percent of organized providers selected each challenge as the greatest hurdle for their organization.

Source: Capgemini Consulting and Omnicom Health Group

On the other hand, private practice providers were much more troubled with EHR implementation and meaningful use attestation. One-half of these respondents stated that EHR projects were the greatest challenge facing their organization.

Like organized providers, the next biggest obstacle was quality measurement and patient satisfaction with 18 percent of respondents.

Despite having similar challenges, researchers indicated that organized providers are “now moving beyond meaningful use (MU) to leverage the capabilities of Electronic Health Records (EHR) systems reporting on quality and coordination of care.”

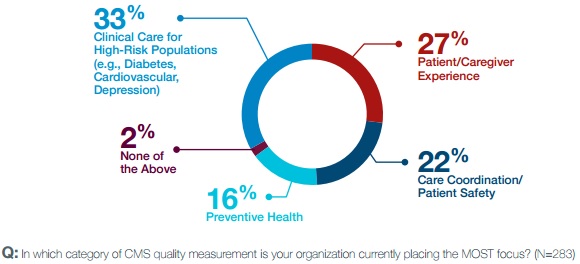

Additionally, the survey showed that providers are shifting their focus on what quality measures to target. One-third of respondents said that their organization is focusing the most on CMS clinical care measures for high-risk populations.

Source: Capgemini Consulting and Omnicom Health Group

Although, patient and caregiver experience measures were a close second with 27 percent of respondents, followed by care coordination and patient safety measures with 22 percent of participants.

To better focus on CMS measures and transition more payments to alternative payment models, survey respondents said that they are looking to three key strategies.

First, organized providers stated that their organizations are working to align clinical operations with quality metrics and care coordination. Leveraging existing health IT systems, such as EHRs, is key to achieving the alternative payment model goal.

Second, organized providers agreed that their healthcare organization needs to focus on improving cost efficiency. Through more efficient cost management and care delivery techniques, the providers aim to make their care more valuable.

Third, investing in health IT implementation and integration was at the top of organized provider priority lists.

“Furthering technology integration with increasingly sophisticated digital health technologies to give providers access to comprehensive, real-world data sets and therefore more powerful insight generation,” stated the survey. “Organized Providers will continue to make investments in their HIT infrastructure so that they are better equipped to respond to payer and patient expectations.”