96% of Healthcare Execs Report Rise in Inpatient Drug Spending

Rising prescription drug rates and increased use of specialty drugs led to significant increases in inpatient drug spending, a Premier survey uncovered.

Source: Thinkstock

- Approximately 64 percent of healthcare executives reported that inpatient drug spending at their organization significantly increased over the past five years, a recent Premier Inc survey revealed. Another 32 percent said that it somewhat increased.

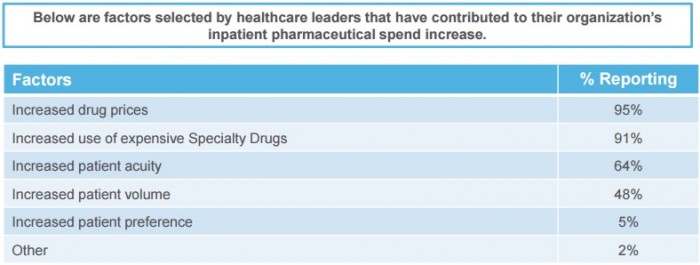

The survey of 47 healthcare C-suite leaders uncovered that rising prescription drug rates led to significantly higher inpatient drug spending with 95 percent of respondents citing it as a reason.

Source: Premier Inc

Another 91 percent of participants identified the increased use of expensive specialty drugs as a driving factor in greater inpatient drug spending.

“Unhealthy, uncompetitive drug markets are not only straining consumer budgets, but they are leading to serious financial repercussions for providers,” stated Michael J. Alkire, Premier’s Chief Operating Officer. “System loopholes are allowing pharmaceutical companies to take full advantage by raising prices on life-saving drugs – creating a perfect storm for healthcare spending.”

Growing prescription drug rates continue to challenge provider organizations. A winter 2017 survey conducted by Premier stated that 99 percent of healthcare executives pinpointed rising drug rates as a top organizational challenge.

The survey added that the prices of nearly 400 generic medications increased by 1,000 percent between 2008 and 2015.

As a result, healthcare organizations are seeing their inpatient drug spending budgets drastically increase. Hospital inpatient drug spending grew by 23.4 percent between 2013 and 2015, reaching $6.5 million in 2015 among community hospitals, a 2016 NORC report uncovered.

To combat growing inpatient drug spending, most healthcare executives in the recent Premier survey (89 percent) stated that their organization is trying to boost generic drug utilization when available.

About 82 percent of C-suite leaders also stated that their organization is tightening drug formularies to control inpatient drug spending.

Other popular strategies for containing prescription drug spending at healthcare organizations included:

• Three-quarters of executives said their organizations are increasing pharmacist use to target expensive drug use and including physicians in a drug use management role, respectively

• 73 percent reported expanding into the specialty and retail pharmacy industry

• 66 percent stated that their organization has renewed its commitment to group purchasing organization contracts

• 61 percent said their organization increased use of restrictive prescribing protocols

• 59 percent reported using an automatic generic substitution tool

• 55 percent adopted and increased use of biosimilar drugs when available

Only 9 percent stated that their organization increased use of private label products to decrease inpatient drug spending.

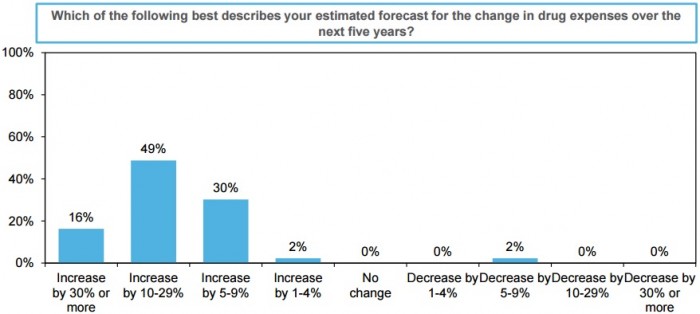

Despite organizational improvements to control prescription drug expenses, nearly one-half of C-suite leaders still expect inpatient drug spending to increase between 10 to 29 percent over the next five years.

Source: Premier Inc

Another 30 percent anticipate budgets to grow by 30 percent in the same period and 16 percent said it will increase by 30 percent of more.

Just 2 percent of respondents expect inpatient drug spending to decrease in the near future.

With inpatient drug spending straining healthcare budgets, Premier recommended several actions Congress and the Trump administration should take to foster competitive pharmaceutical markets.

Competition in the markets would combat rising prescription drug rates, the organization contended earlier in June. For example, when two or more generic drug manufacturers entered the market, drug rates dropped to 52 percent of the original price. Prices continued to fall as more competitors emerged.

However, the slow FDA drug approval process that can last up to four years prevents robust pharmaceutical market competition.

To increase competition and bring down prescription drug rates, Premier advised policymakers to implement nine improvements, including promoting biosimilar use and requiring the FDA to prioritize review of generic drug applications when competition for that drug is limited.

The organization also suggested that policymakers prohibit drug manufacturers from paying generic companies to delay low-cost alternative releases as well as extend the patent life when manufacturers change the formulation of the original drug, rather than pulling it from the market.

“Now is the time for policymakers to address flaws in the system that enable drug monopolies and directly contribute to unsustainable pharmaceutical expenses,” Alkire stated in the most recent survey.