AMGA: Value-Based Reimbursement Transition Slower Than Expected

While fee-for-service revenue decreased by over 20 percent in 2016, value-based reimbursement revenue was lower than expected this year, AMGA reported.

- Fee-for-service revenue decreased by more than 20 percent as value-based reimbursement payments increased, reported the American Medical Group Association (AMGA). But the transition to value-based reimbursement may be slowing down compared to last year.

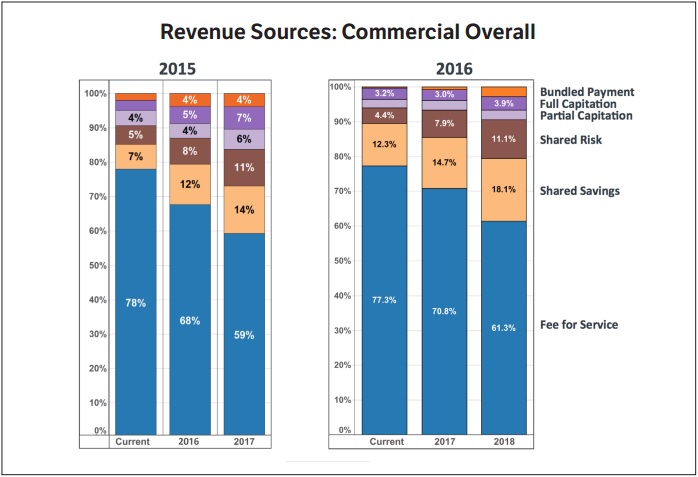

The 205 healthcare leaders participating in the recent AMGA survey stated that 77.3 percent of their commercial revenue came from fee-for-service payment structures. However, survey respondents in 2015 predicted fee-for-service revenue in 2016 to only account for 68 percent of commercial revenue.

AMGA attributed the value-based reimbursement slowdown to a lack of commercial risk-based alternative payment models and standardized data sharing.

“AMGA members are working diligently to provide high-quality healthcare in a value-based payment environment,” Chester A. Speed, JD, LLM, AMGA Vice President of Public Policy, stated in a press release. “But without access to commercial risk products and appropriate data that’s exchanged in a standardized way, it will be difficult for them to fully succeed under risk-based reimbursements.”

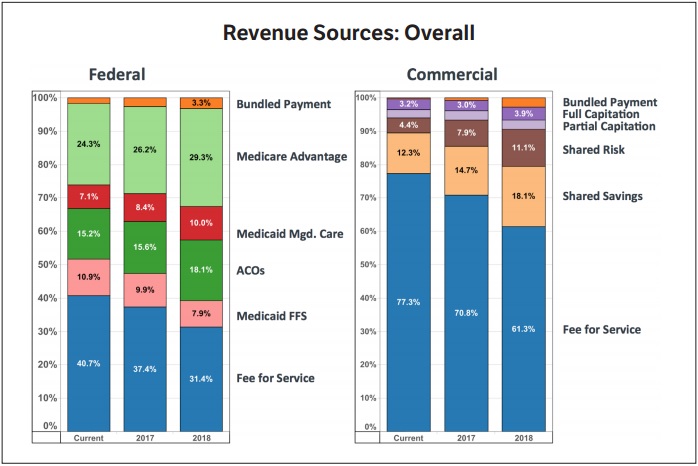

The survey showed an anticipated 23 percent decline in Medicare fee-for-service payments between 2016 and 2018, while Medicaid fee-for-service revenue is also expected to decrease by over 28 percent.

As fee-for-service payments are expected to decline, respondents also indicated that value-based reimbursement will account for roughly half of expected revenues by 2018. However, AMGA noted that the survey did not clarify if the value-based payments would be part of a risk-based model.

For commercial claims revenue, respondents predicted a slower decrease in fee-for-service dependence compared to federal payments. Respondents projected fee-for-service reimbursement from private payers to decrease by 21 percent in three years.

Risk-based reimbursement, on the other hand, is expected to significantly increase in the private payer setting. Healthcare leaders predicted revenue from shared risk products to rise from 4.4 percent in 2016 to 11.1 percent in 2018, a 152 percent increase.

Respondents also projected shared savings revenues to grow from 12.3 percent in 2016 to 18.1 percent of total commercial revenue in 2018, representing a 47 percent boost.

However, healthcare leaders stated that they expect full capitation, which requires more financial risk compared to other value-based reimbursement structures, to only increase by 22 percent from 2016 to 2018, while partial capitation revenue will stabilize at two percent.

In total, capitation revenue will only account for less than six percent of total commercial revenues by 2018.

AMGA also noted that healthcare leaders do not anticipate federal and commercial bundled payments to represent a significant portion of their revenue, even though HHS recently released new bundled payment models, such as the cardiac care bundled payment, and included several as Advanced Alternative Payment Models under the Quality Payment Program.

Compared to 2015 survey results, AMGA found that the transition to value-based reimbursement may be losing momentum. For example, respondents in 2015 indicated that eight percent of commercial revenue would be from shared-risk models, but it only represented 4.4 percent of commercial revenues in 2016.

Healthcare leaders also anticipated capitated payments to reach nine percent of total commercial revenue in 2016, but it only accounted for five percent.

Looking forward, respondents were also more optimistic in 2015 about value-based reimbursement in 2017. In 2015, respondents predicted partial- and full-capitation payments to represent 13 percent of commercial revenues by 2017. However, in the 2016 survey, respondents projected less than five percent of commercial revenue to come from some form of capitation structure in 2017.

In terms of fee-for-service payments in 2017, respondents from 2015 estimated that 59 percent of commercial revenue would come from fee-for-service structures. But respondents in the most recent survey indicated that it would represent 70.8 percent of commercial revenue next year, representing a 20 percent increase from last year’s prediction.

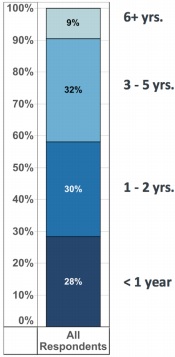

Despite a slower transition to value-based care, more healthcare leaders reported that their organizations are more prepared to take on financial risk in alternative payment models. Approximately 58 percent said their organizations would be ready to accept downside risk within two years, while 41 percent said they needed five or more years.

In 2015, 42 percent of respondents indicated that their organization would be ready to accept downside risk within two years.

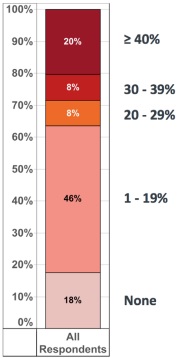

While providers were willing to take on financial risk, AMGA found that many payers did not offer risk-based alternative payment models in their local markets. About 18 percent of participants stated that no payer offered risk-based reimbursement products in their market and another 46 percent said there were only one to 19 percent of plans offering risk-based products.

AMGA added that limited risk-based options may spell trouble for providers participating in the Advanced Alternative Payment Model track of the Quality Payment Program. CMS plans to reward providers that partake in risk-based alternative payment models, including commercial structures.

Providers also identified other top payer impediments to taking on more financial risk, including a lack of data submission standardization, relevant data sharing, and healthcare interoperability.

Internally, providers also faced several challenges with taking on risk. Respondents agreed that the top impediments were limited infrastructure to manage risk, such as EHRs, data analytics, and care management processes.

Many providers agreed that their organizations did not have access to capital to finance infrastructure projects, causing some to consider consolidating with a larger organization.

Additionally, some respondents reported that their organizations hesitated to take on more risk because of uneven success with risk-based alternative payment models. For example, some providers faced an 18-month payment lag under shared savings and risk structures because performance-based payments needed more time for analysis.

AMGA found that 2015 respondents faced similar challenges transitioning to value-based reimbursement, indicating that stakeholders and policymakers have done little to address provider issues.

“According to this year’s data, that deceleration is already occurring,” concluded the report. “Congress and HHS need to address these impediments soon, or the transition to value will either be unnecessarily difficult and prolonged, or it may grind to a halt much like it did in the 1990s.”

The Health Care Payment Learning & Action Network (HCP LAN), an HHS initiative, also found that the majority of healthcare payments were under fee-for-service models in 2016. The group reported in October that only 25 percent of healthcare payments in 2016 were linked to an alternative payment model with population-based accountability.

Similarly, HCP LAN also determined that payers have not made significant progress with alternative payment model adoption. Only about 23 percent of healthcare payments were reimbursed by payers through a population-based alternative payment model in 2015.

Image Credit: AMGA

• Dig Deeper:

• Understanding the Value-Based Reimbursement Model Landscape

How to Develop a Value-Based Care Implementation Strategy