Cardiac Care Bundled Payment Model to Generate Modest Savings

Eighty-five percent of providers in the proposed Medicare bundled payment model for cardiac care are projected to see moderate gains or losses.

- The recently proposed Medicare bundled payment model for cardiac care will likely bring only modest shared savings or losses to participants, according to a study from Avalere Health.

About 85 percent of providers that will be required to take part in the new Medicare cardiac care bundled payment arrangement would not generate gains or losses over $500,000 per year, the report predicts.

“Given the array of new cardiac bundles, there is no magic bullet to achieving savings,” stated Fred Bentley, Vice President of Avalere. “Instead, participating hospitals will need to pull multiple levers to drive down costs.”

“They will be working more closely than ever with their physicians to streamline care and promote adherence to clinical guidelines. And they will accelerate the development of high-performance post-acute networks to cut readmissions and achieve efficiencies for their medically-managed heart attack episodes.”

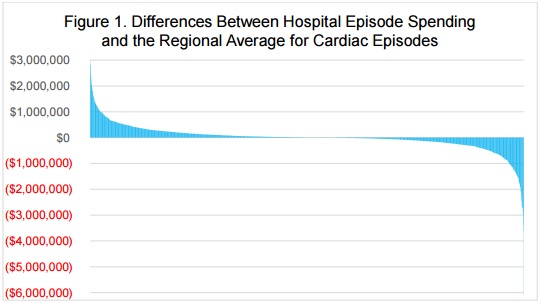

Using Medicare claims data from 2013 and 2014, researchers projected that most participants in the model will not see significant shared savings or losses, but some providers may face substantial penalties based on their historical spending patterns on cardiac care.

CMS proposed using historical spending levels on a hospital-by-hospital basis to determine episodic care payments. However, it plans to phase in the use of regional spending trends to calculate bundled payments for cardiac care.

When researchers compared individual hospital claims data to regional neighbors, they found that certain hospitals would spend far more than the average for their area.

Many of the hospitals that are projected to produce substantial shared losses also lack robust support systems, such as organizational process for managing for post-discharge care, to prevent patients from costly hospital readmissions and follow-up care, researchers reported.

“We’ve hit a tipping point. Healthcare executives recognize that CMS is moving beyond the experimental phase with value-based payment,” said Josh Seidman, Senior Vice President of Avalere. “Many hospitals will now need to develop the data analysis infrastructure, cost management discipline and care coordination capabilities required to deliver efficient cardiac care.”

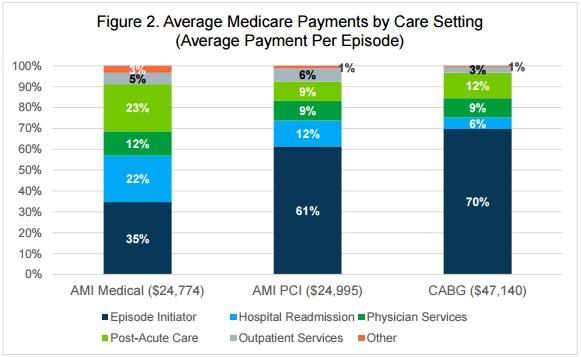

To achieve shared savings, potential participants may wish to focus on developing separate care management plans for surgical and medically-managed patients to achieve shared savings. In the proposal, CMS stated that the cardiac care episode would last for 90 days after discharge, but the report showed that healthcare spending trends differed across the time period for patients who underwent a surgical intervention, such as a coronary artery bypass grafting (CABG) or percutaneous coronary intervention (PCI), and those who did not.

For patients that received a surgical intervention, about 60 to 70 percent of healthcare spending was incurred during the initial hospital stay. However, only 35 percent of spending for heart attack patients who were medically-managed was from the inpatient stay.

Providers can use the differences in spending to develop more effective and cost-saving care management plans based on the type of patient.

For example, the study showed that 47 percent of healthcare spending on patients with medically-managed heart attacks was incurred during post-discharge care, such as post-acute services and readmissions to acute care settings. Care management plans for these patients may need to center on reducing post-discharge spending to produce shared savings.

Participants should also concentrate on lowering medical device spending to help boost their chances of producing shared savings, reported the researchers. Under the proposed cardiac care bundled payment model, CMS gave hospitals more flexibility for creating gainsharing agreements with physicians and provider organizations. By giving providers a share in bonus payments or penalties, hospitals have started to standardize the types of medical devices they use, and may negotiate better rates for the devices.

The report stated that the gainsharing opportunities has started to put downward pressure on medical device prices and many manufacturers are realigning their business models to provide products that support more coordinated care. While providers are focused on driving down medical device spending, they may also be interested in support products from manufacturers that can help reduce costly adverse events.

“Medical device manufacturers and life sciences companies are rethinking supply chain and hospital contracting to focus on paying for value over an episode of care,” said Mary Ann Clark, Vice President of Avalere.

While most participants in the bundled payment model for cardiac care may not see much of a financial change, CMS intends for the alternative payment model to improve care coordination efforts.

“On July 25, 2016, the Department of Health & Human Services proposed new models that continue the Administration’s progress to shift Medicare payments from quantity to quality by creating strong incentives for hospitals to deliver better care at a lower cost,” the federal agency stated.

“These models would reward hospitals that work together with physicians and other providers to avoid complications, prevent hospital readmissions, and speed recovery.”

Healthcare stakeholders have until October 3 to submit comments on the proposed bundled payment models, which are scheduled to start in July 2017.

Image Credit: Avalere Health

Dig Deeper:

• Understanding the Basics of Bundled Payments in Healthcare

• Preparing the Healthcare Revenue Cycle for Value-Based Care