Electronic Claims Management Adoption to Save Providers $7.9B

Manual claims management transactions cost providers $4 more than electronic transaction, resulting in cost-saving opportunities through electronic adoption, CAQH reported.

Source: Thinkstock

- Healthcare providers could save about $7.9 billion annually by switching to automated claims management processes, particularly for prior authorizations, remittance advices, and claim attachment submissions, according to the 2016 CAQH Index.

The fourth annual report revealed that electronic adoption of claims-related administrative processes remained slow, resulting in significant cost-saving opportunities for providers. Electronic adoption among health plans only grew between 1 and 8 percent in 2015.

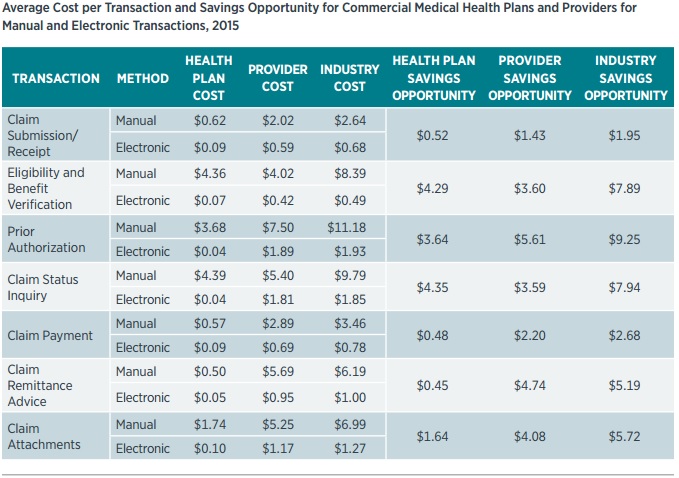

However, manual claims management processes cost providers $4 more than equivalent electronic transactions, CAQH reported.

Out of the seven claims management processes – claims submission, eligibility and verification, prior authorization, claims status inquiry, claim reimbursement, remittance advice, and claim attachments – prior authorization was the area with the greatest potential for reducing costs for providers.

Source: CAQH

On average, providers spent $7.50 on manual prior authorizations in 2015. By transitioning to automated prior authorizations, providers could save $5.61 per transaction, resulting in $4.3 billion in total potential healthcare savings.

READ MORE: Top Revenue Cycle Management Vendors and How to Select One

Despite being the greatest cost-saving area, electronic prior authorization submission saw the most rapid adoption rate (8 percent) in 2015. As a result, full electronic prior authorization adoption reached 18 percent.

The other claims management process most opportune for cost reductions was claim remittance advice. Providers spent $5.69 per manual claims remittance advice in 2015, but automating the process could reduce costs by $4.74.

Most claims remittance advices, however, were sent via mail in 2015. Although one-third of the advices were manually sent, health plans boasted 55 percent electronic claims remittance advice adoption. Electronic adoption also increased by 4 percentage points from 2014.

Rounding out the top three cost-savings opportunities for providers was claim attachments. About 94 percent of supplemental claims submission documents, such as Certificates of Medical Necessity, operative reports, and discharge summaries, were manually submitted in 2015.

But each manual submission equated to about $5.25 per transaction for providers. By automating claim attachment submissions, providers could save $4.08 per transaction.

READ MORE: Key Ways to Improve Claims Management and Reimbursement in the Healthcare Revenue Cycle

CAQH also noted that the overall cost-saving potential for the healthcare industry was over $1 billion more compared to last year’s estimates because the organization recently added claim attachment data to its study.

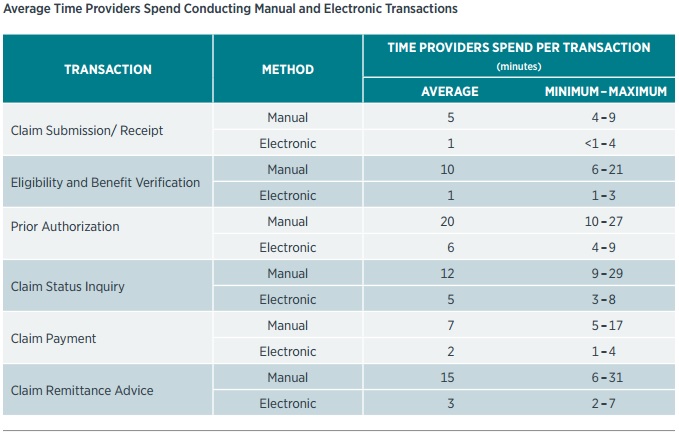

In addition to claims management cost savings, CAQH also reported that providers could make their workflows more efficient by automating processes. On average, providers spent about 8.5 more minutes on performing manual claims management processes compared to electronic transactions.

As a result, a single claim that required six out of the seven claims management processes studied would take up 51 more minutes of provider time if manually handled.

Source: CAQH

“This time could be used more efficiently, on patient care or other business needs, particularly in settings where clinical staff are involved in conducting these business processes,” the report stated.

Under fully automated claims management processes, CAQH estimated that providers could save about 1.1 million labor hours per year.

READ MORE: 31% of Providers Still Use Manual Claims Denial Management

In addition to saving time on manual transactions, an automated claims management solution could also help providers save time on other administrative tasks, such as navigating different payer claims submission requirements.

“Keeping up with all the diagnostic codes and different insurance policies can be exhausting, but there are many software providers that will automatically update codes and requirements,” Michelle Tohill, Director of Revenue Cycle Management at Bonafide Management Systems, stated in June 2016. “This cuts down on your research time, allowing your billing team to spend more time double-checking claims to make sure they meet every single requirement.”

To help providers realize claims management savings, CAQH released three stakeholder considerations for boosting electronic adoption. The suggestions included sharing best practices performing targeted efforts to eliminate adoption barriers, and conducting systematic standards, codes, operating rules, and policies evaluations.

Healthcare stakeholders should distribute best practices for electronic claims management implementation, the organization recommended.

“Given the variable adoption reported by participating health plans, it is critical that entities share and adopt best practices to further drive adoption, as some entities are excelling compared to others,” wrote CAQH.

“Industry and government entities must collaborate to provide ongoing outreach and education for all HIPAA-covered and non-HIPAA-covered entities about the value of, and immediate need for, adoption of electronic transactions, reduction of manual processes and compliance with standards and operating rules,” the organization continued.

CAQH also suggested industry-led initiatives to overcome electronic claims management adoption barriers. Both providers and health plans identified cost of implementation as a top barrier to adopting electronic processes. However, automated claims management processes could be worth the investment, according to the organization’s findings.

“Industry stakeholders should consider innovative investments, including how financial incentives could be applied, or how stakeholders could more actively conduct cost-benefit analyses to demonstrate the value of adoption,” suggested CAQH.

Vendors should also be a part of the push to reduce adoption barriers because many providers use practice management systems or trading partners for claims management transactions. CAQH noted that some vendors charge more for HIPAA-compliant services and delay necessary data or infrastructure updates. Consequently, some providers have hesitated to adopt electronic methods.

To resolve vendor barriers, CAQH suggested that vendors “ensure their products offer integrated, regulation-compliant electronic transactions on a timely basis; certification of practice management systems can help with this transition.”

However, health plans and providers should also ask for the requirements when contracting with the vendor.

Healthcare stakeholders should also conduct regular business processes reviews to identify areas for improvement, added CAQH. As part of the reviews, stakeholders should develop an evaluation schedule for updating standards, codes, operating rules, and policies.

“Administrative simplification must be an ongoing improvement process,” stated the report. “As such, industry stakeholders should embrace ongoing, proactive maintenance that is built into regulations, rather than wait for new mandates.”