Half of ACOs Consider Exiting MSSP Over New Downside Risk Rules

Downside risk rules under the Medicare Shared Savings Program overhaul may push out about half of ACOs, with hospital-led organizations more likely to quit.

Source: Getty Images

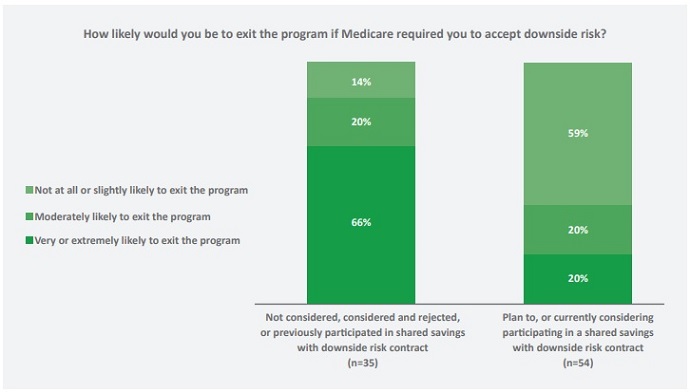

- Accountable care organizations (ACOs) are fairly split on whether or not to exit the Medicare Shared Savings Program (MSSP) under new rules that require downside financial risk adoption sooner, a new survey shows.

Forty-seven percent of the ACOs surveyed by Leavitt Partners in collaboration with the National Association of ACOs (NAACOS) said they were not at all or slightly likely to drop out of the MSSP, while 18 percent were moderately likely and 35 percent were very or extremely likely to exit.

“ACOs are at different places in their journey to value-based care, but they tend to follow a similar sequence of care delivery transformation initiatives as they develop,” David Muhlestein, Chief Research Officer for Leavitt Partners, stated in a press release. “Policymakers need to ensure that sufficient financial incentives are in place for all types of ACOs to progress in their pathways to success.”

The most recent survey report is the second from Leavitt Partners. The annual survey of over 200 ACOs aims to understand current trends and predict future developments relating to the organizations. This year’s survey respondents represent 20 percent of all ACOs.

ACOs are currently on divergent paths, the survey revealed. This year, ACOs fell into two categories: those that are already participating in or considering downside financial risk contracts and are likely to stay in the MSSP and those that are not interested in taking on risk and are likely to drop out of the program.

Source: Leavitt Partners

READ MORE: For Ongoing ACO Shared Savings, Look Outside Inpatient, Primary Care

Assuming downside financial risk is a major component of the recent MSSP overhaul. CMS finalized the overhaul in December 2018, renaming the program Pathways to Success and requiring most participating ACOs to take on risk within two years under the Basic track. CMS plans to implement the changes to the MSSP starting in July 2019.

While CMS acknowledged the overhaul would push some ACOs out of the program, the agency decided to prioritize downside financial risk adoption to put “real ‘accountability’ in accountable care organizations.”

Whether or not an ACO will continue with Pathways to Success will depend on the organization’s willingness to take on greater risk, as well as the type of ACO, the survey found.

Hospital-led ACOs were significantly more likely to consider exiting the MSSP under the Pathways to Success rules. Forty-eight percent of integrated system/hospital-led ACOs said they would drop out compared to 18 percent of physician-led ACOs.

Physician-led ACOs have historically performed better than their hospital-led peers in the MSSP. Physician-led ACOs achieved greater gross savings and received more share savings payments than hospital-led or integrated ACOs, a recent analysis of the 2017 MSSP performance period showed.

READ MORE: Large, Experienced ACOs Assume Downside Financial Risk Sooner

Physician-led ACOs may be more confident with their abilities to successfully assume downside financial risk under Pathways to Success. But the organizations also have an advantage compared to their hospital-led counterparts, Leavitt Partners pointed out.

Under Pathways to Success, CMS plans to divide ACOs based on their revenues. Low revenue ACOs, which will primarily be physician-led organizations, can remain in the Basic track for up to two five-year agreement periods, while high-revenue ACOs must transition to the Enhanced track by their second agreement period.

The Basic track offers a glide path to downside financial risk assumption, while the Enhanced track includes the highest levels of financial risk.

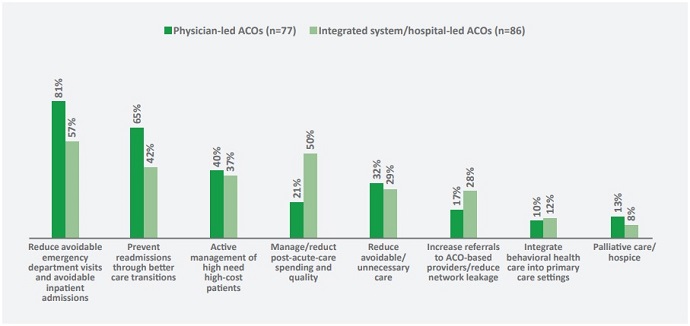

Physician- and hospital-led ACOs are also on different paths when it comes to their priorities and challenges, the survey revealed.

Designing and implement care delivery transformations impacted integrated- and hospital-led ACOs more, while physician-led ACOs were more likely to be challenged by aligning physician compensation with value-based payment and a lack of data analytic capabilities.

Source: Leavitt Partners

READ MORE: How Next Generation ACOs Built a Foundation for Success

However, aligning physician compensation with value-based payment was a challenge for 44 percent of ACOs overall, and those that cited it as a top three challenge were twice as likely to have never qualified for shared savings payments.

ACOs of all types were also challenged by a lack of commercial contract offerings. Overall, 22 percent of ACOs (including 31 percent of physician-led and 8 percent of integrated/hospital-led) reported limited alternative payment model opportunities in their commercial payer market.

Researchers also found that less than one-half of ACOs (47 percent) with a risk-based Medicare contract also had a risk-based contract with Medicare Advantage, Medicaid, or a commercial payer.

“This indicates that a lack of payers offering risk-based contracts diminishes ACOs ability to take on more risk,” the report stated.

While ACO type impacts an organization’s risk portfolio, the survey also found that ACOs tend to take a similar pathway to downside financial risk adoption.

“They tend to follow a similar sequence of care delivery transformation initiatives starting with the lowest hanging fruit (e.g., reducing excessive post-acute care facility use) before moving on to more difficult changes (e.g., redesigning physician practices),” the report stated. “We can look to the most experienced ACOs for an indication of initiatives that may become more widespread as new organizations gain experience managing populations.”

For example, ACOs that started in 2015 or before are more likely to run a program to address opioid overuse (44 percent versus 23 percent), and ACOs currently participating in a risk-based contract more frequently reported having implemented changes that enable physicians to manage medications for high-cost patients.

“Our survey shows that ACOs are forging their own, unique paths towards success,” the report concluded. “As long as they have sufficient financial incentives and are able to adapt to changing program requirements, they will continue to move forward.”

“Payers, ACO-enablers, policymakers, and other stakeholders should recognize that there can be multiple pathways to success and in addition to creating solutions and incentives for ACOs as a whole, consider creating solutions and incentives tailored to specific segments of ACOs based on their unique experience, priorities, and challenges.”