Healthcare Reimbursement Still Largely Fee-for-Service Driven

The healthcare industry is still heavily reliant on fee-for-service reimbursement despite a drive to adopt value-based care, according to Xtelligent Healthcare Media’s recent Value-Based Care Assessment.

Source: Getty Images

- Value-based reimbursement is frequently cited as healthcare’s silver bullet. Changing the way providers are incentivized to deliver care can alter care delivery, placing the focus on high-quality, low-cost care rather than high-volume, sick care. Many alternative payment models have emerged that leverage various quality metrics and levels of financial risk.

But the healthcare industry is still heavily reliant on fee-for-service reimbursement, according to a recent study by Insights, the research division Xtelligent Healthcare Media.

The Value-Based Care Assessment — the first of many Insights publications to come in 2020 — surveyed 174 healthcare professions to understand the current state of value-based care.

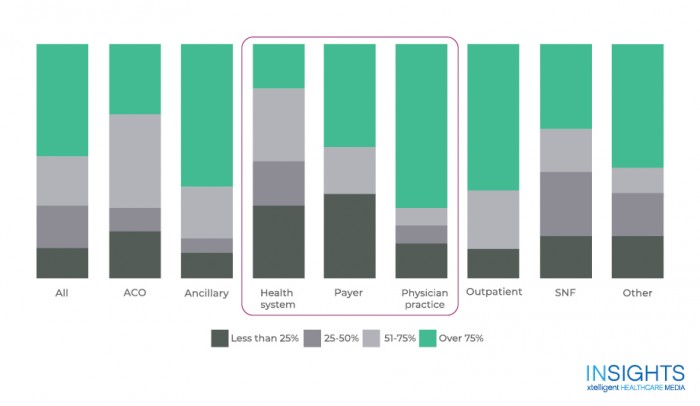

Among all respondents, 48 percent report that over three-quarters of their organization’s revenue comes from fee-for-service reimbursement. And only 57 percent report using value-based reimbursement models. So despite value-based reimbursement’s promise, the industry is still heavily reliant on fee-for-service.

The survey found that a reliance on fee-for-service varies by organizational type, highlighting a disconnect across the industry. Whereas 70 percent of physician practices report over 75 percent of their revenue comes fee-for-service reimbursement, only 19 percent of hospitals and health systems report the same.

This misalignment is a call for reform and action. Organizations thought to be pulling in the same direction are not. Incentive structures vary considerably and cause providers to shift their focus to n different aspects of care. Until there is better alignment of incentives, care will continue to be disjointed across the system.

The Value-Based Care Assessment also highlights findings from a supplemental focus group. Payers and providers came from across the industry:

- Federally qualified health centers

- Health systems

- Home health agencies

- Managed care organizations

- National and regional health plans

- Physician practices

- Outpatient centers

Overall, their conversation highlights a need for improved communication between payers and providers. Strategic alignment of incentives and a shared definition of value will enable providers to feel more confident in adopting more complex models of care with varying levels of risk.

Source: Xtelligent Healthcare Media

“Payers are the ones who have always taken risks. That’s our job. It seems silly to ask the provider groups, who are best suited to deliver high-quality patient care to our members, to also start thinking about how to mitigate risk,” said a focus group member from a regional health plan with public and commercial lines of business.

Healthcare reimbursement exists on a spectrum. On one end is fee-for-service; on the other, provider-sponsored plans and population-based payments. As organizations move across this spectrum, they assume more downside financial risk. But as the focus group highlighted, providers are best equipped to deliver patient care, less so to mitigate financial risk.

It is unsurprising that the Value-Based Care Assessment revealed the industry is still very close to the fee-for-service reimbursement end of the spectrum. The most commonly adopted value-based reimbursement model is pay-for-performance, the model most similar to fee for service. Only 26 percent of physician practices and 8 percent of hospitals or health systems are participating in shared losses or downside financial risk.

“Value-based care is payer driven, but provider and hospital partners need to come together and recognize this is something bigger. We’re not just trying to do something niche. We’re trying to help people prosper across our population,” said a focus group representative from a regional commercial health plan.

In order to continue to move towards the riskier end of the value-based care spectrum, providers need to be more confident in their ability to assume downside risk, and this is largely driven by their confidence in their payer partnerships and an alignment of incentives across payers.

Without better collaboration between payers and providers, value-based care will not succeed.

The Value-Based Care Assessment also highlights which value-based care models organizations are implementing, when organizations expect to participate in downside risk models, investments organizations are making to succeed in value-based care, and the technology needed to assist in revenue cycle management for these models. The full report can be found here.