Hospitals Saw 23% Rise in Inpatient Prescription Drug Spending

A recent NORC study found that significant increases in inpatient prescription drug spending between 2013 and 2015 have negatively impacted hospital revenue cycles.

- Hospital inpatient prescription drug spending has increased by 23.4 percent from 2013 to 2015, reported a recent study from the University of Chicago’s NORC. The increases in spending have left most providers struggling to manage their hospital revenue cycles.

The research, commissioned by the American Hospital Association (AHA) and the Federation of American Hospitals (FHA), showed that 90 percent of the 712 surveyed hospitals reported that inpatient prescription drug spending increases had a moderate or severe impact on their organization’s ability to manage healthcare costs.

“Hospitals bear a heavy financial burden when the cost of drugs increases and must make tough choices about how to allocate scarce resources,” Richard J. Pollack, AHA President and CEO, and Charles N. Kahn III, FHA President and CEO, wrote in the report. “One hospital put the challenge starkly: last year, the price increases for just four common drugs, which ranged between 479 and 1,261 percent, cost the same amount as the salaries of 55 full-time nurses.”

Total prescription drug spending, including discounts, grew by $309.5 billion annually, making prescription drugs the fastest rise segment in the healthcare industry, according to a cited IMS Health study. CMS also reported that drug spending increased by 12.2 percent in 2014, outpacing the overall healthcare spending growth rate at 5.3 percent and hospital and physician care spending growth rates at 4.1 and 4.6 percent, respectively.

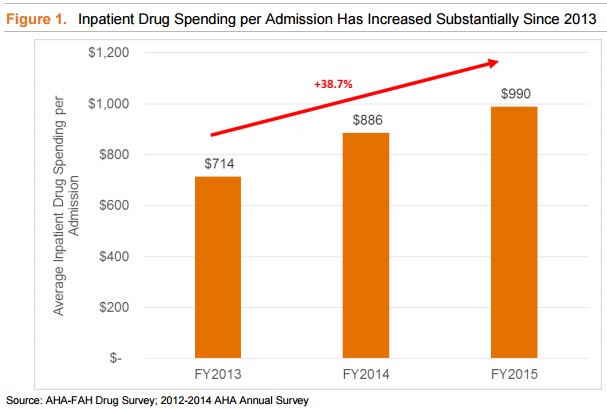

While prescription drug spending in general has increased, the NORC report showed that inpatient drug spending has particularly impacted hospitals. Average annual inpatient drug spending at community hospitals rose from $5.2 million in 2013 to $6.5 million in 2015.

In the same time period, average inpatient prescription drug spending per admission increased by 38.7 percent.

The increases in prescription drug spending were primarily driven by rising drug prices rather than hospital utilization, reported the study. Another IMS Health study found that prescription drug spending increased by 8.5 percent in 2015, but total prescriptions dispensed only increased by one percent.

Prescription drug price increases, however, were “random and inconsistent from one year to the next,” the NORC study stated. Many of the drugs that increased in price were high-volume drugs for hospitals, such as calcitonin, nitroprusside, isoproterenol, neostigmine methylsulfate, phytonadione, and glycopyrrolate.

Most of the drugs that saw price increases were not innovator drugs, researchers added, and about half of the 28 studied drugs did not have an active generic competition, forcing hospitals to buy the product at higher prices.

“And while nearly everyone can agree that price increases in the hundreds or thousands of percent are unjustifiable, many hospitals report that annual price increases of 10 or 20 percent on widely-used older generic drugs can have an even greater effect, given the large quantities that a hospital must purchase,” wrote Pollack and Khan.

Researchers noted that drug price increases were not predictable. For some medications, the price change occurred after the pharmaceutical company was bought by another business. For example, the leukemia drug Oncaspar, which was approved in 1994, saw a price increase of $10,000 in 2015 after Baxalta Inc. was purchased. The anti-parasitic Daraprim, which was approved in 1950, also witnessed a 3,000 percent price increase after the new owner of Turing Pharmaceuticals boosted the price in 2015.

In addition, temporary market failures contributed to drug price variations. In 2012, Luitpold Pharmaceuticals, one of two glycopyrrolate manufacturers, temporarily shut down its factory to correct quality control issues, causing Hikma Pharmaceuticals, the other glycopyrrolate maker, to increase its prices in 2013. Group purchasing organizations reported a 334 percent boost in the drug’s price in 2014.

In response to changes in prescription drug spending, the majority of hospitals experienced issues balancing healthcare budgets. Nearly 57 percent of hospitals said that higher drug spending moderately affected their budgets, while one-third of hospitals reported that the impact was severe.

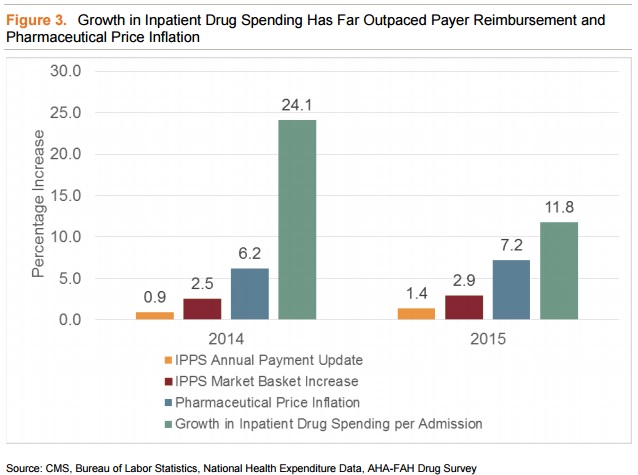

Hospital revenue cycle constraints were compounded by low Medicare reimbursement rates for prescription drugs, the report added. Medicare determines reimbursement for inpatient medications using the Inpatient Prospective Payment System or a set rate, such as a percentage of Medicare reimbursement. CMS calculates the rates using the Bureau of Labor Statistics prescription drug component, which updates the pharmaceuticals index every five to seven years and adds new drugs every year.

However, the annual pharmaceutical index updates do not account for rising drug prices for existing medications until the five to seven-year update, causing Medicare reimbursement rates to lag behind rapidly rising supply chain costs.

While inpatient prescription drug spending grew by almost one-quarter, Medicare reimbursement rates under the Inpatient Prospective Payment System increased by only 2.7 percent, reported NORC researchers.

Hospitals had to absorb excess costs after reimbursement rates fell short and many had to sacrifice other patient care or quality improvement items to make up for increases in prescription drug spending.

“Managing these skyrocketing cost increases forces difficult choices between providing adequate compensation to employees, many of whom are highly skilled in professions facing shortages; upgrading and modernizing facilities; purchasing new technologies to improve care; or paying for drugs, especially when these price increases are not linked to new therapies or improved outcomes for patients,” Pollack and Khan wrote.

Earlier this year, CMS also reported a 17 percent, or $17 billion, increase in prescription drug spending under the Medicare Part D program between 2013 and 2014. Similarly, drug spending increased faster than medication claims, which only saw a three percent boost.

Image Credit: NORC

Dig Deeper:

• Why Healthcare Needs Value-Based Supply Chain Management

• Exploring the Role of Supply Chain Management in Healthcare