How to Plan Out the Transition to Value-Based Reimbursements

To effectively transition to value-based reimbursements, providers should be aware of government policies, local markets, their current reimbursement structures, and their goals.

- Providers should address the drivers of value-based reimbursements to appropriately pace their transition to alternative payment models without sacrificing crucial fee-for-service revenue, according to a new guide from Pershing Yoakley & Associates, PC (PYA).

The primary drivers include government policies, local and regional markets, the organization’s current position with the value-based transition, and the organization’s strategic profile for adopting alternative payment models. By understanding these underlying issues, organizations may be able to develop a successful transition plan tailored to the pace of the local market.

“Success under value-based reimbursement requires walking a fine line between acting too quickly and waiting too long,” stated Scott Clay, PYA Principal, in a press release. “The former can result in compromising an organization’s financial stability; the latter potentially exposes an organization to the risk of obsolescence. Knowing the considerations for setting the pace affords organizations a framework for successfully timing the transition.”

Understand government policies and regulation

Regulations from Medicare and Medicaid dictate how much of a provider’s Medicare fee-for-service revenue must be tied to an alternative payment model and when those changes are slated to take place. Paying attention to shifts in the policies from public payers, as well as other government agencies, will help develop a roadmap.

“One driver in common with all providers is the federal government’s push to value-based reimbursement in the Medicare program,” the guide stated. “In essence, the Centers for Medicare & Medicaid Services (CMS) sets the ‘floor’ on the level and pace of change required.”

CMS has already announced that 30 percent of traditional Medicare reimbursements have been linked to an alternative payment model, and the federal agency intends to move half of its payments to value-based care by the end of 2018.

State Medicaid programs have also set goals to tie more reimbursements to value-based care, but these policies may be more rewarding for providers, the guide added.

“State Medicaid policies provide a different type of driver for providers,” wrote PYA. “While the goals are the same from the payer’s perspective (i.e., lower per-capita cost, consistent quality), alternative payment models for Medicaid populations offer providers the opportunity to minimize losses through more effective management.”

“In other words, there is less downside on transitioning away from FFS [fee-for-service] given lower reimbursement rates, but there is a potential upside in minimizing the use of high-cost services, which providers often furnish to this population at a loss.”

Observe local and regional market trends

In addition to mandatory requirements, healthcare organizations should also monitor local and regional market drivers to determine the right time to implement value-based care. Providers must consider population size and density, market costs and use rates, commercial payer activity, employers, and competitors.

PYA notes that areas with large, urban populations, as well as markets that are outliers for healthcare costs and utilization, will be the first to attract payer attention for cost management through value-based reimbursement. Providers in these areas should expect to be some of the first in the region to sign up for value-based contracts.

Healthcare organizations may also have a “first-mover advantage” in markets where commercial payers are seeking an ACO partner and where self-insured employers are dominant, added the guide. Commercial payers will be less interested in developing value-based care models in rural areas and regions with limited health plan competition, while large, self-insured employers are increasingly entering into direct partnerships with healthcare systems to better manage healthcare costs and reduce variability.

Healthcare organizations should also consider how quickly their competitors are developing value-based care capabilities and entering into value-based reimbursement contracts.

“In a market where health systems and large physician groups are aggressively developing population health capabilities, building networks, and signing value-based contracts, rapid action may be required,” wrote PYA.

Evaluate value-based reimbursement progress so far

The third driver of value-based care transition is the organization’s current stance on shifting from fee-for-service reimbursement to alternative payment models. To effectively shift payments, leaders and stakeholders must have a “clear and common understanding of where the organization currently stands – and why.”

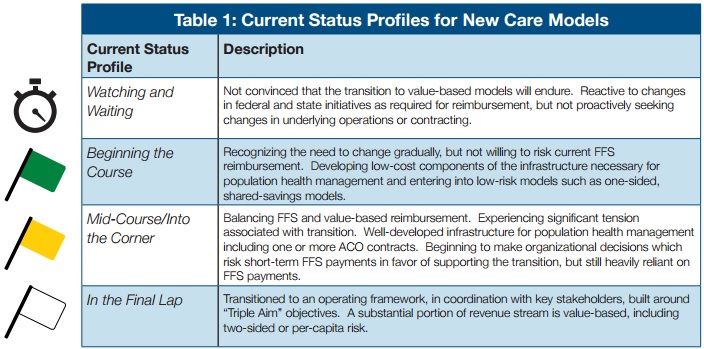

Providers can fall into one of four categories, ranging from “watching and waiting” to “in the final lap,” the guide explained. An organization’s progress depends on how willing it is to risk fee-for-service revenue and invest in costly infrastructure projects that support more data-driven models.

External market forces, as well as staff preferences and the healthcare system’s history, culture, and leadership, can also affect an organization’s profile.

According to the guide, the organization should use the following three elements to determine a provider’s organizational profile:

• Broad stakeholder involvement, including critics and champions of value-based care

• Honest evaluations that reflect how the healthcare system behaves, rather than how it thinks of itself or the image it aims to project

• Assessments that include discussions on what has influenced the organization during its value-based care transition, such as external factors, risk-averse culture, historical experiences

Create a list of goals and expected results

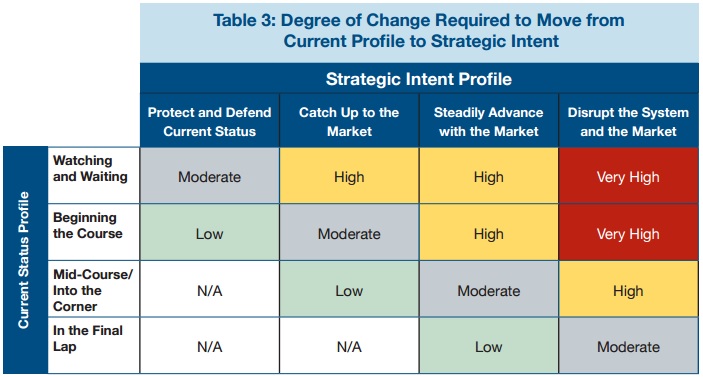

To successfully navigate the transition to value-based reimbursement, healthcare organizations must address the gap between their current status and their ultimate goals.

By pinpointing the gap between the current organizational profile and anticipated future results, providers can evaluate how quickly they need to tie payments to value-based care models. For example, if an organization is only just starting to implement alternative payment models, but it wants to steadily advance with the market, it will have to ramp up its transition timeframe.

The pace must also reflect real-time monitoring of market drivers. Healthcare organizations must regularly assess market drivers to “determine optimal timing for key initiatives,” such as investing in data analytics tools.

“While the industry continues to evolve to alternative payment and care models, a more nuanced approach is emerging for individual systems,” wrote PYA. “By honestly assessing who they are and where they want to be positioned in their market, healthcare systems can pace their change to reflect the reality of their local markets and proactively manage the risk of transition.”

Image Credit: Pershing Yoakley & Associates, PC

Dig Deeper:

• Preparing the Healthcare Revenue Cycle for Value-Based Care

• Value-Based Care Implementation Delayed for Most Hospitals