Implementation of Risk-Based Contracts in Healthcare Stalling

The median percentage of revenue tied to risk-based contracts in healthcare hovered around 10 percent for the third consecutive year, a survey shows.

Source: Getty Images

- A new survey of more than 500 C-suite executives showed that most organizations are still experimenting with risk-based contracts in healthcare despite having more ambitious goals for implementation by 2018.

The fourth annual The State of Population Health survey from Numerof & Associates and David Nash, Dean of the Jefferson College of Population Health, revealed that the median percentage of revenue in models with either upside or downside financial risk has remained at ten percent for three years in a row.

Additionally, almost one-third of respondents in risk-based contracts said their agreement had no downside financial risk. The organizations only had the possibility of earning a bonus if providers met certain targets.

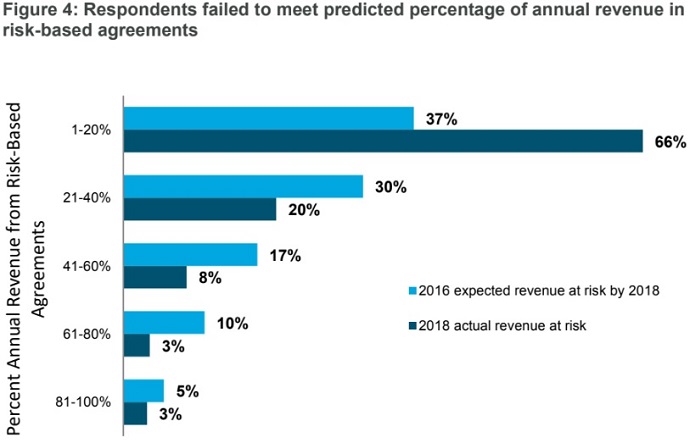

The recent findings showed that providers are not as far along with risk-based contract implementation as they thought they would be. In the 2016 survey, nearly one in three respondents predicted that their organizations would have at least 40 percent of their revenue tied to financial risk agreements by 2018.

However, only 14 percent of respondents to the latest survey reported meeting that threshold.

“Healthcare is an industry in transition, but the resistance to necessary change is deeply entrenched,” Rita Numerof, PhD, President of Numerof & Associates, stated in a press release. “Rather than embracing new models that they perceive as risky and difficult to manage, providers are trying to muddle their way through as long as possible.”

Source: Numerof & Associates and David Nash

Providers organizations are pumping the brakes with assuming financial risk under alternative payment models for a variety of reasons. One respondent explained that his organization’s initial experiences with risk-based contracts in healthcare were negative, resulting in his organization stalling the transition away from fee-for-service.

Another executive respondent comment that his organization’s expectations did not align with their risk-based predictions because it “takes time to build out the capabilities, get continued buy-in, and scale programs from pilot to full risk.”

Even executives who have experience with risk-based contracts pointed out the difficulty of transitioning to downside financial risk while the majority of revenues are still entrenched in fee-for-service.

Implementation of risk-based contracts is especially troubling smaller provider organizations. About 90 percent of executives from large hospitals and health systems reported participating in at least one at-risk contract, while 76 percent of respondents from mid-sized organizations and 71 percent from smaller organizations said the same.

“Risk is often more acutely felt at smaller institutions, which have more limited capital reserves and feel disadvantaged by the ‘tyranny of small numbers.’ That is, with a smaller population at risk, an outlier has a proportionally larger impact on overall results,” the survey report stated.

Implementing risk-based contracts in healthcare is a major undertaking, requiring significant capital, investment, cultural alignment, and clinical and financial transformation. Providers may be struggling to keep the momentum going, but they are confident their organizations will get there eventually, the survey showed.

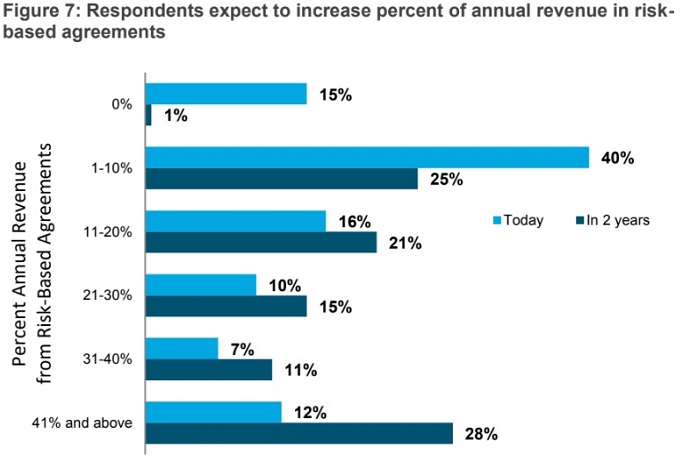

Healthcare executives overwhelmingly agreed that their organizations will have some revenue in alternative payment models with upside and/or downside financial risk in the next two years.

Source: Numerof & Associates and David Nash

However, the leaders are moderating their expectations. The median projection for the percent of revenue in risk-based agreements decreased from 30 percent in the 2017 survey to 25 percent in the latest survey.

Executives also predicted an increase in revenue tied to capitated contracts. Approximately 85 percent of respondent anticipate having some revenue in the full financial risk model within two years.

About half of the respondents (51 percent) currently participate in the full financial risk model. But like other risk-based contracts, the percentage of revenue tied to the capitated contract is limited. Only 14 percent of respondents have over 10 percent of their revenue in the models.

For provider organizations to meet their goals, executives have a lot of work to do, the survey report stated.

Aligning the organization’s culture with risk-based contracts will be a key step for provider organizations. Both administrators and physicians need to be on the same page to realize success in risk-based models, one executive pointed out.

Executives also agreed that scaling alternative payment models will help them achieve their risk-based goals. Leaders will need to start “translating experience into guidance that can be fully operationalized,” the survey report stated.

“The road to improving health is paved with value-based payment systems,” said the survey report’s collaborator Nash. “While our speed on this road seems to have slowed a bit, we will surely reach our destination soon.”