KLAS: athenahealth, Aprima Earn Top Marks for Ambulatory RCM

Provider organizations in a KLAS report valued consistent customer service and performance when it came to their ambulatory RCM services and three vendors demonstrated both.

Source: Thinkstock

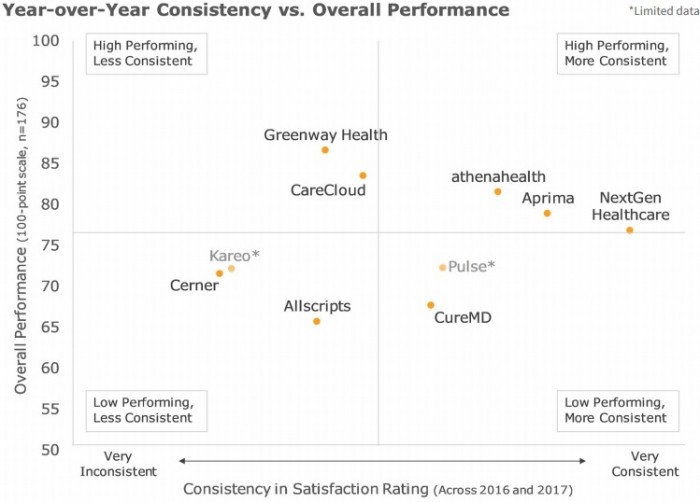

- Aprima, athenahealth, and NextGen Healthcare topped the list for overall performance and most consistently satisfactory ambulatory revenue cycle management (RCM) services among large and small practices in 2017, according to a new KLAS Research report.

“These vendors not only do a good job of keeping a consistent cash flow for customers but have also managed to meet or exceed the expectations of most of their customers; fewer than 15 percent of each vendor’s customers report being significantly unsatisfied,” the research firm stated.

Greenway Health and CareCloud also earned top marks for ambulatory RCM services for small clinics.

Consistency was key for provider organizations this year. Over 70 percent of the 174 outpatient organizations interviewed reported that they would buy from their current vendor again.

Provider organizations are demanding outsourced RCM services to save time and money. One patient accounts director told KLAS researchers, “[Our vendor] is worth whatever we pay because we would have to hire multiple people and pay the benefits and everything to replace it…I do multiple things here, and [my vendor] helps me. Trying to find somebody who has some background in medical terminology, finances, insurance, and processing would be tough. We just don’t come across that. So to me, whatever we pay [them] is worth it.”

The remaining 29 percent of organizations that would not purchase from their current ambulatory RCM vendor again cited inefficient services and poor customer support as their reasons why. These organizations are implementing in-house workflows and systems to manage some RCM functions.

A business office director explained to KLAS researchers, “We pay our own staff to run audits on [our vendor’s] RCM work because we don’t trust the quality of the work. We have found numerous mistakes. [Our vendor’s] RCM consultants have left a lot of money on the table.”

Providing a consistent experience of high performance and customer satisfaction is not an easy feat for ambulatory RCM vendors. Only three companies demonstrated both excellent RCM performance and consistent customer satisfaction in the past 18 months, KLAS researchers found.

Source: KLAS Research

The top two ambulatory RCM vendors from 2016 also failed to sustain consistently high performance and customer satisfaction. KLAS named CureMD and Pulse the top ambulatory RCM vendors in 2016, but both companies saw customer satisfaction ratings drop by at least 0.5 points by 2017.

Researchers pointed out that falling customer satisfaction rates may be a product of “growing pains.” Last year’s top-performers for satisfaction experienced significant customer base growth in the past year. The ambulatory RCM vendors may not have effectively managed the dramatic growth in customers, causing customer service and RCM functions to drop-off.

Growing pains may be a challenge for Greenway Health and CareCloud, researchers warned. Sustaining customer satisfaction and overall performance improvements will be an obstacle as demand for services continues to grow.

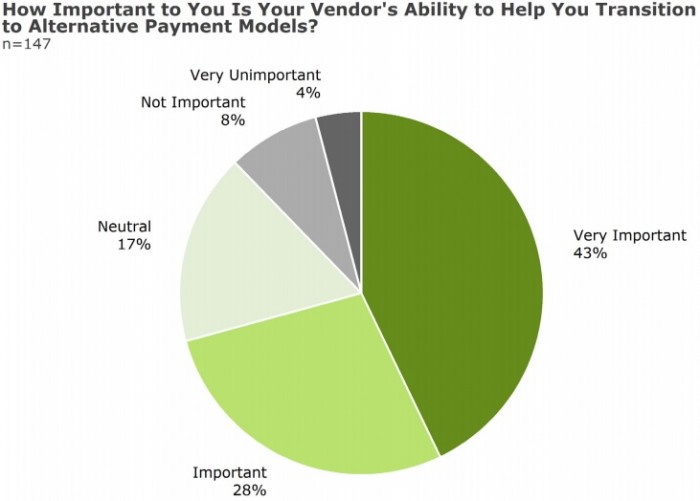

Additionally, the ambulatory RCM market analysis uncovered that providers organizations are demanding more than consistency from their vendors. Practices are also seeking vendor assistance with alternative payment model adoption.

Almost one-half of respondents stated that it will be very important that their ambulatory RCM vendor support them with transitioning to alternative payment models.

Source: KLAS Research

Fewer than 15 percent of the interviewed organizations reported that vendor assistance with alternative payment models will not be important.

“I am sure that value-based care is the way of the future, and we want to make sure we can still collect payments in the future,” a respondent said. “A lot of things are changing.”

However, ambulatory RCM vendors should have time to develop tools and systems to help provider organizations with alternative payment model implementation. Very few provider organizations stated that they would seek a different vendor if their current one does not offer the necessary information or tools to participate in alternative payment models.

KLAS plans to track which ambulatory RCM vendors assist provider organizations with alternative payment models as the demand increases.