Location, Market Competition Influence Hospital Price Variation

Hospital price variation across the country varied by a factor of three and consolidated markets had prices that were about 12 percent higher, a new study showed.

Source: Thinkstock

- Hospital prices for the privately insured depend on where a facility is located and how consolidated its market is, a recent Health Care Pricing Project analysis revealed.

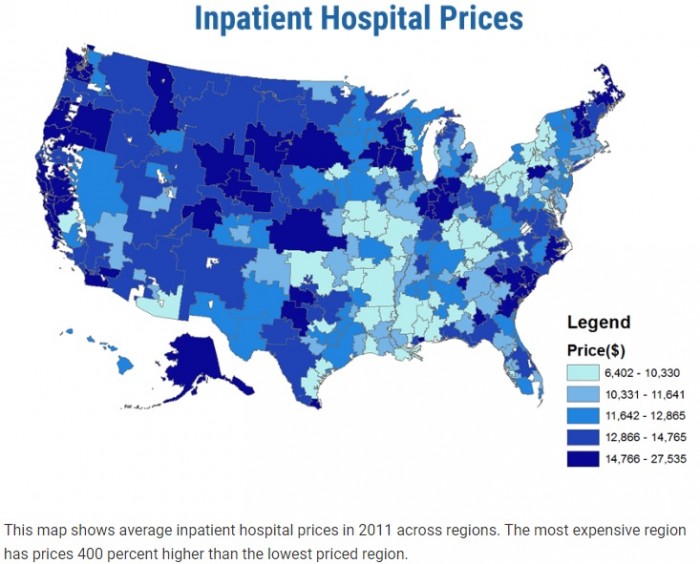

Using insurance claims from three of the largest commercial insurers (Aetna, Humana, and UnitedHealth), researchers found that healthcare spending on the privately insured varied by a factor of three across the country, and about one-half of that variation across all 306 hospital referral regions (HHRs) is driven by hospital price variation.

The HHR in the 90th percentile of the healthcare spending distribution (Grand Junction, Co.) spent about 47 percent more compared to the HRR in the 10th percentile (Sarasota, Fl.), showed the data on 27.6 percent of individuals with employer-sponsored coverage between 2007 and 2011.

Source: Health Care Pricing Project

In comparison, hospital reimbursement rates set by Medicare only represented 13 percent of the variation in healthcare spending across regions, while healthcare utilization accounted for 95 percent of the variation.

Researchers noted that the sum equals over 100 percent because of a covariance terms accounting for negative 8 percent.

READ MORE: The Role of the Hospital Chargemaster in Revenue Cycle Management

For healthcare spending on the privately insured, healthcare utilization only drove one-half of the variation across the HRRs.

“Virtually everything we know about health spending and most of the basis for federal health policy comes from the analysis of Medicare data,” said study author Zack Cooper, Assistant Professor of Health Policy and Economics at Yale University.

“The rub is that Medicare only covers 16 percent of the population. The majority of individuals — 60 percent of the US population — receive healthcare coverage from private insurers. This new dataset really allows us to understand what influences health spending for the majority of Americans. This information is critical to creating better public policy.”

Cooper et al.’s findings also point to issues with the regions policymakers rely on for developing policies and regulations.

“Many of the regions cited by policymakers as models for the nation, like Grand Junction, Colorado, Rochester, Minnesota, and La Crosse, Wisconsin have extremely high spending for the privately insured,” he explained. “Simply put, we cannot use these areas to shape federal policy.”

READ MORE: Healthcare Price Variation a Challenge for State, Local Leaders

Policymakers also may have to dig deeper into hospital price variation because the analysis revealed that price variation also existed within HRRS and even within individual hospitals.

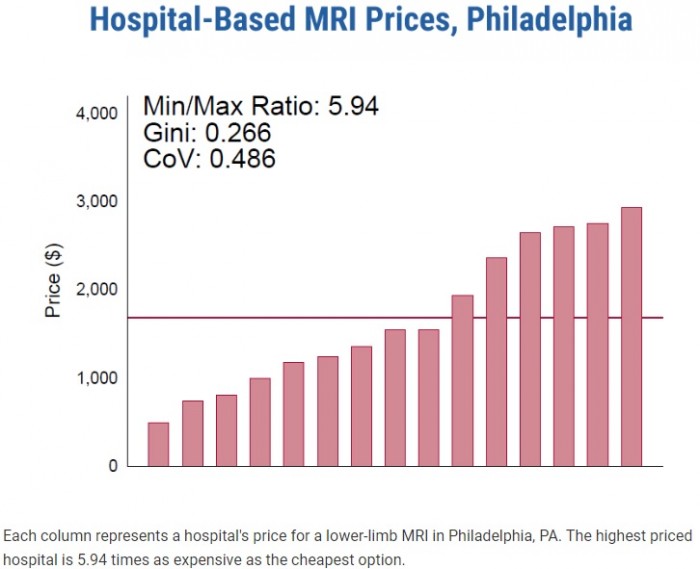

Hospital-level prices within an HRR significantly varied for seven common procedures. For example, the coefficients of variation across hospital-level prices within Philadelphia were 0.258 for hip replacements, 0.308 for knee replacements, 0.265 for cesarean sections, 0.235 for vaginal deliveries, 0.282 for percutaneous transluminal coronary angioplasties, 0.383 for colonoscopies, and 0.482 for lower-limb MRIs.

Source: Health Care Pricing Project

Researchers observed similar hospital price variations for the procedures within all HHRs.

To illustrate the significance of the hospital price variation within an HRR, researchers reported that total inpatient spending on privately insured patients would drop 25.8 percent if patients sought treatment at hospitals with the median price in an HRR.

Researchers also saw hospital price variation within hospitals because of differing rates from private payers. For instance, about one-fifth of the total case-level price variation occurs within a hospital for lower-limb MRIs, which are near homogenous services.

READ MORE: Hospital Utilization Management Can Reduce Denials, Improve Care

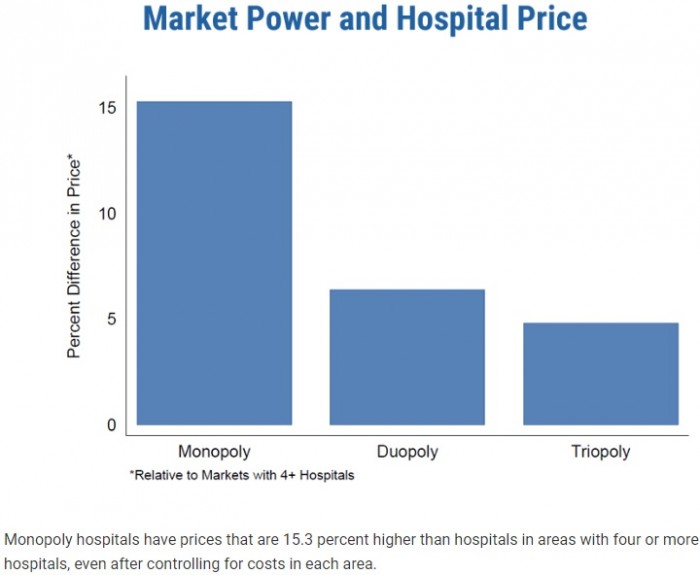

While a number of factors influence hospital prices, the analysis uncovered that healthcare consolidation plays a major role. Hospitals in markets with fewer competitors had substantially higher prices compared to their peers in more competitive markets.

Hospital prices at facilities that have a monopoly in their market were 12 percent higher than those in markets with four or more competitors.

Duopolies, in which the market includes two competitors, had 7.6 percent higher prices compared to competitive markets of four or more hospitals.

Source: Health Care Pricing Project

“These price differences between hospitals can be thousands of dollars,” said study author Martin Gaynor, the E.J. Barone Professor of Economics and Health Policy at Carnegie Mellon University.

“For example, the price of an average inpatient stay where there’s a monopoly hospital is almost $1,900 higher than where there are four or more competitors. We know that these higher prices end up getting translated into higher premiums that employers pass on to workers.”

Monopoly hospitals also engaged in a greater number of payer contracts that push more financial risk on insurers (e.g., contracts with prices set as a share of charges). Conversely, hospitals with lower prices that operate in more competitive markets tend to bear more financial risk under payer contracts that pay hospitals a fixed dollar amount for Diagnostic Related Groups (DRGs).

Hospitals in a monopoly market had 10.5 percentage points more cases as a percent of charges than hospitals in areas with four or more peers.

“At least descriptively, when hospital markets are concentrated (and/or insurer markets are fragmented), hospital prices are higher and hospitals are able to obtain contracts that shift more risk on to insurers,” Cooper et al. wrote.

This could spell trouble for the value-based care transition, which aims to shift risk to provider organizations. Few organizations already engaged in two-sided financial risk models that put more risk on providers than payers.

To spur increased competition, researchers suggested greater antitrust enforcement efforts. The analysis of the 366 hospitals mergers between 2007 and 2011 showed that mergers involving hospitals within five miles of each other resulted in the merging facilities increasing prices by over six percent.

“There have been over 1,200 mergers in the hospital industry since 1994, and 457 since 2010,” Gaynor explained. “Our work shows that the consequences of this wave of mergers can be dire for consumers. There’s a real need for continued vigorous antitrust enforcement and other policy options to encourage competition and combat market power.”