Medicare Spending Greater on Patients in Downside Risk MSSP ACOs

Medicare spending was about $250 more per beneficiary attributed to downside risk MSSP ACOs even though the risk-based organizations generated greater savings.

Source: Thinkstock

- Moving accountable care organizations (ACOs) to Medicare Shared Savings Program (MSSP) tracks with downside financial risk may not help the accountable care initiative generate savings, according to a new analysis from the Center for Healthcare Quality and Payment Reform (CHQPR).

The study found that CMS spends more per beneficiary in ACOs with downside risk compared to organizations in the upside-only track despite downside risk ACOs generating greater savings.

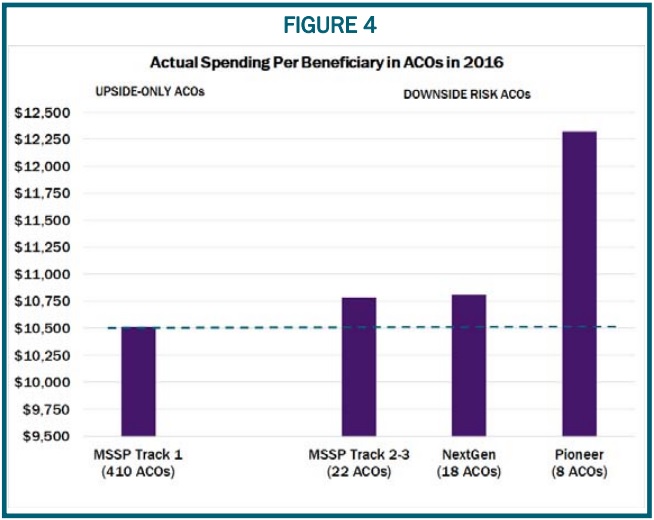

The most recent performance year data showed that Medicare saved $77 per beneficiary attributed to MSSP ACOs in Tracks 2 and 3 in 2016. In contrast, Medicare saw a financial loss of $10 per beneficiary in Track 1 ACOs that same performance year.

While the downside ACOs produced greater savings, the recent CHQPR analysis revealed that actual spending per beneficiary is greater in downside risk ACOs. In 2016, CMS spent about $10,500 per beneficiary in MSSP ACOs in Track 1.

The federal agency spent a little over $10,750 per beneficiary in ACOs in Tracks 2 and 3, which are downside financial risk tracks.

READ MORE: Exploring Two-Sided Financial Risk in Alternative Payment Models

Similarly, spending per Medicare beneficiary was higher in other accountable care demonstrations that contained only downside risk ACOs. CMS spent about the same on Medicare beneficiaries attributed to Next Generation ACOs, which includes the most financial risk than any other Medicare ACO program.

Source: Center for Healthcare Quality and Payment Reform

The federal agency also spent significantly more on beneficiaries attributed to Pioneer ACOs. Actual spending per beneficiary reached slightly over $12,250 in 2016. The Pioneer ACO model concluded at the end of that year.

MSSP ACOs assuming downside risk in 2016 produced greater savings even though CMS spent more on their attributed patients because the organizations delivered more expensive care prior to 2016, researchers explained.

CMS sets financial benchmarks in the MSSP based on historical spending. As a result, organizations with historically higher expenditures have more of an opportunity to generate savings, while organizations with lower benchmarks face challenges with constantly becoming more efficient.

In 2016, downside risk ACOs generally had higher financial benchmarks compared to their peers in Track 1.

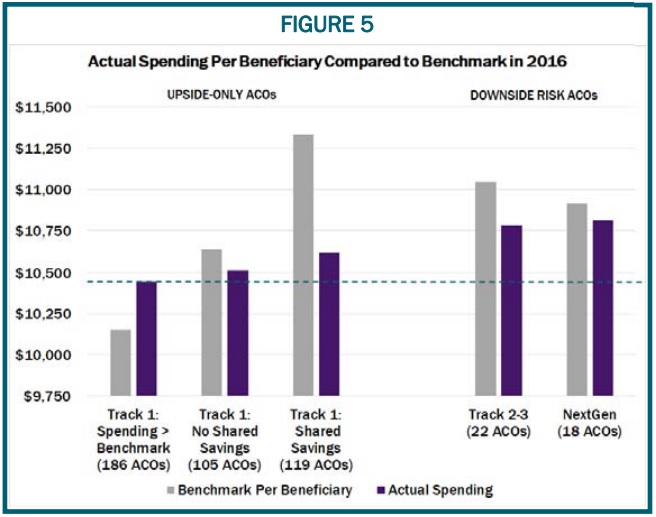

Source: Center for Healthcare Quality and Payment Reform

READ MORE: Examining the Role of Financial Risk in Value-Based Care

Actual spending per beneficiary was also significantly higher compared to MSSP ACOs with upside-only risk. Average Medicare spending per beneficiary was even lower in the 186 Track 1 ACOs that spent more than their financial benchmark.

CHQPR researchers argued that Track 1 ACOs that spent over their financial benchmark actually delivered the highest value care since average quality scores were nearly identical across all MSSP organizations. These 186 organizations spent the least per beneficiary compared to their Track 1 peers who spent less than their benchmark and their Tracks 2 and 3 colleagues.

Track 1 ACOs that spent over their target reported spending less than $10,500 per beneficiary in 2016, while Track 1 ACOs with no shared savings but expenditures under the benchmark spent about $10,500, Track 1 ACOs with shared savings spent about $10,600, and Tracks 2 and 3 ACOs spent over $10,750.

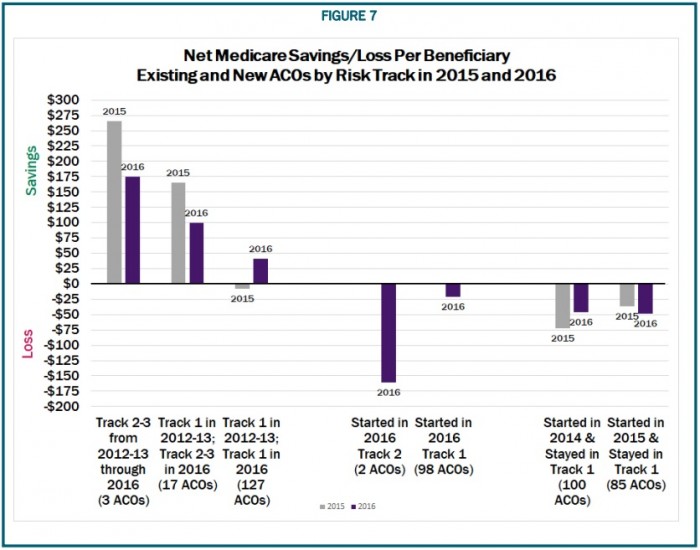

CHQPR also argued that moving MSSP ACOs to downside financial risks may not increase program savings because the data showed assuming downside risk decreased savings.

In 2016, 17 ACOs that launched the program in 2012 and 2013 transitioned to Tracks 2 or 3, while 127 of the inaugural organizations remained in the upside-only Track 1.

READ MORE: ACOs Plan to Move to Downside Financial Risk, Capitation Contracts

The few organizations assuming downside risk in 2016 had generated net savings to the MSSP in 2015. But savings per beneficiary decreased by 39 percent by 2016.

In addition, the number of beneficiaries attributed to these ACOs dropped 11 percent in 2016.

Conversely, savings increased in ACOs that chose not to assume downside financial risk in 2016. The 127 ACOs that remained in Track 1 in 2016 reported a small net loss in 2015 but saw net savings by 2016.

The average savings per beneficiary in this group of ACOs was about half the as much as the savings in downside risk organizations, but the Track 1 ACOs treated about eight times as many Medicare beneficiaries.

Consequently, CMS earned $111 million in net savings from the upside-only ACOs in 2016, which was over three times the amount of net savings from ACOs that switched to downside risk tracks.

Source: Center for Healthcare Quality and Payment Reform

Rather than require MSSP ACOs to assume downside financial risk, CHQPR researchers suggested that CMS consider the following options:

- Remove ACOs from the program if they do not achieve savings after two years

- Decrease shared savings payment to ACOs that incur significant financial losses before producing savings

- Reduce the shared savings rate of 50 percent for Track 1 ACOs

- Permit ACOs to take accountability for specific spending in their control versus total Medicare spending

While CHQPR offered MSSP improvements, the researchers ultimately advised CMS to drop the shared savings payment model of the MSSP in favor or a patient-centered alternative payment model (APM).

The Patient-Centered APM created by the CHQPR allows a team of providers to coordinate care for individual patients. The team would agree to be held accountable for the feasible outcomes of that patient.

Patients would also be able to select their provider team based on the quality standards and outcomes that each team commits to achieve for that individual patient and the total amount that the patient and Medicare or other payers will pay for all the services that the patient will receive for their health need.

“Physicians and other providers who want to work together through Accountable Care Organizations could use Patient-Centered APMs as a way of overcoming the barriers in fee-for-service payment that each individual care provider currently faces,” researchers explained.

“Even if the ACO views itself as one large coordinated entity managing care for a population of patients, most patient care will be delivered by small teams of providers focused on specific patient needs. Patient-Centered APMs could provide a mechanism for the ACO to ensure that each team has the resources it needs to deliver the care patients need and that each team takes accountability for the aspects of overall spending and quality that it can control.”