MSSP ACOs Fell $2B Short of CBO’s Medicare Spending Estimate

MSSP accountable care organizations increased Medicare spending by $384 million despite a cost-saving projection of $1.7 billion between 2013 and 2016, Avalere reported.

Source: Thinkstock

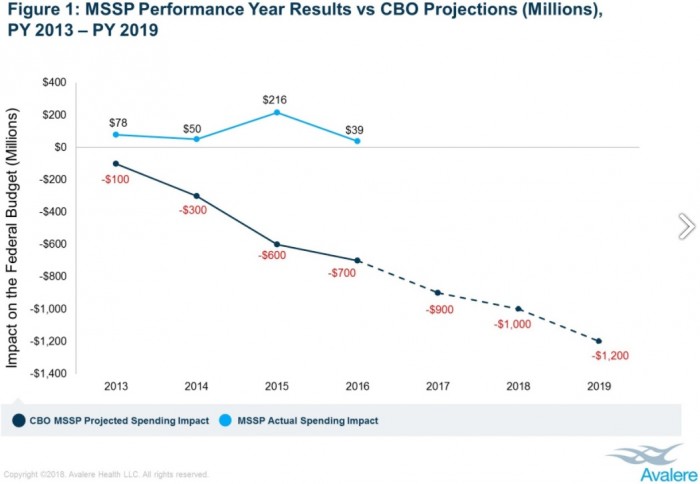

- A new analysis from Avalere showed that Medicare Shared Savings Program (MSSP) accountable care organizations (ACOs) failed to reduce Medicare spending as the Congressional Budget Office (CBO) projected in 2010.

The CBO estimated that the MSSP would generate $1.7 billion in net savings to the federal government between 2013 and 2016.

However, the MSSP increased Medicare spending by $384 million during that period, representing a difference of over $2 billion, Avalere found using Medicare ACO participation and performance data from 2012 to 2016.

“The Medicare ACO program has not achieved the savings that CBO predicted because most ACOs have chosen the bonus-only model,” explained Josh Seidman, Senior Vice President of Avalere.

Source: Avalere

MSSP ACOs in the most popular track of the program are responsible for repaying CMS for financial losses exceeding a benchmark because the organizations do not assume financial risk unlike organizations in Tracks 1+, 2, and 3, which are financially accountable for their losses. The upside-only organizations, however, can still earn shared savings payments for reducing their costs below a set target.

While the number of MSSP ACOs has grown from just 27 participants when the initiative launched in 2012 to 560 organizations in 2018, the majority of MSSP ACOs still participate in Track 1 of the program. In 2017, 91 percent of the 480 MSSP ACOs participated in Track 1.

By 2018, the percentage of ACOs participating as upside-only organizations only fell to 82 percent.

The addition of the Track 1+ spurred more ACOs to assume downside financial risk because the track acts as a ramp for organizations. The track contains downside financial risk, but the levels are significantly lower than those in Tracks 2 and 3.

About 10 percent of MSSP ACOs are in Track 1+ in 2018, while 7 percent are in Track 3 and 1 percent in Track 2.

The reluctance to assume downside financial risk in the MSSP may prevent the value-based reimbursement initiative from saving the federal government money. Few organizations were accountable for paying back financial losses, but CMS was still responsible for rewarding high-performing organizations through shared savings payments.

For example, about 56 percent of MSSP ACOs saved compared to their benchmark in 2016, and 31 percent earned shared savings payments for their cost-reduction efforts, a Duke University and Leavitt Partners analysis showed.

Despite over one-half of the ACOs reducing costs, the program still suffered a net loss of $39 million in 2016 after bonuses were paid out, researchers reported.

Moving MSSP ACOs to downside financial risk tracks could help the program save, the Avalere analysis indicated.

Researchers found that organizations in downside financial risk tracks saw greater savings than their peers in Track 1. MSSP ACOs taking on downside financial risk decreased Medicare spending by $60 million over five years, whereas upside-only organizations boosted spending by $444 million in the same period.

In addition to moving to downside financial risk, time may also support cost reductions in the program, the report stated.

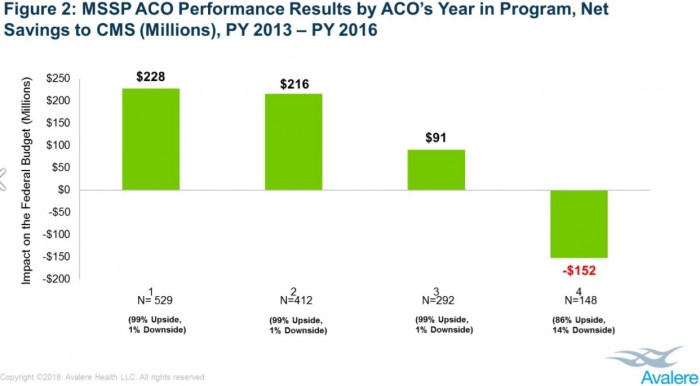

Experienced MSSP ACOs tended to produce greater savings regardless of financial risk levels. The data revealed that organizations in their fourth performance year generated net savings of $152 million to the federal government.

Source: Avalere

Conversely, younger MSSP ACOs generated net losses in 2016 and losses increased as MSSP ACO experience decreased. First year organizations produced the greatest net loss to the federal government with $228 million, followed by second year organizations with $216 million and third year organizations with $91 million.

The findings echoed the results of a 2017 Office of the Inspector General (OIG) report that showed ACO participation length was associated with savings. ACOs in the MSSP for three years reduced costs by an average of $10.1 million per organization in 2015, while ACOs in their first year only decreased costs by an average of $5.4 million per organization.

CBO may not have accounted for the affect time and ACO participation has on cost savings, Avalere Health explained.

Moving more ACOs to downside financial risk and accounting for time and experience are key to reducing Medicare spending under the MSSP, explained John Feore, Avalere Health’s Director.

“While data do suggest that more experienced ACOs and those accepting two-sided risk may help the program to turn the corner in the future, the long-term sustainability of savings in the MSSP is unclear,” he said. “ACOs continue to be measured against their past performance, which makes it harder for successful ACOs to continue to achieve savings over time.”