MSSP ACOs Improve Care Quality, Struggle to Realize Savings

Medicare Shared Savings Program ACOs earned an average quality score of 93 percent, but only about one-half generated cost savings, a study showed.

Source: Thinkstock

- Medicare accountable care organizations (ACOs) found overwhelming success with care quality improvements in 2016, but the organizations were still working on reducing costs, according to a recent analysis published in the Health Affairs blog.

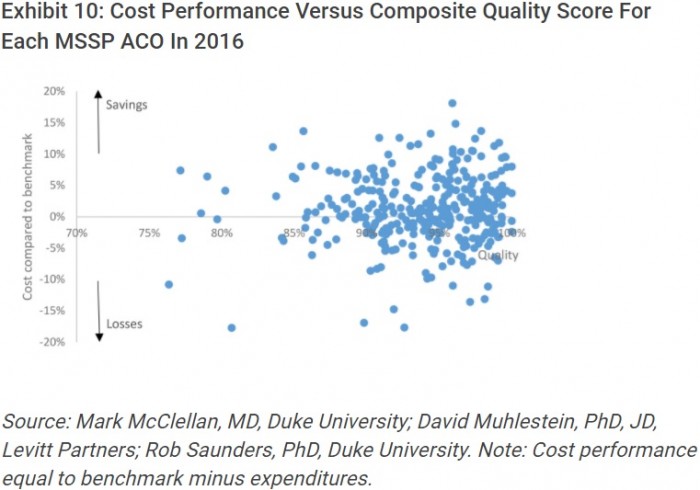

The study of the Medicare Shared Savings Program (MSSP) 2016 results showed that ACO quality performance remained high, with an average composite score of 93.4 percent.

ACOs that earned shared savings payments and those that did not also generated similar quality performance scores. Organizations receiving the bonus in 2016 had an average composite quality score of 94 percent and the average score for ACOs that did not earn a bonus was 93 percent.

Source: Health Affairs

“Consistent with prior years, there was little relationship between net spending and quality,” wrote researchers from the Duke-Margolis Center for Health Policy, Leavitt Partners, and Health Care Payment Learning and Action Network’s Guiding Committee. “The high quality scores may indicate that most participating ACOs had identified ways to achieve high quality; the bigger challenge is how to simultaneously reduce costs.”

Though the values are not as impressive as the quality performance scores, some Medicare ACOs did simultaneously reduce costs in 2016. About 56 percent of organizations in the MSSP saved compared to their spending benchmark, and 31 percent earned shared savings payments.

Despite the majority of MSSP ACOs reducing costs, Medicare suffered a net loss of $39 million on the program after bonuses were paid out.

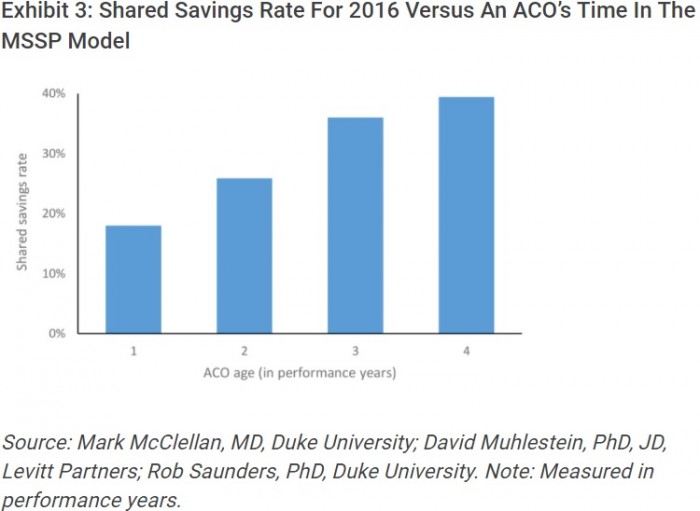

Savings may take time to realize under ACO programs, researchers explained. More experienced MSSP ACOs earned shared savings payments in 2016.

The rate of MSSP ACOs earning shared savings payments grew from less than 20 percent of organizations in their first performance year to almost 40 percent of those in their fourth performance year.

Source: Health Affairs

More experienced ACOs also generated net savings per beneficiary, which is the benchmark level less expenditures and any bonuses. The most mature ACOs produced net savings of $140 per beneficiary.

Researchers also pointed out that quality performance scores were relatively the same regardless of ACO maturity.

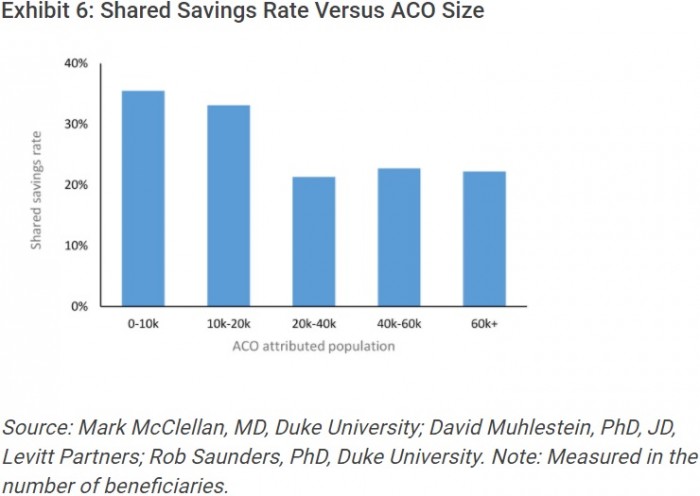

In addition to maturity, researchers also found that smaller, physician-led organizations were also more likely to realize cost savings.

The shared savings rates for MSSP ACOs with attributed populations of up to 10,000 patients and between 10,000 and 20,000 patients were significantly higher compared to the rates of larger ACOs.

Source: Health Affairs

Physician-led MSSP ACOs were also the only ACO type to produce net savings per beneficiary. The organizations generated $50 in net savings per beneficiary versus net losses of $65 per beneficiary for hospital-led ACOs and $13 per beneficiary for integrated ACOs.

The analysis indicated that moving these ACOs, as well as the rest of the MSSP organizations, to downside financial risk tracks may improve overall program savings. Over 400 MSSP ACOs out of 432 total organizations were in the upside-only track.

Nearly one-half of the MSSP ACOs had costs exceeding their benchmarks. But ACOs in the upside and downside financial risk tracks produced about $33 million in net savings to Medicare out of $4.7 billion of expected spending.

However, small, physician-led organizations may face challenges with taking on downside financial risk. Risk-based ACO models require enhanced data analytics capabilities, population health management programs, and care coordination, which all need additional capital.

Downside financial risk is key to realizing savings in the MSSP. Therefore, CMS should support smaller ACOs by reducing reporting and regulatory burdens. The organizations could also benefit from operational guidance on how to redesign care processes for populations.

“Such support would make alternative payment reforms more attractive to independent physician practices and would align with the recently announced CMS vision for models that support smaller practices,” researchers added.

CMS could also better support all MSSP ACOs by aligning Medicare programs with other payer models. ACOs will be better positioned to realize savings if quality measures, data sharing, and financial incentives are aligned across all programs.

“While we are seeing organizational-level improvements, particularly with the ACOs that continue with the program for multiple years, there are still opportunities for MSSP to generate cost benefits to the Medicare program,” the analysis concluded. “The many examples of organizations that have made substantive changes to how they provide care give us hope that those learnings can be shared more broadly across the healthcare system to hasten the improvement of care delivery.”