MSSP ACOs Missed $886M in Potential Revenue By Avoiding Risk

A simulation analysis indicated that non-risk bearing MSSP ACOs may financially benefit from assuming downside risk, especially with MACRA bonuses available.

Source: Thinkstock

- Accountable care organizations (ACOs) in Track 1 of the Medicare Shared Savings Program (MSSP) could have received an additional $886 million in net payments in 2015 if the organizations took on downside financial risk and earned the 5 percent bonus under MACRA’s Advanced Alternative Payment Model track, a recent Avalere analysis uncovered.

The analysis suggests that non-risk bearing ACOs may financially benefit from taking on downside financial risk, particularly with the opportunity to earn bonuses under MACRA.

“CMS’ new value-based payment incentives really tip the scales for doctors to assume greater financial risk,” stated Josh Seidman, Avalere’s Senior Vice President. “For those physicians who were dipping their toes in the water with low-risk ACO models, the incentives now make it advantageous for a majority of them to move more aggressively into greater accountability for population health.”

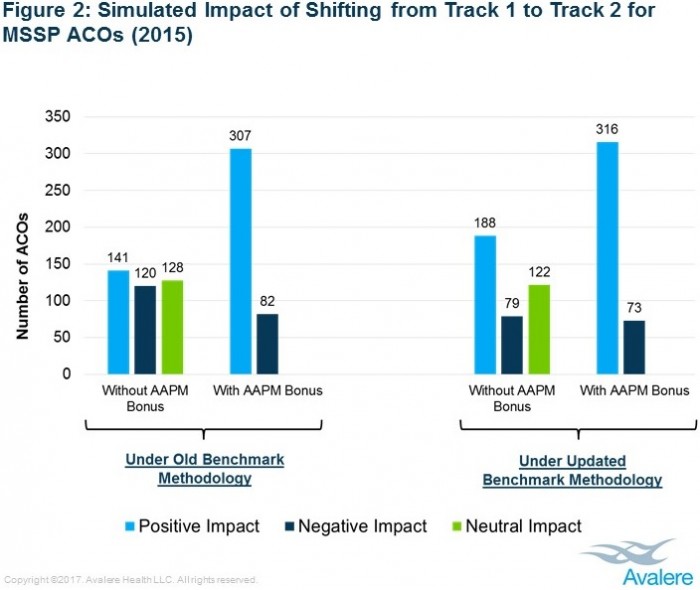

To determine how 389 MSSP Track 1 ACOs would have fared if all the organizations assumed downside financial risk under Track 2 in 2015, researchers created a simulation that assumed the ACOs operated with a minimum savings rate and loss rate of 2 percent and negative 2 percent, respectively. The simulation also set the total maximum sharing rate at 60 percent with quality-based adjustments.

The simulation accounted for regional variations by adjusting for local healthcare spending trends.

Researchers also assumed that the MSSP ACOs would qualify for the maximum bonus payment offered under the Advanced Alternative Payment Model track if it was available in 2015.

Under the simulation model, researchers found that most MSSP Track 1 ACOs would have seen their payments increase under greater financial risk structures. About 79 percent of organizations would have financially benefited, while just 21 percent would have reported net losses.

In total, the 389 ACOs would have faced a $178 million increase in reimbursement from the higher percentage of shared savings and decreased minimum savings rate under the risk-bearing MSSP Track 2 model.

Source: Avalere

The organizations also would have seen a $1.1 billion boost in payments from the 5 percent Advanced Alternative Payment Model bonus if the incentive reimbursement was offered at that time.

Despite some ACOs having to refund CMS a portion of financial losses under the simulation, researchers noted that almost one-third of this group would have counteracted their financial losses by earning the Advanced Alternative Payment Model bonus.

The study’s findings indicate that MSSP Track 1 ACOs may be in a good position to transition to a risk-bearing track. The majority of MSSP ACOs (486 organizations) in 2017 were still locked into upside risk-only structures, while just six ACOs were in Track 2 and 36 in Track 3.

The trend of staying in upside risk-only structures also appears in other ACO models. A 2016 Leavitt Partners study revealed that 61 percent of ACO contracts across payers only contained upside risk provisions.

CMS aims to move more ACOs into risk-bearing structures to advance value-based care. The federal agency recently incentivized ACOs to move to downside financial risk models by including Tracks 2 and 3 of the MSSP as Advanced Alternative Payment Models under MACRA.

Officials also established the MSSP Track 1+ to motivate non-risk-bearing MSSP ACOs to assume greater financial risk. The additional MSSP track includes lower levels of downside risk than Tracks 2 and 3, but still qualifies for the maximum incentive payments under the Advanced Alternative Payment Model track.

Additionally, CMS developed a new methodology in June 2016 to address regional spending in MSSP ACO benchmarks. For second and subsequent agreement periods beginning in 2017, the federal agency incorporated regional spending factors to calculate an ACO’s threshold for earning shared savings.

The updated methodology aims to reward ACOs that demonstrate greater efficiency relative to its region.

In the Avalere simulation, researchers estimated that more MSSP Track 1 ACOs would have generated greater revenue in 2015 if the new methodology applied that year. Roughly 33 percent more ACOs would have financially benefitted from joining Track 2, even without the MACRA bonus payment.

Source: Avalere

With the bonus payment, nine more ACOs would have earned shared savings under the regional benchmarking system.

“On balance, the 2016 changes to the payment methodology will support efficient ACOs,” stated John Feore, a director at Avalere. “This could spur more ACOs to accept downside risk, creating a more sustainable Medicare ACO market.