MSSP ACOs Saved $1.84B, Nearly Double CMS Estimate, Study Finds

The study also shows MSSP accountable care organizations generated $541.7 million in savings after bonuses from 2013 to 2015, whereas CMS estimates the ACOs increased Medicare spending.

Source: Thinkstock

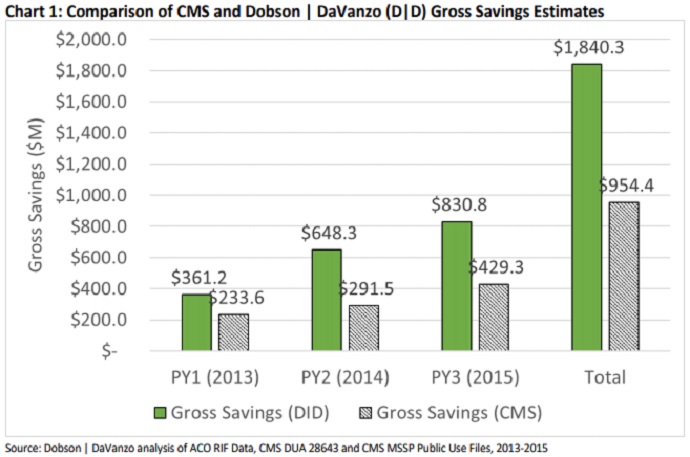

- CMS estimates that accountable care organizations (ACOs) in the Medicare Shared Savings Program (MSSP) saved $954 million from 2013 to 2015. However, a new Dobson DaVanzo & Associates analysis, commissioned by the National Association of ACOs (NAACOS), shows that actual savings could be almost double that figure.

The analysis uncovered that MSSP ACOs generated $1.84 billion during the 2013 to 2015 performance years.

Source: Dobson DaVanzo & Associates

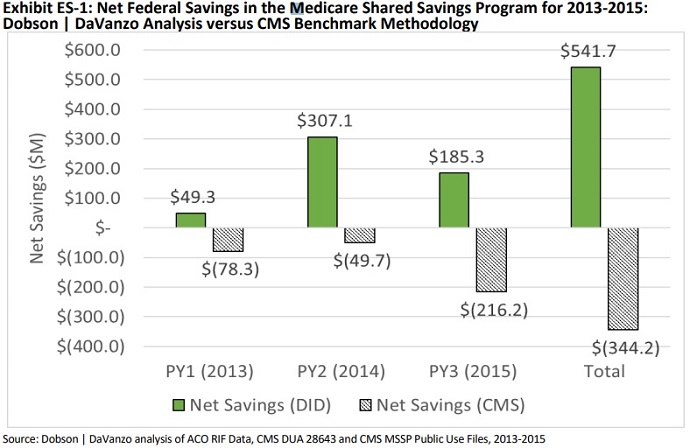

MSSP ACOs also produced net savings to Medicare of $541.7 million during the three-year period after shared savings bonuses were paid out, the data revealed. The analysis counters the CMS benchmark calculation that suggests the organizations increased Medicare spending by $344.2 million.

Source: Dobson DaVanzo & Associates

Dobson DaVanzo & Associates’ findings are consistent with other studies that have found CMS underestimates MSSP ACO savings. For example, a 2016 evaluation of the Medicare ACO program by McWilliams and colleagues found that the ACOs saved $867 million from 2013 to 2014, with overall savings of $213 million after shared savings bonuses.

An updated evaluation by McWilliams and colleagues also showed MSSP ACO savings totaled $704 million in 2015, with net savings to Medicare of $145 million.

READ MORE: For Ongoing ACO Shared Savings, Look Outside Inpatient, Primary Care

In addition, the Medicare Payment Advisory Commission (MedPAC) recently reported that ACOs may have saved Medicare up to two percent more than CMS estimated.

Disagreement over MSSP ACO savings stems from the methodology used by CMS to calculate ACO savings, Dobson DaVanzo & Associates explained in the analysis.

The federal agency draws on an administrative formula to determine whether ACOs will earn shared savings, as well as if the organizations saved Medicare money. The federal agency calculates MSSP savings by taking the sum of total savings from ACOs that spent below the benchmark plus the sum of spending from ACOs that exceeded the benchmark.

But the CMS strategy is problematic for program evaluations, the firm contended.

“The CMS benchmarking methodology addresses the question ‘How has ACO spending changed compared to prior years’ spending?’ While this may be an appropriate way to set performance benchmarks, it produces a biased estimate of program savings when compared to what may have occurred if the ACO program had not been in place,” the report stated.

READ MORE: Good Data, Better Value-Based Care Can Boost Population Health

Instead, the firm stated that program evaluations should answer the question, “How have ACOs changed expenditures compared to providers not participating in the ACO program?”

Dobson DaVanzo & Associates set out to answer the question by using a difference-in-difference regression analysis similar to the one used by McWilliams and colleagues. The firm described the methodology as the “gold standard for program evaluation.”

The firm also pointed out that CMS contractors used a difference-in-difference methodology when evaluating the Pioneer and Next Generation ACO models.

What does this mean for the MSSP?

The findings show that ACOs participating in one-sided financial risk models can save money, NAACOS argued. The MSSP currently has 82 percent of its participating ACOs in Track 1, the program’s one-sided financial risk model.

“The analysis should put to rest claims that shared savings only ACOs do not save Medicare money,” Clif Gaus, ScD, NAACOS President and CEO, said in a press release. “The findings confirm the wisdom of giving ACOs adequate time to build the care coordination, information technology, and data analytics capabilities needed to manage financial risk successfully.”

READ MORE: Exploring Two-Sided Financial Risk in Alternative Payment Models

CMS, however, has a different impression of one-sided risk ACOs and the MSSP based on its own calculations, which show one-sided risk ACOs increase Medicare spending.

“Medicare cannot afford to support programs with weak incentives that do not deliver value,” stated CMS Administrator Seema Verma in August 2018. “ACOs can be an important component of a system that increases the quality of care while decreasing costs; however, most Medicare ACOs do not currently face any financial consequences when costs go up, and this has to change.”

Living up to her word, she proposed to overhaul the MSSP. CMS proposed a rule that would replace the MSSP with the Pathways to Success initiative, a Medicare ACO model that would accelerate the timeline for ACOs taking on two-sided financial risk from six to two years.

In addition, the Pathways to Success initiative would reduce the shared savings opportunity for one-sided risk ACOs from 50 to 25 percent.

NAACOS and other industry experts are calling for changes to the proposed MSSP overhaul in light of the Dobson DaVanzo & Associates analysis.

In an accompanying Health Affairs blogpost, NAACOS’ Gaus and Robert E. Mechanic, Executive Director of the Institute for Accountable Care, advised CMS to allow MSSP ACOs to remain in the one-sided financial risk track for at least three years.

One-sided risk ACOs that meet specific savings and quality goals in the first three years should also be allowed to remain in the shared savings-only model for another two years, they recommended.

Additionally, CMS should also apply the current 50 percent shared savings rate for the entire period in the one-sided financial track. Compared to the proposed 25 percent rate, the current MSSP rate ensures “that the model remains financially feasible for new entrants.”

The recommendations would ensure the MSSP ACO model remains sustainable, Gaus and Mechanic argued.

CMS currently projects the proposed MSSP overhaul to shrink the largest Medicare ACO program by 20 percent over the next decade.

A recent NAACOS survey also suggests that the reduction could be greater. About 71 percent of current MSSP ACOs that must two on two-sided financial risk by 2019 per program rules said they were more likely to quit the ACO program rather than assume additional risk.

“The changes we propose would go a long way towards improving incentives for growth of Medicare ACOs, while achieving the administration’s goal of a faster movement to risk,” Gaus and Mechanic wrote.

“Our nation urgently needs to transform its healthcare system to deliver better care at lower cost. Accountable care organizations are the best chance we’ve got to get there,” they concluded. “Let’s invest in policies that accelerate this movement rather than slow it down.”