Nearly 71% of Practice Revenue Under Fee-For-Service in 2016

Despite 59 percent of practices engaging in value-based reimbursement, practice revenue primarily stemmed from fee-for-service, an AMA survey showed.

Source: Thinkstock

- Fee-for-service was still the dominant source of medical practice revenue in 2016, the American Medical Association (AMA) recently reported.

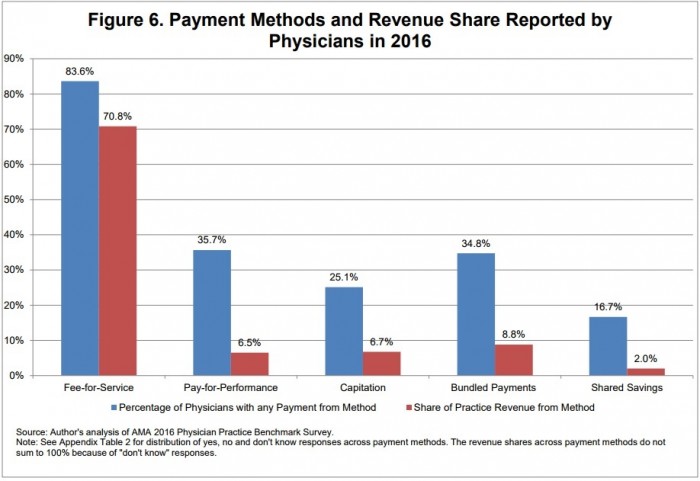

Almost 84 percent of physicians stated that their practice received fee-for-service revenue in 2016. The percentage of physicians reporting fee-for-service revenue is down from 89.4 percent of doctors in 2012, revealed data from the AMA’s Physician Practice Benchmark surveys.

While more practices engaged in value-based reimbursement models by 2016, practice revenue still primarily came from traditional reimbursement structures. About 59 percent of physicians worked in a practice that earned payments from at least one alternative payment model.

But nearly 71 percent of practice revenue on average stemmed from fee-for-service in 2016.

Source: American Medical Association

The share of revenue coming from fee-for-service models remained relatively unchanged in the past five years. Physicians reported an average of 69 percent of practice revenue coming from fee-for-service in 2012 and an average of 71.9 percent in 2014.

READ MORE: Best Practices for Value-Based Purchasing Implementation

The findings indicate that practices are operating under fee-for-service and value-based reimbursement models. Fee-for-service still leads revenue sources, but some reimbursement stemmed from alternative payment models.

Of the 59 percent of practices engaging in value-based reimbursement in 2016, pay-for-performance and bundled payments were the most popular alternative payment models. Approximately 35 percent of physicians worked in a practice with pay-for-performance and bundled payment models in place.

However, pay-for-performance and capitation only accounted for 7 percent of practice revenue and bundled payments represented just 9 percent.

While not as popular, shared savings arrangements also made up 2 percent of practice revenue.

AMA pointed out that value-based reimbursement represented a greater share of practice revenue at practices that were part of medical homes and accountable care organizations (ACOs). Providers in medical homes and ACOs were about twice as likely to have earned pay-for-performance and bundled payment revenue, three times as likely to have received shared savings payments, and 1.5 times as likely to have capitation payments.

READ MORE: Preparing the Healthcare Revenue Cycle for Value-Based Care

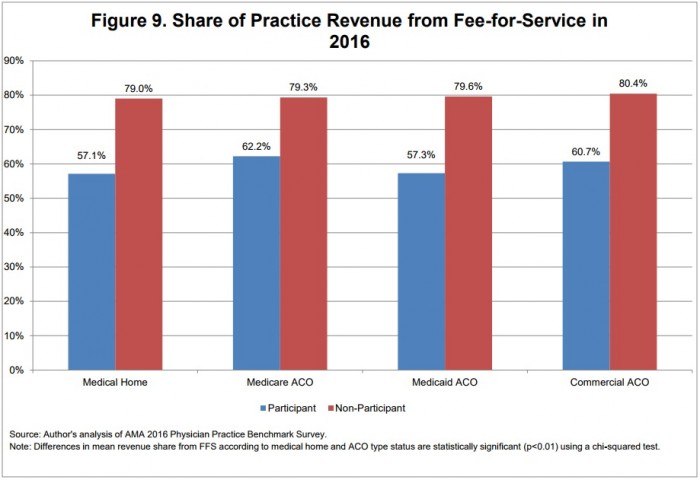

But fee-for-service also dominated practice revenue sources at practices part of a medical home or ACO. About 57 percent of revenue stemmed from a fee-for-service model in 2016 for medical home participants.

Medicare ACO practices saw 62.2 percent of their revenue come from fee-for-service and Medicaid ACO practices had 57.3 percent of their revenue stem from fee-for-service. About 60.7 percent of revenue came from fee-for-service for commercial ACO practices.

Source: American Medical Association

More practices may see value-based reimbursement revenue rise as medical home and ACO participation increases. The percentage of physicians in medical home practices rose from 23.7 percent in 2014 to 25.7 percent in 2016.

Participation in Medicare ACOs also increased from 28.6 percent to 31.8 percent in the same period.

Almost 21 percent of physicians also reported that their practice was in a Medicaid ACO in 2016 and nearly 32 percent said their practice was in a commercial ACO. Previous AMA Physician Practice Benchmark surveys did not track Medicaid and commercial ACO participation.

READ MORE: AMGA: Value-Based Reimbursement Transition Slower Than Expected

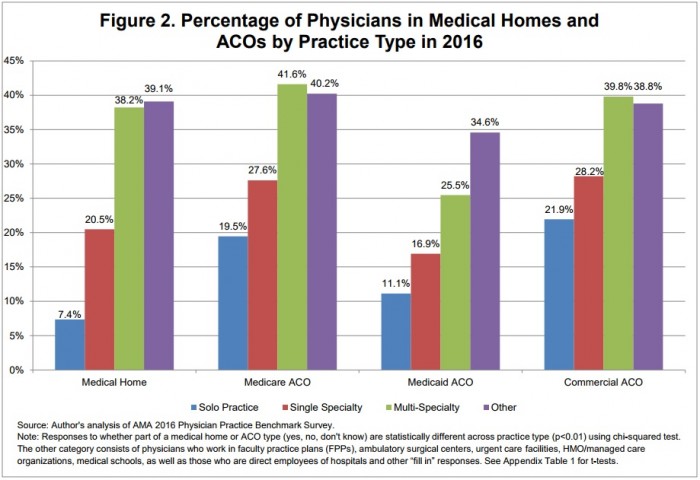

Medical home and ACO participation rates were higher among physicians in multi-specialty practices than independent offices. Only about 7.4 percent of physicians in a solo practice were part of a medical home, 19.5 percent in a Medicare ACO, 11.1 percent in a Medicaid ACO, and 21.9 percent in a commercial ACO.

Physicians in multi-specialty practices reported remarkably higher medical home and ACO participation rates, with about 40 percent in medical homes, Medicare ACOs, and commercial ACOs, respectively. About 25.5 percent were also in Medicaid ACOs.

Source: American Medical Association

Single specialty practices were more likely to be part of medical homes and ACOs than independent offices, but not nearly as much as multi-specialty practices, AMA noted. Participation by single specialty practices was influenced more by practice ownership.

Medical home participation was about 20 percentage points higher among doctors in hospital-owned practices than physician-owned practices.

Physicians in hospital-owned practices also reported a participation rate for Medicare and Medicaid ACOs that was 10 percentage points higher than for doctors in physician-owned practices.

However, commercial ACO participation was similar across both ownership types.

Specialty also impacted whether a single specialty practice participated in medical homes and ACOs. Participation rates of providers in primary care single specialty settings mirrored the rates of multi-specialty practice participation.

Value-based reimbursement models may be more of a challenge for independent and physician-owned practices. Fifty-eight percent of providers in a 2016 Deloitte survey said that they would consider joining a larger organization to gain access to the resources and capabilities necessary for value-based reimbursement.

The rates were also higher than those of physicians in non-primary care single specialty practices, the AMA report stated. Medical home participation was over 20 percentage points higher for physicians in primary care practices.

One-third of providers in primary care single specialty practices also engaged in Medicare and commercial ACOs compared to just 25 percent of physicians in non-primary care settings.

“This is not surprising because medical homes are fundamentally a model of how primary care should be organized and delivered,” AMA wrote. “Further, primary care physicians serve as the ‘linchpin’ of an

ACO program.”

Primary care and multi-specialty practices are transitioning to value-based reimbursement faster than other healthcare settings, such as independent practices. But the overall shift to fee-for-service has not gained the momentum many stakeholders predicted. HHS aims to tie one-half of Medicare fee-for-service payments to value by the end of 2018.

The opportunity still exists to attract more providers from across healthcare settings to adopt value-based reimbursement models, from pay-for-performance to ACOs.