Provider Profitability Drops Under Biosimilar Use Reimbursement

Claims reimbursement models for biosimilar use result in provider profitability reductions between $9 per unit in offices to $43 in hospitals.

Source: Thinkstock

- Biosimilar use could be the key to lowering healthcare costs associated with biologic treatments, but provider profitability may suffer by as much as $100 million across care settings if providers continue to administer the low-cost alternative, a recent Navigant analysis uncovered.

“Biosimilars have the potential to reduce overall treatment costs, but the current reimbursement models for these therapies present a significant obstacle to broader adoption,” researchers wrote. “Though it may be possible for insurers to influence biosimilar uptake through restrictive formularies and benefit design, getting providers on board will require longer-term commercial reimbursement models that align hospital and physician incentives with those of the payer.”

Providers are currently reimbursed for administering biologic and biosimilar treatments using a buy-and-bill method. Under the reimbursement arrangement, providers receive reimbursement for the biologic with an additional percentage of the price added for acquisition, storage, and dispensing costs.

For biologic use, providers generally receive between about 9 to 10 percent for commercial payers and 4.3 percent of the prescription drug’s average sales prices under Medicare after accounting for the most recent Budget Control Act sequestration.

The buy-and-bill reimbursement model may establish disincentives for providers to use lower-cost biosimilar drugs, the study claimed.

READ MORE: Key Ways to Improve Claims Management and Reimbursement in the Healthcare Revenue Cycle

CMS addressed the claims reimbursement challenge by requiring Medicare to reimburse providers for biosimilar use at the average sales price plus 6 percent of the innovator drug’s price. However, commercial payers have not widely adopted similar claims reimbursement rates for biosimilar use.

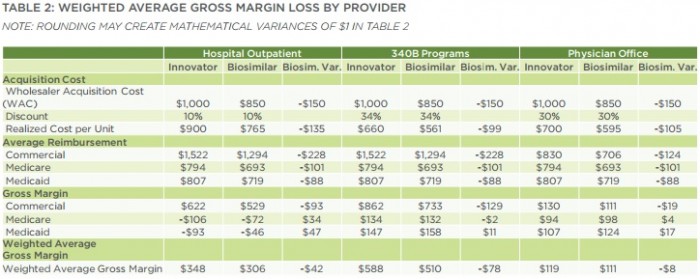

Researchers explored the effects of the claims reimbursement model in a hypothetical situation in which providers had the choice between an infused innovator product priced at $1,000 per unit dose and a biosimilar with a 15 percent discount.

They used the discount value because drug manufacturers currently use a similar discount for biosimilars in US markets. Manufacturers are also unlikely to increase the discount as they do in European markets because of the complex FDA approval process and the competitive nature of biosimilar markets.

Under current buy-and-bill claims reimbursement arrangements for biosimilar use, weighted average gross margin losses (reimbursement minus acquisition cost) would range from $9 per unit vial in a physician office, to $43 in a hospital outpatient department and $79 in a hospital participating in the 340B drug discount program.

Source: Navigant

The estimated provider profitability loss would equate to over $50,000 per year at a hospital treating just 50 patients by administering two vials of biosimilar drugs a month.

READ MORE: Preparing the Healthcare Revenue Cycle for Value-Based Care

Even if drug manufacturers dropped the acquisition costs of biosimilars, claims reimbursement structures that used average sales price plus or percentage of billed charges methods would still result in provider profitability decreases.

Any reimbursement model tied to the drug’s acquisition cost would lead to gross margin losses for providers if costs decreased, researchers stated.

Additionally, providers would particularly experience profitability reductions in their commercial business lines when using biosimilars versus biologics. Providers would generate a weighted average margin loss of $93 for commercial revenue in a hospital outpatient setting, $129 in a 340B hospital, and $19 in a physician office.

Conversely, providers would experience increased profitability in their government-payer business lines. Providers would face the following weighted average gross margin losses:

• Hospital outpatient departments would see a $34 boost for Medicare and $47 increase for Medicaid

READ MORE: Prescription Drug Rates Remain Top Healthcare Supply Chain Issue

• 340B hospitals would see a $2 loss for Medicare and a $11 increase for Medicaid

• Physician offices would see a $4 boost for Medicare and a $17 increase for Medicaid

Government-payer business lines would not suffer as much as commercial revenue lines because CMS designed the unique Medicare reimbursement model for biosimilar use.

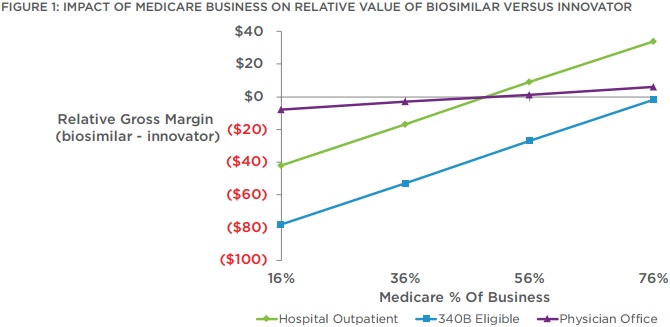

However, researchers stated that the average payer mix of 16 percent Medicare, 22 percent Medicaid, and 62 percent commercial would not offset the financial losses. Hospitals and physician offices would need to have over 50 percent of their business stemming from Medicare to generate a net margin improvement.

Source: Navigant

340B hospitals would not see a financial benefit until they saw 75 percent of their business come from Medicare.

Researchers projected that the financial losses to providers to grow as additional biosimilars enter the market.

Providers may also see their profitability plunge lower as they continue to use biosimilars in lieu of expensive treatments. A recent Premier survey uncovered that healthcare executives are prioritizing biosimilar use to decrease inpatient drug spending. About 55 percent said that their organization increased use of biosimilar drugs to cut costs.

Navigant researchers suggested two claims reimbursement methods that could overcome provider profitability losses.

First, payers should consider a fixed reimbursement model in which providers receive a capitated payment for care delivery.

“With a fixed reimbursement model the payer ‘capitates’ the cost of the drug by paying a fixed amount regardless of whether the innovator or biosimilar was administered, thereby eliminating the financial incentive for providers to use the more expensive innovator drugs,” they stated.

“Under this type of reimbursement model, providers realize the value of lowering their acquisition cost, while payers, which reimburse less than they are currently paying for the innovator, and more than they are paying for the biosimilar, reduce their drug spend,” they added.

Second, commercial payers should adopt a claims reimbursement method like the one used by Medicare. The federal agency uses a differential reimbursement models for biosimilars, but only about 3 percent of commercial payers currently employ this type of model to incentivize providers to use biosimilars.

“Our analysis shows if payers increase the incentive for a biosimilar by about 4 percentage points (eg, from ASP plus 10 percent to ASP plus 14 percent) it would alter the relative margin for physician offices and remove the financial disincentive of using a biosimilar,” researchers wrote.

Although, payers would need to establish additional financial incentives for the claims reimbursement option to be viable. Hospitals would require financial incentives at about 16 percentage points for broader biosimilar adoption.