Risk-Averse MSSP ACOs Missed $966M By Not Assuming Downside Risk

MSSP ACOs in non-risk bearing Track 1 would have benefited financially from assuming downside risk and collecting the Advanced APM incentive payment in 2016, an analysis showed.

Source: Thinkstock

- Accountable care organizations (ACOs) in the non-risk bearing track of the Medicare Shared Savings Program (MSSP) could have boosted their bottom lines by an additional $966 million in net payments in 2016 if they had assumed downside risk in the new MSSP track, a new Avalere analysis revealed.

The organizations also would have qualified as Advanced Alternative Payment Model (Advanced APM) participants.

The Washington, DC-based healthcare consulting firm stated that the 5 percent incentive payment under MACRA’s Advanced APM pathway should motivate ACOs to assume downside financial risk.

“The Medicare bonus payment will enable more providers to gain financially when taking on downside risk,” stated Josh Seidman, Senior Vice President at Avalere. “As they take on more risk, Medicare beneficiaries should see their providers doing more to keep their patients healthy.”

Avalere simulated how MSSP ACOs in Track 1, the program’s non-risk bearing pathway, would have performed if all of the organizations switched to the new MSSP Track 1+. The newest addition to the program requires ACOs to assume some downside financial risk, with a minimum shared savings and shared losses rate of 2 percent and negative 2 percent, respectively.

READ MORE: Accountable Care Organizations Grow, But Face New Challenges

The downside financial risk in Track 1+ is less than the rates offered under Tracks 2 and 3. But the new MSSP pathway still qualifies for the 5 percent incentive payment under the Advanced APM program in MACRA.

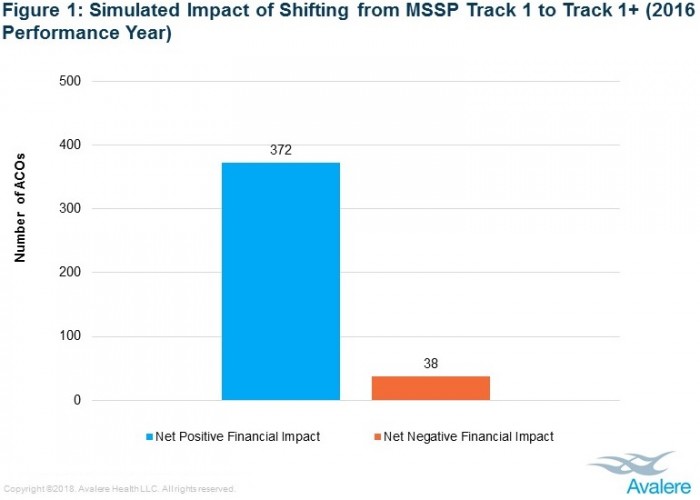

If all 410 Track 1 ACOs analyzed participated in the Track 1+ pathway, 91 percent would have financially benefited from assuming downside financial risk and earning the Advanced APM incentive payment based on 2016 performance data, the simulation uncovered.

Source: Avalere

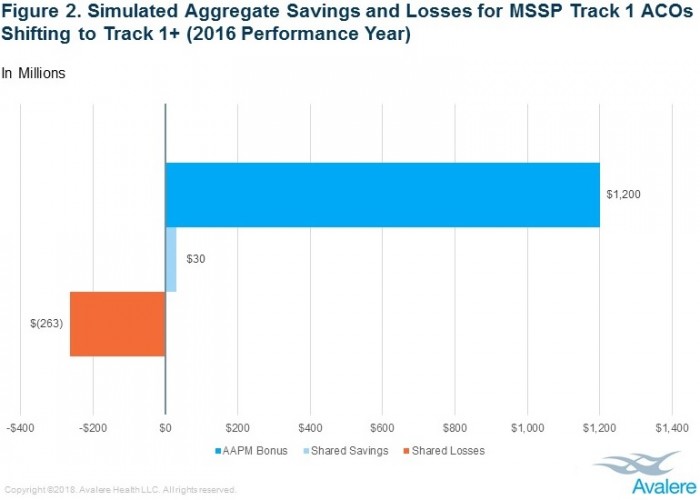

The organizations would have earned a total of $966 million in net payments by participating in Track 1+, which was more than Avalere projected in a 2017 simulation that moved MSSP Track 1 ACOs to Track 2.

In the 2016 simulation, the consulting firm found that non-risk bearing MSSP ACOs missed $886 million in additional payments in 2015 by not participating as Track 2 organizations.

With the addition of a new MSSP track, ACOs have more of an opportunity to assume downside financial risk without taking on excessive levels. And the organizations can financially benefit from becoming risk-bearing MSSP ACOs, the most recent analysis revealed.

READ MORE: The Future of Accountable Care Organizations Involves Risk

The Advanced APM incentive payment was key to financial success, researchers explained. Absent the incentive payment, only 5 percent of MSSP ACOs would have realized net positive earnings.

Even the MSSP Track 1+ ACOs that would have had to repay CMS for shared losses would have benefited from Advanced APM participation. The simulation uncovered that the ACOs would have incurred $263 million in shared savings in 2016.

Source: Avalere

However, nearly three-quarters of the organizations that had to repay their shared losses would have offset their financial setback with the Advanced APM incentive payment.

The Advanced APM incentive payment should be an effective tool for CMS to encourage more providers to assume downside financial risk, explained Avalere’s Director John Feore.

“CMS is eager to encourage more ACOs to take on performance-based risk,” he said. “With the incentive payments and increasing comfort with the Medicare Shared Savings Program, risk-based ACOs will continue to grow in the coming years.”

READ MORE: ACOs Plan to Move to Downside Financial Risk, Capitation Contracts

ACOs encounter many challenges with assuming downside financial risk, particularly in the MSSP. Risk-bearing tracks are “not viable for most ACOs and set the bar much too high in terms of financial risk,” the National Association of ACOs (NAACOS) explained.

“Having to potentially pay millions of dollars to Medicare is simply not practical nor feasible for these organizations,” the association stated. “This type of risk often necessitates that ACOs have considerable financial backing, which is why, for the most part, these models have attracted ACOs with hospitals, health systems or outside investors.”

However, MSSP ACOs are slowly venturing into downside financial risk tracks with the help of the newest program track, according to new data from CMS. In 2018, the number of program ACOs participating in an MSSP track with downside financial risk more than doubled from the previous year. About 18 percent of MSSP ACOs will now be risk-bearing.

The significant increase in risk-bearing MSSP ACOs can be attributed to the addition of the Track 1+ pathway, which ramps up financial risk. Fifty-five organizations will be participating as Track 1+ ACOs in 2018.

“We are pleased to see more ACOs moving into two-sided models,” Clif Gaus, ScD, NAACOS President and CEO said regarding the CMS data. “This growth is an encouraging sign that more ACOs are preparing to take on risk, but it’s vital to recognize all the time and effort for these ACOs to be ready to assume risk. We need to continue to improve the ACO program as a whole to provide the stability and demonstrated success necessary for ACOs to feel confident to enter into these risk-based ACO models.”