ACOs Plan to Move to Downside Financial Risk, Capitation Contracts

ACOs anticipate entering downside financial risk contracts within the 10 months for shared savings/losses arrangements and 17 months for capitation, a survey showed.

Source: Thinkstock

- Accountable care organizations (ACOs) are planning to enter downside financial risk arrangements, with 47 percent planning on entering a shared savings and losses contract and 38 percent pursuing capitation, uncovered a recent survey of 240 ACOs from the National Association of ACOs (NAACOS) and Leavitt Partners.

Shared in a Health Affairs blogpost, the survey findings also revealed that Medicare, Medicaid, and commercial ACOs are still implementing initial care redesign and population health management strategies despite their willingness to take on additional financial risk.

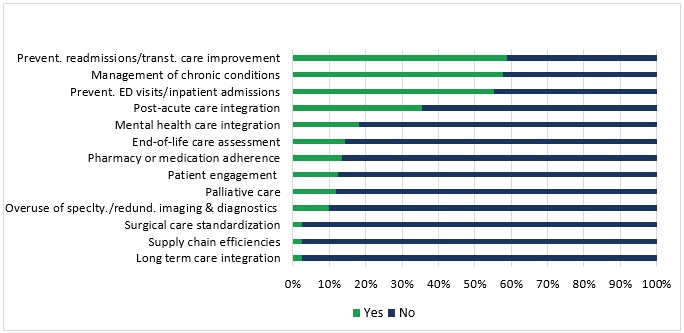

According to respondents, top priorities for ACOs in 2017 include preventing hospital readmissions, chronic disease management, and reducing emergency department visits.

Source: Health Affairs, Leavitt Partners, and NAACOS

More advanced care delivery redesigns that are “necessary for ACOs to achieve their stated goals of reducing costs and improving quality” were further down on priority lists or not on the top focus areas at all. These activities included integrating behavioral health and improving medication management.

“While ACOs are continuing to grow and there are strong pressures to push provider-born risk, this risk cannot be pushed faster than ACOs’ ability to manage it,” experts from NAACOs and Leavitt Partners wrote. “Our results indicate that ACOs have both the appetite and the plans to take on more risk; however, ACOs need time and the support of their payer partners to make that transition.”

READ MORE: Accountable Care Organizations Grow, But Face New Challenges

While ACOs may still be grappling with population health management, the organizations are exploring downside financial risk arrangements. About one-half of ACOs stated that the organization was in at least one active contract with downside risk involving shared savings/losses (38 percent) or capitation (12 percent).

Organizations across payers are also bearing similar financial risk levels. About 53 percent of ACOs said that their organization has the same financial risk levels in their commercial and Medicaid contracts as their Medicare arrangements.

About one-quarter of the organizations actually reported less financial risk in their commercial and Medicaid contracts than their Medicare ones, indicating that private payers and states may not be promoting downside financial risk as much as CMS.

“This is likely a function of the flexibility and variability of commercial and Medicaid contracts,” the experts explained. “When programs are optional, and often subject to negotiation, risk levels may remain low.”

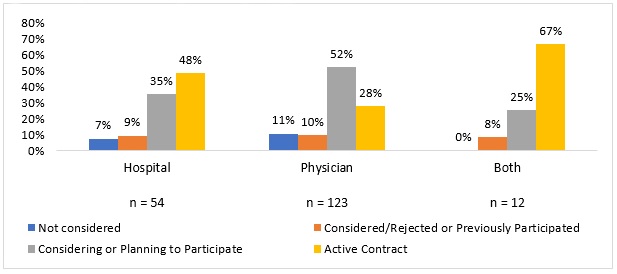

The survey also showed that financial risk levels significantly varied by leadership type. Only 28 percent of physician-led ACOs have an active risk-based contract, whereas almost one-half (48 percent) of hospital-led ACOs are assuming downside financial risk.

Source: Health Affairs, Leavitt Partners, and NAACOS

READ MORE: Exploring Two-Sided Financial Risk in Alternative Payment Models

Despite differing financial risk adoption levels, both physician- and hospital-led ACOs plan to expand their risk-based arrangements in the near future. On average, ACOs plan to take on downside financial risk contracts within the 10 months for shared savings/losses and 17 months for capitation.

Although, ACOs that do not currently participate in risk-based arrangements plan to take more time to adopt downside financial risk. Most of these organizations (63 percent) expect to assume downside financial risk in two to three years, while 17 percent said one year or less and 16 percent said four to five years

To help organizations transition to risk-based contracts, ACO leaders are investing in population health management strategies. However, few are offering services throughout the care continuum.

Most ACOs offer services for primary care (94 percent), labs and imaging (77 percent), specialty care (74 percent), and inpatient care (71 percent).

Only 7 percent offer dental care, 39 percent have long-term care, and 49 percent manage pharmacy services.

READ MORE: Examining the Role of Financial Risk in Value-Based Care

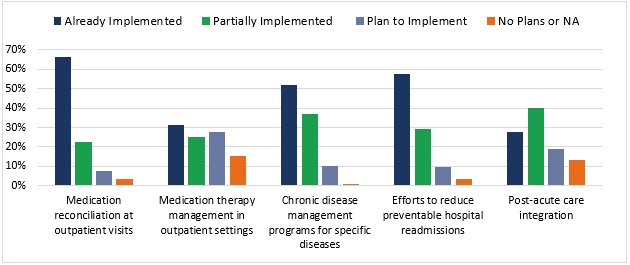

Even though only about one-half of ACOs offer pharmacy services, managing medication costs and clinical complications involving drugs topped the list of ACO population health management strategies.

Medication costs and complications was a high priority, followed by chronic disease management, hospital readmission reduction efforts, and post-acute care integration.

Source: Health Affairs, Leavitt Partners, and NAACOS

“The stages of adoption of key population health management activities suggest that ACOs are still largely focusing on the initial steps of care redesign,” wrote researchers. “For example, when tackling unscheduled care, ACOs tend to seek to prevent emergency department (ED) use with outpatient options instead of using strategies within the ED, indicating a focus on working with primary care practices before integrating more specialized providers.”

ACOs may be improving their population health management strategies. But nearly all organizations (95 percent) have implemented care coordinators to facilitate those strategies.

Almost 90 percent of surveyed ACOs also stated that care coordinators are very or extremely important to the organization’s success. One participant even said that coordinators are a “cornerstone” and another described the role as “glue connect[ing] a disjointed care delivery system.”

In addition to population health management implementation, ACOs are also investing in health IT. The organizations spent an average of $600,000 on health IT, data analytics, and quality reporting operating expenses.

In contrast, the organizations invested about $1.1 million on care management.

“This may suggest that ACOs are able to invest more in clinical care services and patient support, possibly because infrastructure costs, such as health IT, are now more established in ACOs,” the blogpost stated. “Still, expenses of both types represent a significant investment, particularly for smaller organizations.”

With ACOs spending a significant portion of their budgets on health IT and care management, organization leaders are finding cost reductions to be a major challenge. The top challenges that ACOs face include:

• Decreasing healthcare costs

• Planning participation in mandatory downside financial risk arrangements

• Collaborating with payers and a lack of flexibility on their part

• Understanding and complying with government regulations

• Managing health IT requirements

• Meeting care quality benchmarks

Based on the survey’s findings, researchers stated that CMS and other payers can better support ACOs to foster their success with downside financial risk and population health management.

“For example, CMS could continue to introduce multi-payer models and other opportunities for providers to reap the financial benefits of care delivery improvements across several populations,” they wrote. “Additionally, CMS could develop better guidance for navigating multiple payment models to help providers maximize the returns from investing in a multipronged approach to value transformation.”