Medicaid Expansion Linked to $5M Annual Hospital Revenue Boost

A new study revealed that Medicaid expansion resulted in several hospital revenue cycle improvements, including a $5 million boost in annual revenue.

Source: Thinkstock

- Hospital revenue in Medicaid expansion states increased by $5 million annually per facility after states chose to extend Medicaid coverage to more individuals, a recent Robert Wood Johnson Foundation and Urban Institute report showed.

The study of hospitals in 19 Medicaid expansions states that implemented Medicaid eligibility extensions in late 2014 also revealed that uncompensated care costs decreased from $9.4 million from before the expansion to just $3.2 million post-expansion. Uncompensated care cost reductions represented a 34 percent decrease.

“This updated analysis finds that the ACA [Affordable Care Act] was associated with substantial changes in hospitals’ payer mix, with larger effects for hospitals in states that expanded Medicaid,” the report stated. “Through FY 2015, hospitals in expansion states experienced reductions in uncompensated care costs and increases in Medicaid revenue and financial margins, compared with hospitals in non-expansion states.”

Under the Affordable Care Act’s authority, 32 states chose to expand Medicaid eligibility to more low-income residents. While 19 states have elected not to extend Medicaid coverage, researchers pointed out that hospitals in Medicaid expansion states fare financially better than hospitals in non-expansion states.

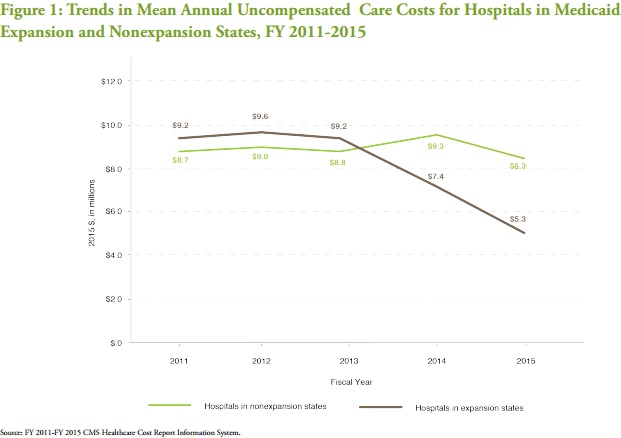

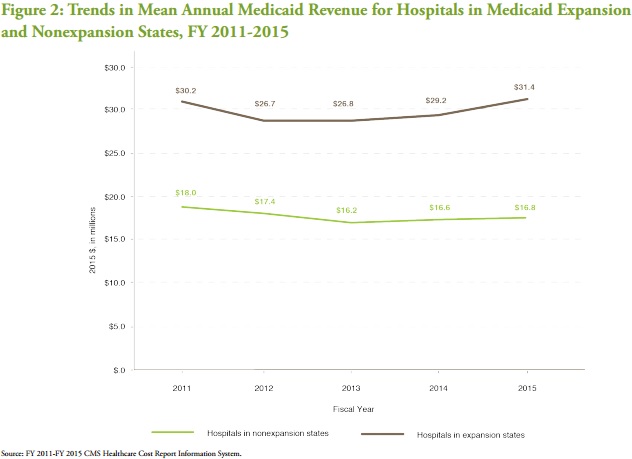

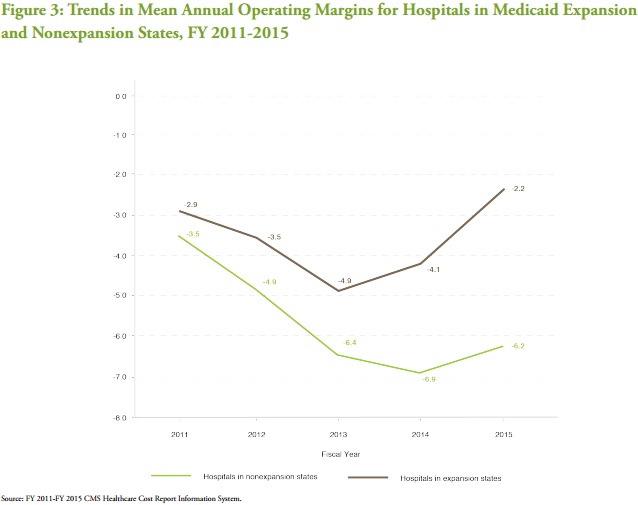

Hospitals in both Medicaid expansion and non-expansion states saw similar uncompensated care costs, Medicaid revenue, and hospital margins trends before early Medicaid expansion adopters implemented the project in 2014.

READ MORE: Preparing the Healthcare Revenue Cycle for Value-Based Care

However, mean annual uncompensated care costs for hospitals in Medicaid expansion states dropped by almost $4 million during the post-implementation period from 2013 to 2015.

In contrast, hospitals in non-expansion states saw uncompensated costs increase by $0.5 million in 2014 and then decline by only $1 million in 2015.

Source: Robert Wood Johnson Foundation and Urban Institute

Hospitals in Medicaid expansion states also received more mean annual Medicaid revenue during the post-implementation period. Medicaid revenue grew by $4.6 million from 2013 to 2015, while it increased by just $0.6 million among hospitals in non-expansion states.

Source: Robert Wood Johnson Foundation and Urban Institute

In terms of hospital revenue cycle management, operating and excess margins increased significantly more at facilities in Medicaid expansion states than their counterparts in non-expansion states. Mean annual operating margins at expansion hospitals grew by 0.8 percentage points in 2014 and another 1.9 percentage points in 2015.

But operating margins among hospitals in non-expansion states declined by 0.6 percentage points in 2014 and increased by only 0.8 percentage points in 2015.

Source: Robert Wood Johnson Foundation and Urban Institute

READ MORE: Best Practices for Value-Based Purchasing Implementation

Hospital excess margins demonstrated similar trends as the operating margins from 2014 to 2015.

Based on the hospital comparisons, researchers concluded that Medicaid expansion was associated with significant hospital revenue improvements. Medicaid revenue as a percentage of total hospital revenue rose by 2.9 percentage points as a result of extending Medicaid eligibility.

Before Medicaid expansion, hospitals maintained a mean of $27.9 million in Medicaid revenue. But the $3.2 million boost in hospital revenue equated to an 18.1 percent increase in Medicaid money.

Researchers also linked Medicaid expansion to improved operating margins (2.5 percentage points) and excess margins (1.7 percentage points). The hospital revenue cycle improvements represented respective 67.3 percent and 41.4 percent increases compared to pre-expansion numbers.

Hospital revenue cycle advancements are not a “one-time effect” from Medicaid expansion, researchers added. With the projected Medicaid expansion effects in 2015 larger in magnitude than the 2014 estimates, the findings indicate that the hospital finance improvements will continue.

READ MORE: Top Revenue Cycle Management Vendors and How to Select One

Additionally, the report found that small, for-profit, and non-federal-government-operated hospitals, as well as hospitals in nonmetropolitan areas, experienced the greatest hospital revenue cycle improvements post-Medicaid expansion.

Hospitals of all sizes in expansion states saw uncompensated care costs decline and Medicaid revenue increase, but operating margins for small hospitals with 100 beds or fewer grew by 3.9 percentage points versus just 1.2 percentage points at large hospitals and 0.3 percentage points at medium hospitals.

Excess margins at small hospitals also increased by 2.5 percentage points compared to just 1.5 percentage points at large facilities and 0.3 percent at medium facilities.

Medicaid expansion was also associated with greater hospital revenue cycle improvements for for-profit and non-federal hospitals. Non-profit hospitals only saw 0.8 percentage point and 1.4 percentage point boosts in operating and excess margins.

But operating and excess margins for for-profit hospitals increased by 3.2 percentage points and 2.7 percentage points, while non-federally-owned hospitals saw respective 6.9 percentage point and 3 percentage point increases.

Hospitals in nonmetropolitan areas also fared better than their peers in more urban areas, the report continued. Among nonmetro hospitals, Medicaid expansions boosted operating margins by 4 percentage points and excess margins by 2.3 percentage points.

On the other side, Medicaid expansions only increased operating and excess margins among metro hospitals by 1 percentage points and 0.9 percentage points respectively.

Researchers concluded that the study’s results suggest that hospital payer mix and overall financial health is likely to improve under potential Medicaid expansions in the 19 remaining states.

“However, changes in financial outcomes for specific hospitals, beyond the characteristics analyzed in this study, likely will depend on a host of factors, such as existing state or regional coverage gains under the ACA, state Medicaid eligibility thresholds before the 2014 expansion, Medicaid reimbursement levels, and subsidies hospitals would receive for providing uncompensated care to people losing coverage,” researchers added.

Hospital revenue cycle improvements stemming from Medicaid expansions may also slow by 2018. The Affordable Care Act mandates CMS to significantly reduce Medicaid Disproportionate Share payments to hospitals next year. The supplemental payments provide additional financial support to hospitals that treat larger proportions of Medicaid and uninsured individuals.

But states looking to expand Medicaid after 2018 will not have access to Medicaid Disproportionate Share payments to offset some uncompensated care costs while Medicaid revenue increases.

As a result, researchers stated that “the financial gap between hospitals in expansion and non-expansion states could further increase if current policy remains the same.”