200 Hospitals Face 5.5% Medicare Payment Cut Under Site-Neutral Rule

Six percent of hospitals would shoulder 73 percent of the Medicare payment cuts under proposed site-neutral payment expansions in 2019.

Source: Thinkstock

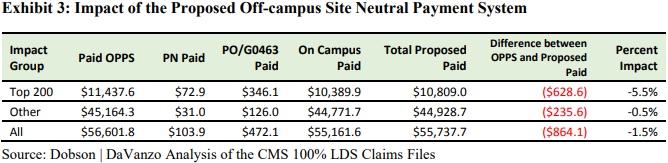

- About six percent of hospitals subject to the Medicare Outpatient Prospective Payment System (OPPS) would be disproportionately impacted by a recent proposal to expand site-neutral Medicare payments, a new analysis shows.

The 200 hospitals would shoulder 73 percent of the proposed Medicare payment reduction, Dobson DaVanzo & Associates, LLC recently reported in analysis done for the Integrated Health Care Coalition.

Source: Dobson DaVanzo & Associates, LLC, Integrated Health Care Coalition

The small group of hospitals would see their Medicare reimbursement fall by an average reduction of 5.5 percent, translating to a collective $628.6 million drop in hospital outpatient payments in 2019.

The remaining hospitals would only face a 0.5 percent decrease with hospital outpatient payments falling just $235.6 million in 2019.

The Medicare payment reduction would stem from the CMS proposal to pay for clinic visits performed at off-campus provider-based hospital departments at the lower site-neutral rate regardless of a department’s excepted status.

READ MORE: The Difference Between Medicare and Medicaid Reimbursement

Clinic visits are the most common service in the outpatient setting and CMS pays off-campus provider-based hospital departments more for the service than if it was performed in the physician office setting. The proposal would decrease the Medicare reimbursement rate by the Physician Fee Schedule relatively adjuster, which is currently 40 percent of the OPPS rate.

The federal agency designed the site-neutral payment policy to reduce the unnecessary use of hospital outpatient departments, which cost Medicare more. CMS projected in the CY 2018 OPPS proposed rule that total spending under the outpatient payment system would increase by over $5 billion from 2018 to 2019, reaching a total of nearly $75 billion.

The outpatient spending projection is about twice the total estimated spending in CY 2008, CMS pointed out.

In light of increased hospital outpatient use, the Social Security Act also required the HHS Secretary to “develop a method for controlling unnecessary increases in the volume of covered OPD [outpatient department] services.”

However, the Integrated Health Care Coalition report suggests that outpatient spending may not be growing as fast as CMS thinks.

READ MORE: When Claims Reimbursement Doesn’t Cover Healthcare Innovation

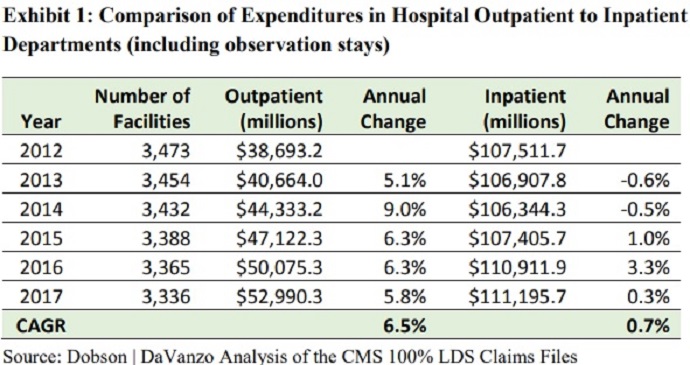

The analysis of Medicare outpatient spending trends from 2012 to 2017 revealed that the growth rate for outpatient expenditures actually moderated since policymakers enacted site-neutral payments for off-campus provider-based departments in Section 603 of the Bipartisan Budget Act of 2015.

The compound annual growth rate (CAGR) for outpatient expenditures was 6.5 percent during the period.

Source: Dobson DaVanzo & Associates, LLC, Integrated Health Care Coalition

The CAGR found by the Integrated Health Care Coalition is lower than the growth rate reported by CMS. In the proposed CY 2019 OPPS rule, the federal agency stated that the CAGR was 8.5 percent.

“Based on this analysis, it is clearly uncertain whether the growth in outpatient expenditures has been ‘unnecessary,’” the report stated.

Instead, government policies and technological advancements may be behind the growth in outpatient spending and utilization, Dobson DaVanzo & Associates suggested.

READ MORE: How the Bipartisan Budget Act of 2018 Impacts Claims Reimbursement

Recent healthcare policies have shifted some expensive inpatient care to the cheaper outpatient setting. For example, CMS removed total knee replacement from the Medicare inpatient-only list in the CY 2018 OPPS final rule.

The industry-wide push to pay for value rather than volume is also prompting healthcare organizations to reconsider inpatient use.

Under value-based care models, healthcare organizations are becoming financially and clinically responsible for the outcomes of their services. Shifting care to a less expensive setting without impacting patient outcomes is a key strategy for succeeding under alternative payment models.

Technological advancements may also be pushing more care to the outpatient space by making it more convenient and safer to perform surgeries outside of the inpatient setting.

Hospitals are not happy with the CMS proposal to expand site-neutral payments and reduce hospital outpatient reimbursement.

The American Hospital Association (AHA) specifically said the site-natural payment proposals, “run afoul of the law and rely on the most cursory of analyses and policy rationales. Taken together, they would have a chilling effect on beneficiary access to care and new technologies, while also dramatically increasing regulatory burden.”

The industry group added that CMS would be exceeding its statutory authority by implementing the site-neutral payment expansion.

Section 603 of the Bipartisan Budget Act of 2015 clearly excepts some off-campus provider-based departments from site-neutral payments. However, the proposed expansion would subject the excepted provider-based departments (PBDs) to a site-neutral clinic visit rate.

“CMS does not have the authority to implement the Medicare Act in a fashion that eliminates an exception that was expressly established by statute,” the AHA wrote in a comment letter on the proposed rule. “When it enacted section 603, Congress made a clear policy choice that excepted PBDs would not be subject to the same site-neutrality policies that apply to nonexcepted PBDs.”

“CMS’s proposal disagrees with and seeks to overturn the policy choice made by Congress. But it is well established that ‘federal agencies may not ignore statutory mandates or prohibitions merely because of policy disagreements with Congress,” the group added.

In the comment letter, the AHA also decried other proposed changes to site-neutral payments, including the proposal to reimburse excepted off-campus provider-based departments the site-neutral rate for delivering new clinical families of services.

The Integrated Health Care Coalition also submitted comments to CMS on the proposed rule. The comments included the results from the Dobson DaVanzo & Associates analysis.

CMS has yet to release the CY 2019 final rule. Stakeholders should expect a final rule later in the fall.