Documentation Issues Behind $23B in Medicare Improper Payments

Medicaid also had $4.3 billion in payment errors in 2017 but differing documentation requirements resulted in substantially greater Medicare improper payments.

Source: Thinkstock

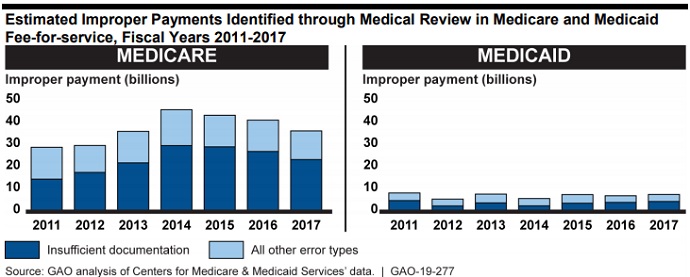

- Medicare and Medicaid are on the Government Accountability Office’s (GAO) list of programs that are at an elevated risk for fraud, waste, abuse, and mismanagement after a recent investigation found $27.5 billion in Medicaid and Medicare improper payments due to insufficient documentation in fiscal year (FY) 2017.

Both public healthcare programs review medical record documentation to ensure reimbursement only goes to eligible providers and hospitals for services that are medically necessary and covered by the payers.

However, the GAO analysis showed that Medicare fee-for-service paid approximately $23.2 billion in improper payments in FY 2017 due to insufficient documentation, while Medicaid fee-for-service paid an estimated $4.3 billion for the same type of improper payments.

Source: Government Accountability Office

Insufficient documentation accounted for the majority of estimated fee-for-service improper payments in Medicare and Medicaid in FY 2017, with 64 percent of Medicare and 57 percent of Medicaid medical review improper payments.

But Medicare fee-for-service faced significantly more improper payments due to insufficient documentation in FY 2017 compared to its Medicaid counterpart, GAO pointed out.

READ MORE: The Difference Between Medicare and Medicaid Reimbursement

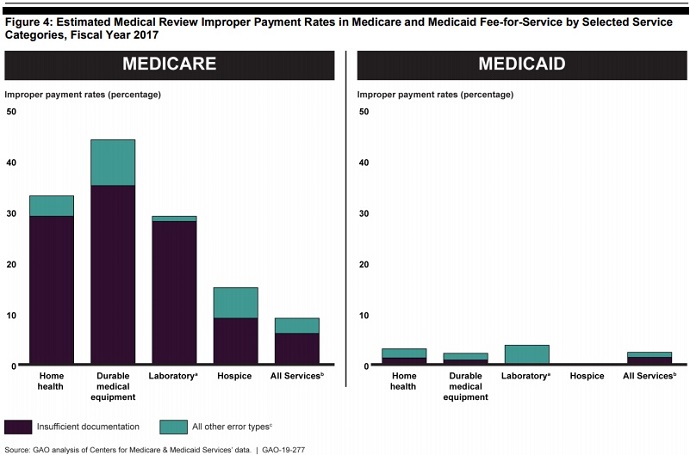

CMS data revealed that the rate of insufficient documentation across all services in FY 2017 was 6.1 percent for Medicare versus 1.3 percent in Medicaid. The rate was also significantly greater than the difference in rates for all other types of payment errors, which were 3.4 and 1 percent, respectively.

Additionally, the insufficient documentation rate was at least 27 percentage points greater for home health, durable medical equipment, and laboratory services paid for by Medicare versus Medicaid. The rate of insufficient documentation for Medicare hospice services was also 9 percentage points higher.

Source: Government Accountability Office

The differences between Medicaid and Medicare coverage policy and documentation requirements contributed to Medicare’s substantially higher rate of improper payments due to insufficient documentation, GAO stated.

Medicare generally has more extensive documentation requirements for certain services compared to Medicaid. For example, Medicare requires additional documentation for services that involve physician referrals, while states determine their own Medicaid requirements and use prior authorizations and other mechanisms to verify compliance with coverage policies, the report stated.

But the federal watchdog identified four notable differences in coverage policy and documentation requirements that likely impacted how the programs conducted medical reviews and estimated improper payments.

READ MORE: Exploring the Fundamentals of Medical Billing and Coding

First, Medicare implemented the policy from the Affordable Care Act (ACA) that required referring physicians to conduct a face-to-face examination of beneficiaries as a condition of reimbursement. In contrast, states were still in the process of adopting the coverage policy by FY 2017.

Implementing the face-to-face examination requirement resulted in an increase in Medicare improper payments due to insufficient documentation, GAO reported.

Second, Medicare does not use prior authorizations for certain services, while Medicaid has the authority to do so. Medicare primarily used prior authorizations in FY 2017 through temporary demonstrations and models, which saved the program an estimated $1.1 to $1.9 billion as of March 2017.

However, six states in the study reported using prior authorizations in Medicaid for at least one of the four services analyzed by GAO. State officials told GAO that prior authorizations prevented Medicaid improper payments from occurring in the first place, contributing to lower rates of insufficient documentation.

Third, Medicare has stricter standards for what constitutes a valid physician signature. Both public payers require a physician’s signature on provider documents to verify validity, but Medicare will not accept illegible signatures and initials on their own.

READ MORE: Maximizing Revenue Through Clinical Documentation Improvement

In contrast, state Medicaid agencies generally do not have detailed physician signature requirements and reviewers can generally rely on their own judgement.

Finally, Medicare requires documentation from referring physicians to support the medical necessity of the referred services, while state Medicaid agencies generally do not require the same level of documentation.

“CMS officials attributed any differences in the two programs’ documentation requirements to the role played by the states in establishing such requirements under Medicaid, and told us that they have not assessed the implications of how differing requirements between the programs may lead to differing assessments of the programs’ risks,” the GAO report stated.

“CMS relies on improper payment estimates to help develop strategies to reduce improper payments, such as informing Medicare’s use of routine medical reviews, educational outreach to providers, and efforts to address fraud. Without a better understanding of how documentation requirements affect estimates of improper payments, CMS may not have the information it needs to effectively identify and analyze program risks, and develop strategies to protect the integrity of the Medicare and Medicaid programs.”

To ensure Medicare and Medicaid are appropriately identifying improper payments and assessing program risk, the GAO advised CMS to establish a process to routinely assess Medicare and Medicaid documentation requirements to ensure they are necessary and effective.

Additionally, the watchdog recommended that CMS:

- Ensure Medicaid medical reviews provide robust information about and result in corrective actions that address the root cause of improper payments, including adjusting the sampling approach to reflect state-specific program risks and partnering with state Medicaid agencies to leverage other information sources

- Minimize the potential for medical reviews to compromise fraud investigations by directing states to identify if providers selected for specific types of medical reviews are also being investigated for fraud

- Address disincentives for state Medicaid agencies to notify contractors of providers under fraud investigations, including educating state officials about reporting providers under fraud investigations and modifying how claims from providers under fraud investigation are accounted for in state improper payment rates

HHS – parent department of CMS – concurred with three of the four GAO recommendations, and emphasized the agency’s work through the Patients Over Paperwork initiative, which focuses on simplifying Medicare documentation requirements

However, the federal department took issue with the recommendation that CMS ensure Medicaid medical reviews provide robust information about and result in corrective actions. The department argued that increasing the sample size of medical reviews analyzed by the national department would increase costs and state Medicaid agency burden.