Electronic Claims Management Adoption Could Save Providers $9.5B

Providers are slated to save more this year by adopting electronic claims management processes as health plan web portals stall the transition away from manual processes.

Source: Thinkstock

- Transitioning from manual to fully electronic claims management would save the healthcare industry $11.1 billion annually, with providers seeing the greatest share of the savings, the fifth annual CAQH Index found.

Providers would save approximately $9.5 billion a year by adopting automated processes for just seven common claims management transactions.

The estimated savings stemming from full adoption of electronic claim submission, status inquiry, payment, and attachment, as well as eligibility and benefit verification, prior authorization, and remittance advice has increased, CAQH researchers pointed out.

In last year’s Index, the entire healthcare industry was slated to save $9.4 billion by eliminating manual claims management processes, with providers seeing $7.9 billion in savings.

Provider savings were significantly up in 2017 because of an increase in health plan adoption and use of web portals, researchers explained. Online portal use resulted in the volume of manual claims management transactions from providers rising 55 percent in the past year.

Web portals allow providers to track their claims and reimbursement for a specific payer. Providers can also receive remittance advice and claims denial management opportunities via online portals from payers.

However, CAQH considers web portal use an electronic transaction for payers, but a manual process for providers. While web portals offer an automated solution for claims management, providers face significant administrative burdens with using the web portals because they must sign on and navigate different online systems for each health plan they accept.

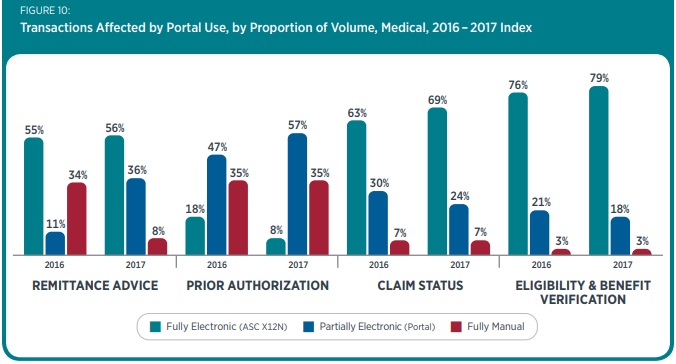

The benefits of online portal use resulted in an 11 percent increase in partially electronic portal use for remittance advice and a ten-percentage-point boost in partially electronic portal use for prior authorization.

But their benefits were offset by a boost in manual transactions. The increase in web portal use resulted in a ten-percentage-point reduction in the adoption of fully electronic transactions, while the use of manual transactions remained steady, researchers reported.

Source: CAQH

While web portals affected the adoption of fully electronic claims management transactions, the analysis revealed that automated claims management processes did increase modestly for most of the common transactions studied for medical plans and providers. Key findings included:

- Fully electronic claim submission adoption increased one percentage point, reaching 95 percent adoption, while fully manual processes also fell one percentage point to 5 percent

- Adoption of fully electronic coordination of benefits and crossover claim transactions grew 19 percentage points, reaching 75 percent, while fully manual processes dropped from 44 to 23 percent

- Fully electronic eligibility and benefit verification adoption rose slightly to 79 percent, while fully manual processes remained at three percent

- Use of a fully electronic claim status inquiry process increases six percentage points, reaching 69 percent, but the volume of telephone inquiries and the need for manual labor remained stable at seven percent

- Fully electronic remittance advice use jumped modestly to 56 percent, while fully manual remittance advice transactions fell dramatically from 34 to 8 percent

Fully electronic claims attachment adoption did not significantly change compared to the previous study. Adoption remains at about 6 percent.

Researchers noted that only two of the transactions studied experienced decreases in fully electronic adoption. Electronic funds transfer (EFT) use for claim payments fell to 60 percent from 62 percent the previous year.

Adoption of fully electronic prior authorizations also decreased. The volume of prior authorizations may have grown more than nine percent this year, but the use of fully electronic transactions dropped from 19 percent to just 8 percent.

“The year-to-year volatility and low overall level of fully electronic adoption for this transaction are likely due to a confluence of market factors,” the report stated. “For example, some national health plans reported that, because vendor products often do not support HIPAA 278 transactions, the use of partially electronic online portals is being promoted to providers as an alternative.”

By boosting electronic claims management adoption, providers would not only achieve savings but decrease their time spent on administrative tasks. The report showed that, on average, providers spend five more minutes performing manual transactions compared to electronic transactions.

Automating the key claims management processes could save providers up to 40 minutes on average.

To help providers save time and money, CAQH advised stakeholders to support provider access to electronic data interchange (EDI) systems.

A supplementary analysis showed that EDI systems from clearinghouses and practice management system vendors did not fully support EDI transactions. For example, only 12 percent of the systems currently on the market support prior authorization.

This suggests that providers are using multiple EDI technologies to fully automate common EDI transactions.

“The vendor community, specifically clearinghouses and practice management system vendors, can more completely support the adoption and ongoing use of fully electronic transactions by prioritizing the development of products and services that give providers a greater range of alternatives.”

CAQH also called on stakeholders to examine the role of web portals and fully commit to the electronic claims management transition.

“Going forward, the three strategies outlined above can advance the transition to fully electronic transactions and facilitate its long-term momentum,” the report concluded.