Healthcare Merger, Acquisition Activity to Rise Despite Slow Q3

Healthcare merger and acquisition activity dropped 11 percent in 2017’s third quarter, reaching 211 announced deals, a PwC report showed.

Source: Thinkstock

- Healthcare mergers and acquisition activity in the third quarter of 2017 may be down by 11 percent compared to last year and 6 percent compared to last quarter. But deal volume still reached over 200 announced transactions for the twelfth quarter in a row, a new PricewaterhouseCoopers (PwC) Deals report showed.

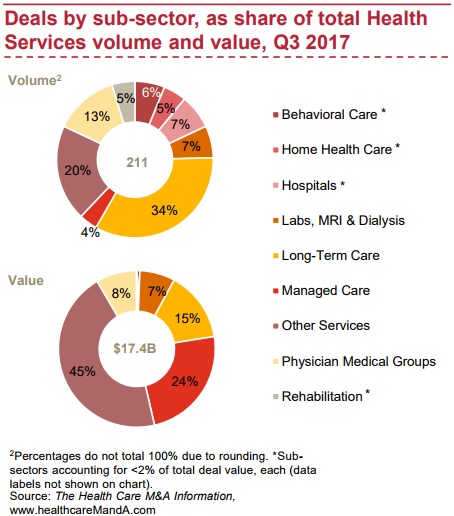

The industry witnessed a total of 211 announced healthcare deals in the third quarter of 2017.

“Health Services deal volume remained active across a variety of sub-sectors in Q3 2017, eclipsing 200 transactions, while healthcare reform continues to be evaluated,” stated Thad Kresho, US Health Service Deals Leader at PwC. “Interest and activity levels also remain broad across the investor (corporate and private equity) and structure (acquisitions, mergers, alliances, etc) types.”

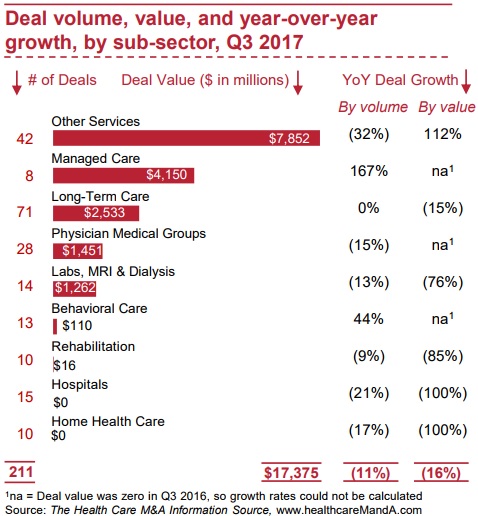

Long-term care organizations drove deal volume in the third quarter. The healthcare space saw 71 transactions, representing over one-third of all deals announced.

Source: PricewaterhouseCoopers (PwC) Deals

The group that experienced the second highest volume of deals (42 announced) was other services besides managed care, physician medical groups, long-term care, labs, MRIs, dialysis, behavioral care, hospitals, rehabilitation, and home health care. The largest deal announced in this group was the merger between American Medical Response and Air Medical Group Holdings.

Physician medical groups ranked third with 28 deals announced in the third quarter.

While experiencing the least amount of deals with just eight announced transactions this quarter, managed care saw the greatest year-over-year deal volume growth. Researchers reported that the healthcare space saw the number of deals grow by 167 percent compared to the previous year.

Source: PricewaterhouseCoopers (PwC) Deals

Behavioral health merger and acquisitions also significantly increased from last year, with 44 percent year-over-year growth.

Despite multiple reports of healthcare merger and acquisition activity waning in 2017’s third quarter, Kaufman Hall recently projected the total number of announced deals in 2017 to surpass 2016’s number.

The consulting firm counted 102 healthcare merger and acquisition deals in 2016. Even with a slow third quarter, 87 deals were announced so far in 2017.

Additionally, PwC Deals researchers stated that overall deal value for healthcare mergers and acquisitions in the third quarter also declined. Announced deal value dropped 16 percent from the previous year, reaching $17.4 billion.

The third quarter’s total deal value was significantly less compared to the second quarter. Deal value decreased 65 percent as the volume and value of megadeals of over $1 billion declined.

Ten megadeals were announced in 2017’s second quarter, with deals totaling $43.3 billion in value.

Only six healthcare merger and acquisition deals exceeded $1 billion in the third quarter. The deals were valued at a total of $11.4 billion, with Centene Corporation’s announced acquisition of Fidelis Care topping the megadeals at $3.8 billion.

In total, the megadeals accounted for 66 percent of the third quarter’s total deal value. The percentage is similar to the average of 65 percent for 2016 to the second quarter of 2017.

Home healthcare and hospitals reported the largest drops in deal value versus last year, the report added. Both witnessed 100 percent declines, but neither group announced healthcare merger and acquisitions with disclosed deal values in the third quarter of 2017.