Hospital Markups Drive Prescription Drug Spending, PhRMA Says

Over 80 percent of hospitals mark up the costs of their medicines by 200 percent or more, a new analysis found. But hospitals are saying that’s not the true driver of prescription drug spending.

Source: Thinkstock

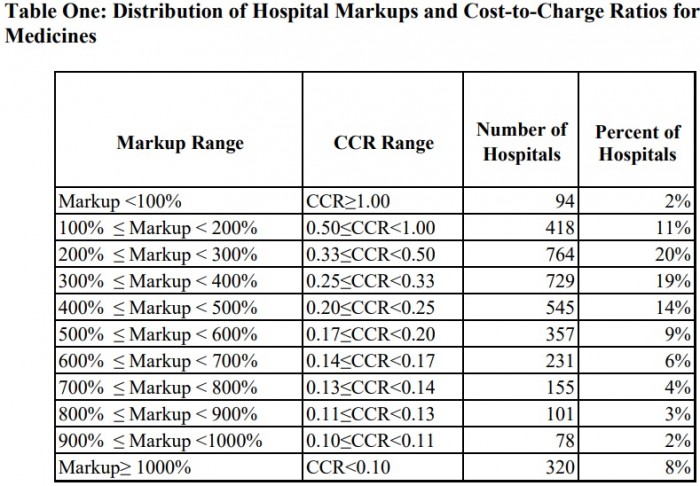

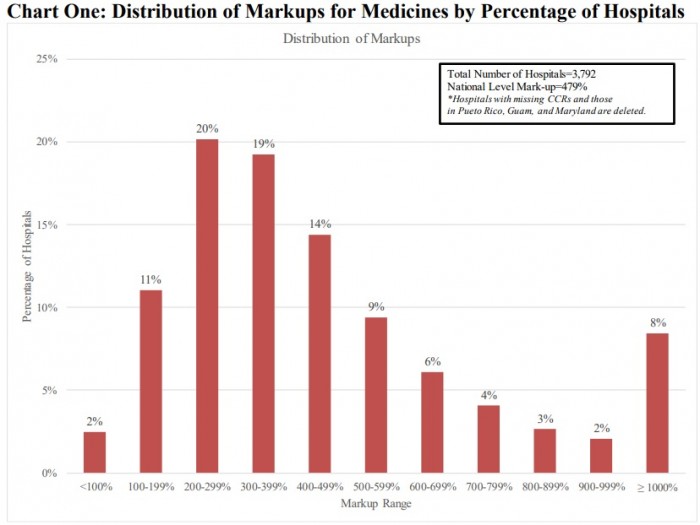

- Prescription drug spending is rising because approximately 83 percent of hospitals charge patients and payers more than double the acquisition cost for medications, according to a recent analysis by the Moran Company for the Pharmaceutical Research and Manufacturers of America (PhRMA).

Using data from Medicare claims and the Magellan Rx Management Medical Pharmacy Trend Report: 2016 Seventh Edition, the Moran Company found that these hospitals are marking up the costs of their medicines by 200 percent or more.

Source: Moran Company, Pharmaceutical Research and Manufacturers of America (PhRMA)

The majority of the 3,792 hospitals analyzed marked up the costs for their prescription drugs. Over one-half of the organizations (53 percent) marked up their medicine between 200 and 400 percent, on average, while a small portion charged even more.

Source: Moran Company, Pharmaceutical Research and Manufacturers of America (PhRMA)

About one in six hospitals (17 percent) charged seven times the price of prescription drugs, the analysis revealed. For a medication with an average sales price (ASP) of $150, a 700 percent mark-up would boost the charge for that drug to $1,050.

Researchers also pointed out that one out of every twelve hospitals (8 percent) reported average charge mark-ups exceeding 1,000 percent. On average, these hospitals ended up charging at least ten times their acquisition cost for prescription drugs.

READ MORE: Prescription Drug Rate Growth to Slow in 2019, Increasing 4.92%

The findings indicate that hospitals are a key factor in the recent spike in prescription drug spending, PhRMA stated in a press release.

“Hospitals receive billions of dollars every year in negotiated and mandatory discounts from biopharmaceutical companies while simultaneously increasing the price of these medicines to insurers and patients,” stated Stephen J. Ubl, PhRMA’s President and CEO. “In order to make medicines more affordable for patients, we must address the role hospital mark-ups play in driving up medicine costs.”

PhRMA also reported that hospitals marking up prescription drug prices leads to higher reimbursement rates because more than one-half of commercial payers reimburse hospital outpatient departments as a percent of billed charges.

Patients with cost-sharing and high-deductibles end up paying more for their medications and payers end up reimbursing hospitals at greater rates because of the hospital mark-ups, the pharmaceutical association explained.

However, hospitals are saying the analysis misattributes the driving factor behind the growth in prescription drug spending. They point to prices set by pharmaceutical companies and manufacturers.

READ MORE: Prescription Drug Rates Remain Top Healthcare Supply Chain Issue

“The Pharmaceutical Research and Manufacturers of America (PhRMA) released yet another ‘report’ in an obvious attempt to divert attention away from a problem of their own making: skyrocketing drug prices,” the American Hospital Association’s (AHA) Senior VP of Public Policy Analysis and Development Ashley Thompson wrote.

“They return once again to their standard playbook of pointing fingers and blaming everyone other than themselves to try to justify the dramatic increases in the prices of drugs, as they continue to make double-digit profit margins,” she continued.

Thompson added that the report misrepresents the reimbursement structure for hospitals.

“The report conveniently fails to explain that, unlike drug manufacturers, hospitals are subject to fixed reimbursement amounts for the vast majority of the care they provide,” she explained.

“In fact, more than half of hospital payments are from public payers, including Medicare and Medicaid, which reimburse hospitals at a set amount far below their costs,” she added. “Private payers also negotiate competitive rates with hospitals that often bundle the cost of drugs into a single, fixed reimbursement.”

READ MORE: Could More Competition Reduce Rising Prescription Drug Costs?

The AHA reiterated their call to target prescription drug prices as a way to control drug spending. Specifically, the group urged policymakers in July 2018 to implement an ASP inflation cap for Medicare Part B-covered drugs to curb prescription drug spending.

Controlling the rising prescription drug spending rate is a top priority for healthcare stakeholders and policymakers. But stakeholders can’t seem to agree on how to reduce spending on medications.

From limiting the authority of pharmacy benefit managers, advising pharmaceutical companies to lower their prices, to Medicare reimbursement reductions for physician-administered drugs, stakeholders have suggested and implement a wide range of solutions.

Specifically, the Trump Administration plans to lower prescription drug spending through the President’s “Blueprint to Lower Drug Prices.” The blueprint outlines a series of reforms, including promoting biosimilar use, introducing competition and increasing negotiation in Medicare Parts B and D, and increasing price transparency.

While policymakers continue to develop solutions to the prescription drug spending problem, a group of hospitals is taking the solution into their own hands. Seven health systems, including Intermountain Healthcare, Mayo Clinic, and Trinity Health, recently launched their own generic drug manufacturing company to tackle drug shortages and prescription drug rates.

“We are creating a public asset with a mission to ensure that essential generic medications are accessible and affordable,” stated Martin VanTrieste, CEO of the recently launched Civica Rx.

“The fact that a third of the country’s hospitals have either expressed interest or committed to participate with Civica Rx shows a great need for this initiative,” added the former Chief Quality Officer of Amgen, one of the largest pharmaceutical companies. “This will improve the situation for patients by bringing much needed competition to the generic drug market.”

The drug company plans to start lowering prescription drug prices by targeting 14 hospital-administered generic drugs. The company intends to become an FDA-approved manufacturer or sub-contract the manufacturing to another organization.