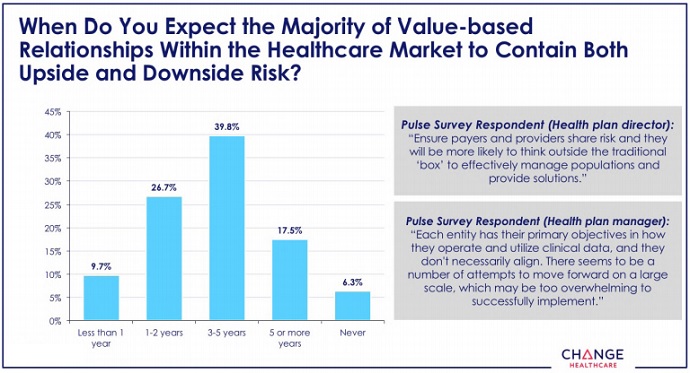

Value-Based Contracts with Risk 3 to 5 Years Away for Providers

Ninety percent of leaders say most value-based contracts will include downside risk within five years, with 39 percent of them estimating three to five years.

Source: Getty Images

- Taking on upside and downside financial risk through value-based contracts is still years away, according to healthcare leaders in a recent survey conducted by HealthCare Executive Group (HCEG) and Change Healthcare.

Approximately 90 percent of the 185 healthcare leaders recently surveyed as part of the ninth annual Industry Pulse report believe the majority of value-based contracts in healthcare will contain both upside and downside financial risk within the next five years. The majority of those respondents (39.8 percent) estimate three to five years.

About 17.5 percent of respondents predict risk-based contracts to be the norm in five or more years, while 6.3 percent said the majority of value-based contracts will never include upside and downside financial risk.

“Is it concerning that the transition from volume to value has been on the HCEG list for ten years and still looks to be five-plus years off,” Ferris Taylor, Executive Director of HCEG, asked in an official press release. “We hope this Annual Report spurs conversation and action for current stakeholders in adapting much faster to demands of a 21st century healthcare system. If traditional stakeholders aren't able to transform healthcare, outside parties will.”

Source: HealthCare Executive Group (HCEG) and Change Healthcare

Traditional stakeholders like payers and providers cited data sharing issues as a top challenge of implementing value-based contracts with full risk. Other top challenges included lack of agreement on outcome measures and incentives for payers and providers to collaborate.

READ MORE: Exploring Two-Sided Financial Risk in Alternative Payment Models

Payers and providers need access to large volumes of clinical and financial data to succeed in risk-based contracts tied to quality and outcomes. With revenue on the line, stakeholders need to access real-time data to track patients throughout their care journey and control their care in a cost-conscious manner.

However, only 11 percent of healthcare leaders currently had access to real-time hospital admission, discharge, and transfer notifications in 2018. And that percentage is up just 1.3 percentage points compared to the previous year.

But data sharing is starting to improve, the survey showed. The number of respondents accessing health information exchange (HIE) data more than doubled compared to 2017, but only 9.1 percent of healthcare leaders used the information.

Respondents said traditional stakeholders need monetary incentives to boost data sharing in the name of value-based care. A total of 19 healthcare leaders said money would motivate payers and providers to share data to drive individual, provider, and payer decisions.

Coming in second with 15 responses was payer and provider integration and collaboration.

READ MORE: How Accountable Care Organizations Can Prepare for Downside Risk

“You can’t exchange data without integration and the prerequisite standards and interoperability,” the report stated. “This directly ties into the recognition that payers and providers must find ways to integrate processes in order to share data and drive decision making.”

Data sharing challenges may be stalling the implementation of value-based contracts with downside financial risk, according to past and present Industry Pulse reports. But payers and providers may want to start addressing the challenges of risk-based contract implementation sooner rather than later.

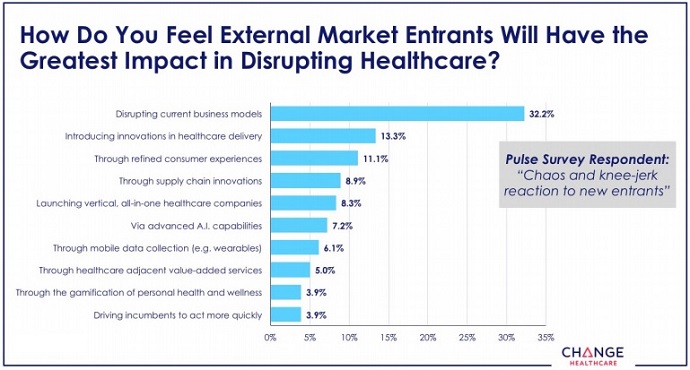

Non-traditional stakeholders could seriously impact how payers and providers do business. External market entrants like Amazon, Walmart, Google, and Apple are moving into the healthcare space and how the major companies will impact care delivery and competition in healthcare remains to be seen.

Healthcare leaders are predicting the external market entrants to primarily disrupt their current business model. About one-third of respondents (32 percent) stated that the greatest impact of the large technology and retail companies will be on business models.

Source: HealthCare Executive Group (HCEG) and Change Healthcare

“This response suggests that healthcare leaders recognize that external entrants will force the industry to change how it conducts business,” the report stated.

READ MORE: Practices Still Averse to Risk-Based Alternative Payment Models

Traditional stakeholders may find it challenging to balance responding to external market entrants and the trend driving many of the large technology and retail companies to healthcare: consumerism.

Patient financial responsibility is on the rise under high deductible health plans and other cost-sharing arrangements. With patients having more skin in the game, they are demanding more retail-like services from their providers and payers.

For example, healthcare price transparency a major demand from consumer-oriented patients. Patients want to know the cost of their healthcare services prior to scheduling their appointments. Patients also want more convenient appointments and service times, easier payment methods, and greater communication with their providers and payers.

Large retail and technology companies have already invested in consumer-facing technologies and services, giving external market entrants a leg up.

Payers and providers, on the other hand, have lagged behind with implementing consumer-friendly services. Nearly all providers in a recent survey said they still rely on paper for medical billing, and only 14 percent of payers in a separate analysis reported being prepared to address consumerism in healthcare.

Putting more revenues under value-based contracts with risk can help traditional stakeholders address the consumerism trend. Value-based contracts help providers and payers demonstrate value to patients and invest in innovative technologies and services.