Steady, Moderate Growth for Healthcare Prices and Spending in 2018

Healthcare prices increased just two percent in the second quarter of 2018, while healthcare spending rose five percent, Altarum reported.

Source: Thinkstock

- Healthcare prices and spending are seeing steady, but moderate growth, the Altarum Center for Value in Health Care recently reported.

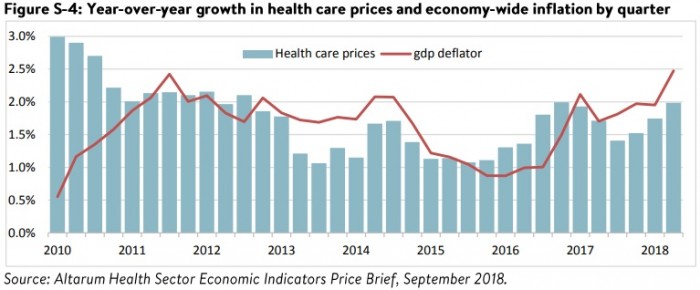

Healthcare prices increased just two percent in the second quarter of 2018, bringing healthcare price growth to a low of 1.9 percent for the first half of the year, the research and consulting organization reported in its newest “Health Sector Trend Report.”

The quarterly report pointed out that healthcare price growth by quarter has not been above two percent since 2012. And even more surprisingly, healthcare price growth is below economy-wide price growth, the organization emphasized.

High healthcare prices are a major issue among policymakers and other healthcare stakeholders. Researchers in a recent JAMA study identified high prices for provider compensation, healthcare services, and prescription drugs as the driver behind America’s healthcare spending, which was nearly double ($9,403 per capita) compared to the mean healthcare spending in similar countries ($5,419 per capita).

Source: Altarum Center for Value in Health Care

In an effort to lower prices, stakeholders are implementing price transparency initiatives like Medicare’s new requirement for hospitals that mandates the facilities publish their prices online. Other stakeholders are attempting to boost healthcare competition and address local price variations to lower healthcare prices.

Despite an industry-wide focus on price growth, healthcare prices continue to rise at a slow and steady pace, Altarum found.

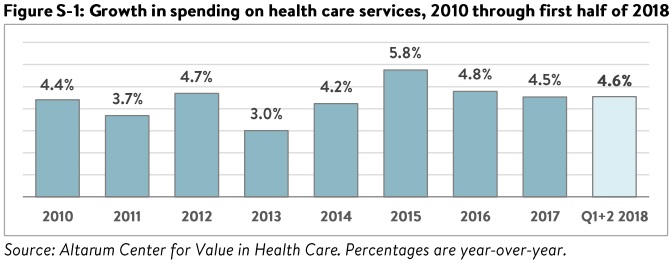

As a result, healthcare spending is also continuing to increase. In the second quarter of 2018, healthcare spending was five percent greater than the previous year. The growth rate for the first half of 2018 was 4.8 percent year-over-year, Altarum reported.

Spending on healthcare services drove the recent uptick in overall healthcare spending. Healthcare service spending represents over 70 percent of healthcare spending, and expenditures on the services jumped up by 4.9 percent in the second quarter of 2018, up from 4.2 percent the previous quarter.

Source: Altarum Center for Value in Health Care

The growth rate for healthcare services spending is now 4.6 percent, which is comparable to the 2017 rate of 4.5 percent and the 2016 rate of 4.8 percent, the report stated.

Retail spending on prescription drugs also increased in the first half of 2018. Prescription drug costs grew by 3.4 percent in the second quarter of 2018 and by 3.7 percent in the first quarter of 2018.

On average, retail spending on prescription drugs saw 3.5 percent growth the first half of the year.

Altarum noted the rate is down from 4.7 percent growth in 2017.

While overall healthcare spending is steadily climbing, private payers are seeing their expenditures rapidly grow, the report showed.

Healthcare spending by private payers has grown significantly faster than the spending by public payers since 2016, Altarum found. And the difference in private and public payer spending peaked in the first quarter of 2018 when private payer spending growth hit 7.4 percent while the public payer spending growth averaged 2.3 percent.

The gap between public and private payer healthcare spending narrowed slightly in the second quarter of 2018. But the difference may persistent as private payers experience higher price growth and healthcare utilization and intensity compared to their public peers.

Overall, the data shows that the healthcare sector “appears to be in a period of stable, moderate growth,” Altarum stated.

However, recent trends could destabilize the current steady growth trends in the healthcare industry.

Legal challenges to the Affordable Care Act, chnages in coverage from additional Medicaid expansion initiatives, reductions in the level of quality of coverage under new policies like Medicaid work requirements, and the timing and nature of the next economic downturn are among the potential near-term disruptors to the healthcare sector.

But even without the near-term disruptors, Altarum emphasized that the moderate growth rates spell trouble in the long-term.

“As we have remarked before, even if health spending growth remains at today’s moderate rates and overall economic growth continues to keep pace, future budgetary tradeoffs will be painful,” the report concluded.

“Policy issues that appear to have potential for near term action such as surprise billings and out-of-pocket drug costs may be provider some relief to consumers, but will do little to address the long-term budgetary challenges,” the organization continued. “Even the Chairman of the Federal Reserve, normally a body that is reticent to comment on fiscal policy, recently called out health spending as a major contributor to ‘unsustainable’ deficits, and urged action while economic times are good.”